Question: Required information Problem 6-31 (LO 6-1) (Static) [The following information applies to the questions displayed below.) Lionel is an unmarried law student at State University

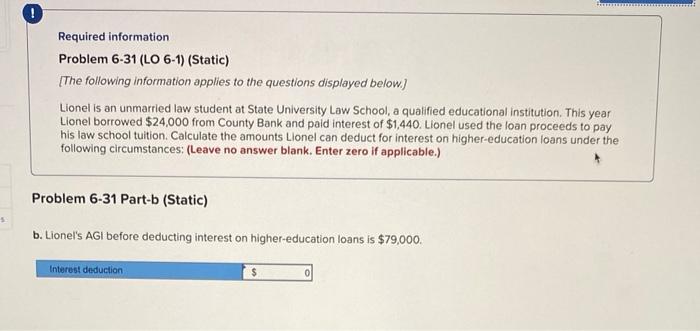

Required information Problem 6-31 (LO 6-1) (Static) [The following information applies to the questions displayed below.) Lionel is an unmarried law student at State University Law School, a qualified educational Institution. This year Lionel borrowed $24,000 from County Bank and paid interest of $1,440. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for interest on higher education loans under the following circumstances: (Leave no answer blank. Enter zero if applicable.) Problem 6-31 Part-b (Static) 5 b. Lionel's AGI before deducting interest on higher-education loans is $79,000. Interest deduction $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts