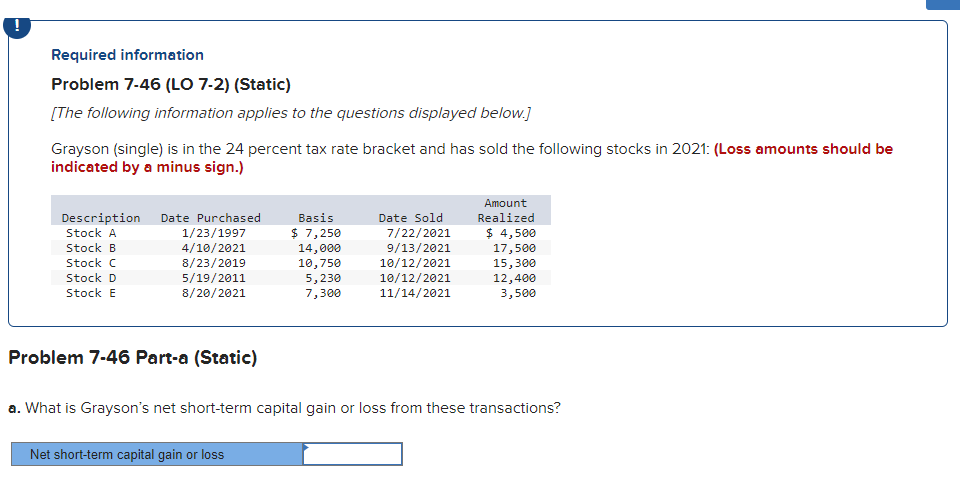

Question: Required information Problem 7-46 (LO 7-2) (Static) [The following information applies to the questions displayed below.] Grayson (single) is in the 24 percent tax rate

![to the questions displayed below.] Grayson (single) is in the 24 percent](https://s3.amazonaws.com/si.experts.images/answers/2024/07/6690589746c21_89466905896e845c.jpg)

Required information Problem 7-46 (LO 7-2) (Static) [The following information applies to the questions displayed below.] Grayson (single) is in the 24 percent tax rate bracket and has sold the following stocks in 2021: (Loss amounts should be indicated by a minus sign.) Description Date Purchased Stock A 1/23/1997 Stock B 4/10/2021 Stock 8/23/2019 Stock D 5/19/2011 Stock E 8/20/2021 Basis $ 7,250 14,000 10,750 5,230 7,300 Date Sold 7/22/2021 9/13/2021 10/12/2021 10/12/2021 11/14/2021 Amount Realized $ 4,500 17,500 15,300 12,400 3,500 Problem 7-46 Part-a (Static) a. What is Grayson's net short-term capital gain or loss from these transactions? Net short-term capital gain or loss Problem 7-46 Part-b (Static) b. What is Grayson's net long-term gain or loss from these transactions? Net long-term capital gain or loss Problem 7-46 Part-c (Static) c. What is Grayson's overall net gain or loss from these transactions? Net capital gain or loss Problem 7-46 Part-d (Static) d. What amount of the gain, if any, is subject to the preferential rate for certain capital gains? Net capital gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts