Question: Required information. Problem 6-50 (LO 6-2) (Static) (The following information applies to the questions displayed below] Calvin reviewed his canceled checks and receipts this

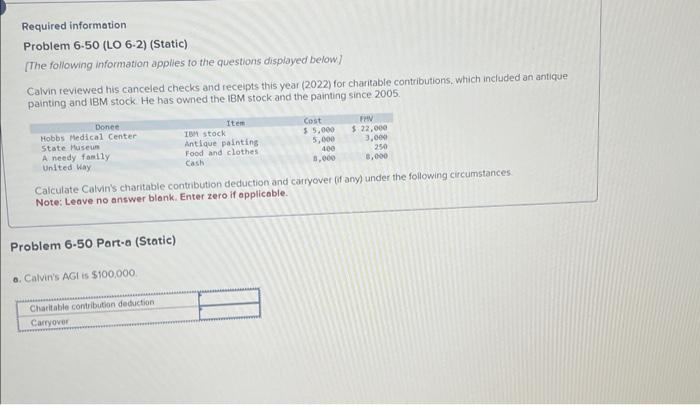

Required information. Problem 6-50 (LO 6-2) (Static) (The following information applies to the questions displayed below] Calvin reviewed his canceled checks and receipts this year (2022) for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005. Donee Item Hobbs Medical Center IBM stock Cost $ 5,000 FHV $22,000 State Museum A needy family United Way Antique painting Food and clothes Cash 5,000 3,000 400 8,000 250 8,000 Calculate Calvin's charitable contribution deduction and carryover (if any) under the following circumstances Note: Leave no answer blank. Enter zero if applicable. Problem 6-50 Part-a (Static) a. Calvin's AGI is $100,000. Charitable contribution deduction Carryover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts