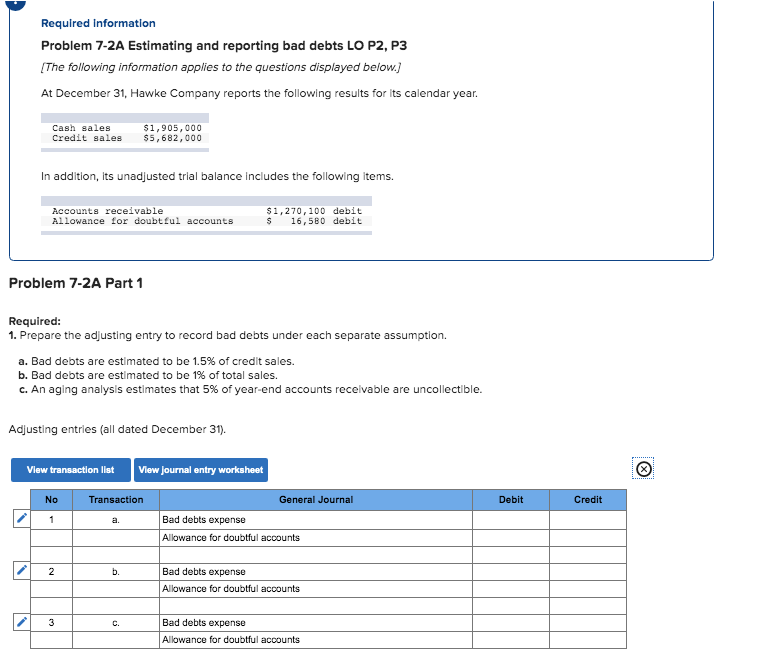

Question: Required Information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.) At December 31, Hawke

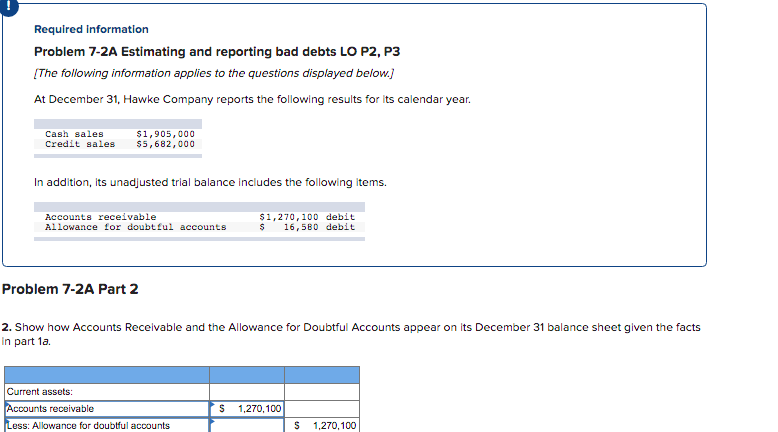

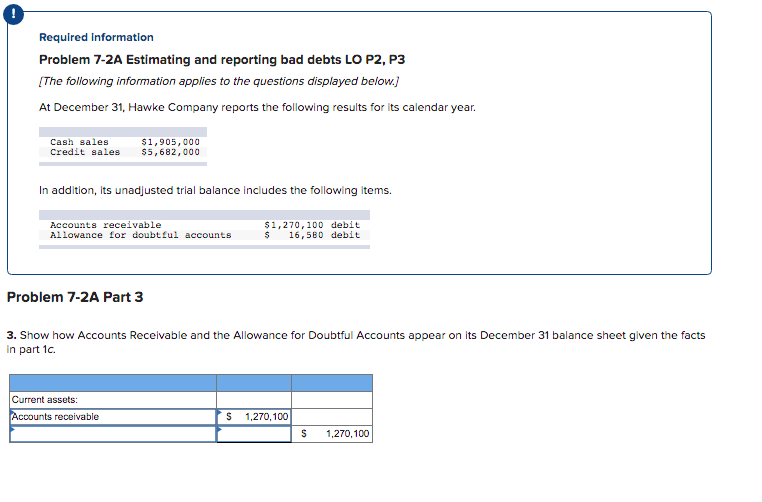

Required Information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.) At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,905,000 $5,682,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1,270,100 debit $ 16,580 debit Problem 7-2A Part 1 Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 1.5% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). View transaction list View journal entry worksheet No Transaction Debit Credit 1 a. General Journal Bad debts expense Allowance for doubtful accounts 2 b. Bad debts expense Allowance for doubtful accounts 3 C. Bad debts expense Allowance for doubtful accounts Required Information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.) At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,905,000 $5,682,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1,270, 100 debit $ 16,580 debit Problem 7-2A Part 2 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts in part 1a. Current assets: Accounts receivable Less: Allowance for doubtful accounts S 1,270,100 S 1,270,100 Required Information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.) At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $1,905,000 $5,682,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts $1,270, 100 debit $ 16,580 debit Problem 7-2A Part 3 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31 balance sheet given the facts in part 10 Current assets: Accounts receivable S 1,270,100 S 1,270,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts