Question: Required information Problem 6.4A & 6-5A (Algo) [The following information applies to the questions displayed below) Joseph Farmer earned $123,000 in 2019 for a company

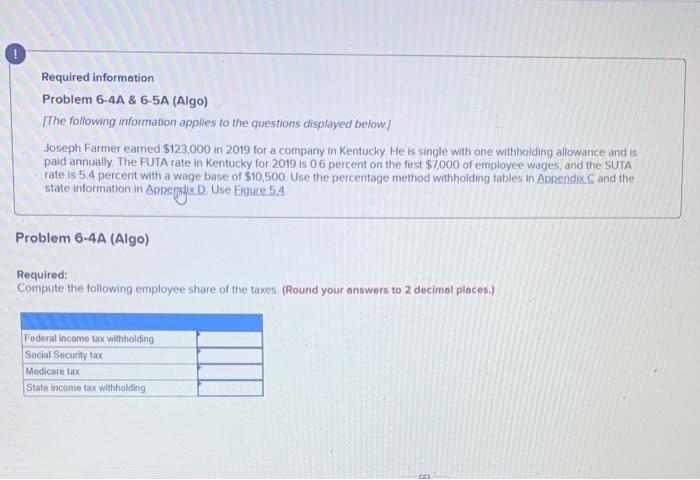

Required information Problem 6.4A & 6-5A (Algo) [The following information applies to the questions displayed below) Joseph Farmer earned $123,000 in 2019 for a company in Kentucky. He is single with one withholding allowance and is paid annually. The FUTA rate in Kentucky for 2019 is 06 percent on the first $7,000 of employee wages, and the SUTA rate is 54 percent with a wage base of $10,500. Use the percentage method withholding tables in Appendix and the state information in Appenx.D. Use Eigue 54. Problem 6-4A (Algo) Required: Compute the following employee share of the taxes. (Round your answers to 2 decimal places.) Federal income tax withholding Social Security tax Medicare tax State income tax withholding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts