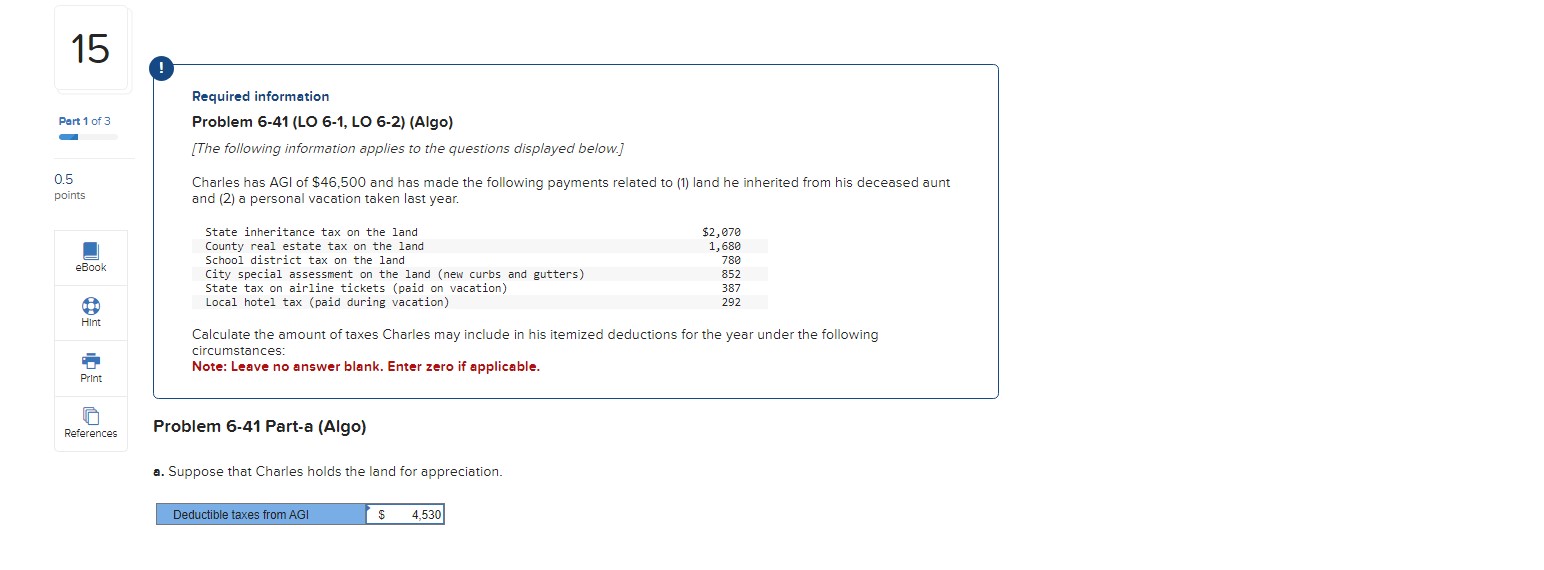

Question: Required information Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $46,500 and has

![information applies to the questions displayed below.] Charles has AGI of $46,500](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f9379dc01ec_73366f9379d4ed64.jpg)

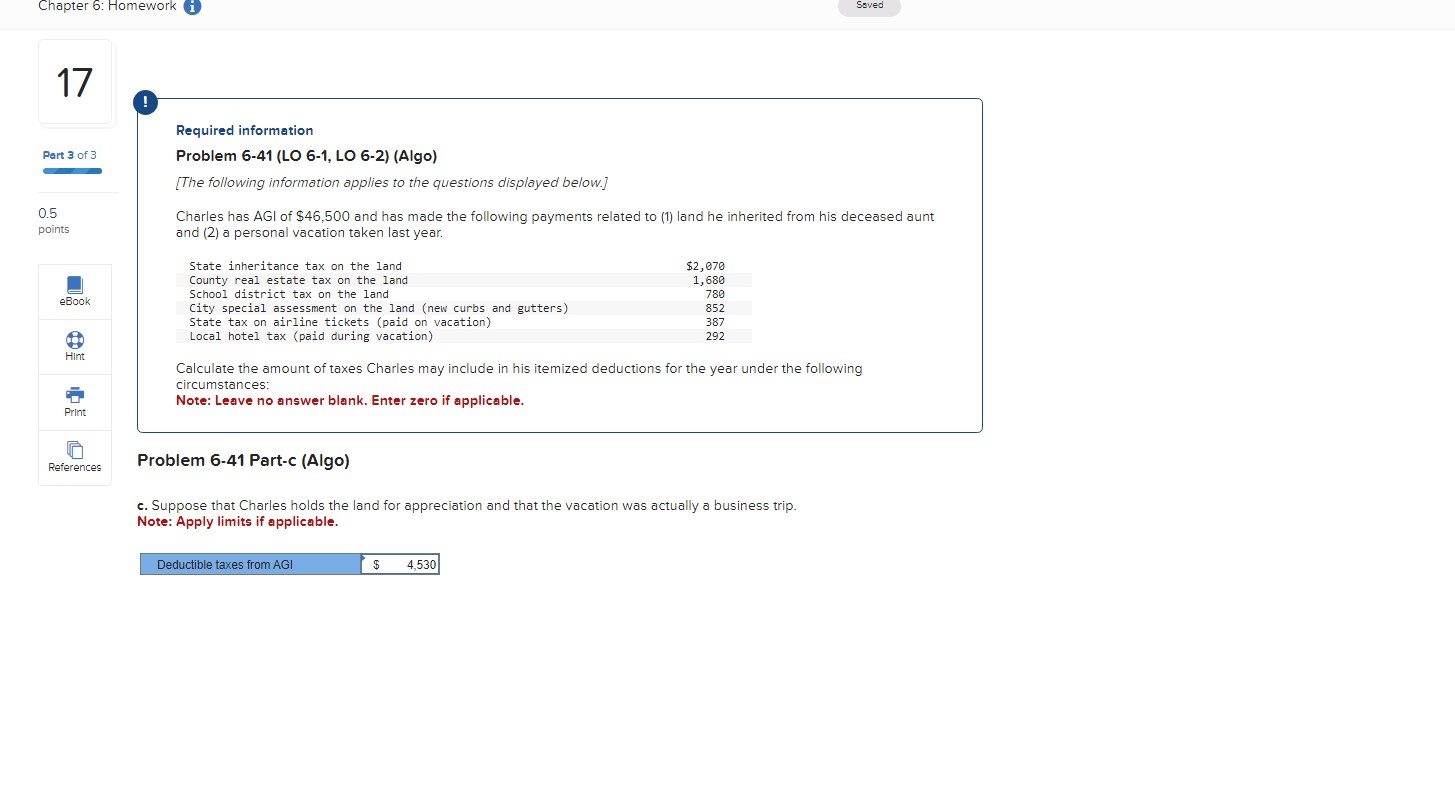

Required information Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $46,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-a (Algo) a. Suppose that Charles holds the land for appreciation. Required information Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $46,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-b (Algo) b. Suppose that Charles holds the land for rent. Answer is complete but not entirely correct. Required information Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $46,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-c (Algo) c. Suppose that Charles holds the land for appreciation and that the vacation was actually a business trip. Note: Apply limits if applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts