Question: Required information Problem 7-36 CVP Relationships; Indifference Point (LO 7-1, 7-4) [The following information applies to the questions displayed below] Corrigan Enterprises is studying the

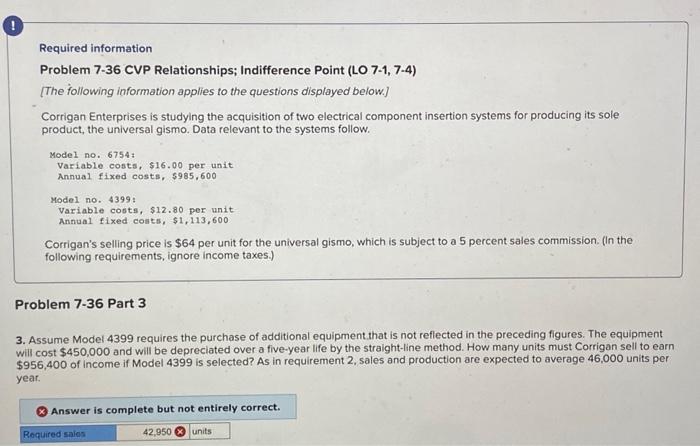

Required information Problem 7-36 CVP Relationships; Indifference Point (LO 7-1, 7-4) [The following information applies to the questions displayed below] Corrigan Enterprises is studying the acquisition of two electrical component insertion systems for producing its sole product, the universal gismo. Data relevant to the systems follow. Model no. 6754: Variable costs, $16,00 per unit Annual fixed costs, $985,600 Model no. 4399: Variable costs, $12.80 per unit Annual fixed conts, $1,113,600 Model no. 6754: Variable costs, $16.00 per unit Annual fixed costs, $985,600 Model no. 4399: Variable costs, $12.80 per unit Annual fixed conts, $1,113,600 Corrigan's selling price is $64 per unit for the universal gismo, which is subject to a 5 percent sales commission. (In the following requirements, ignore income taxes.) Problem 7-36 Part 3 3. Assume Model 4399 requires the purchase of additional equipment that is not reflected in the preceding figures. The equipment will cost $450,000 and will be depreciated over a five-year life by the straight-line method. How many units must Corrigan sell to earn $956,400 of income if Model 4399 is selected? As in requirement 2 , sales and production are expected to average 46,000 units per year. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts