Question: Required information Problem 7-50 (LO 7-2) Three years ago, Adrian purchased 365 shares of stock in X Corp. for $68,620. On December 30 of year

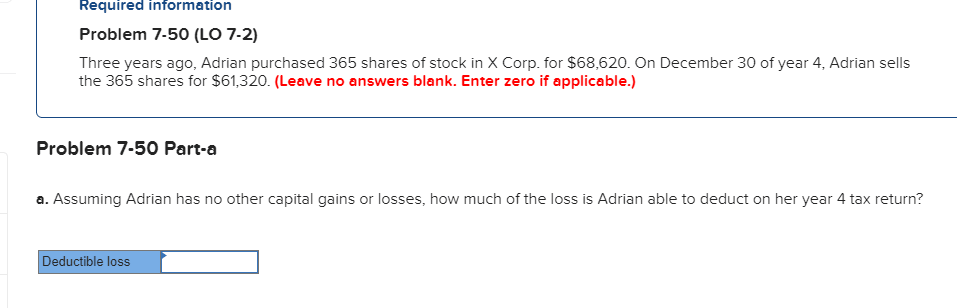

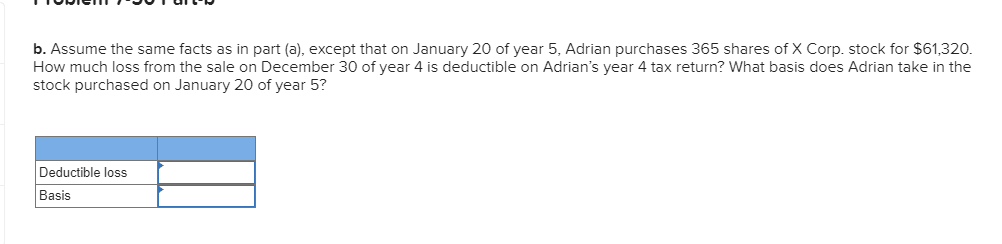

Required information Problem 7-50 (LO 7-2) Three years ago, Adrian purchased 365 shares of stock in X Corp. for $68,620. On December 30 of year 4, Adrian sells the 365 shares for $61,320. (Leave no answers blank. Enter zero if applicable.) Problem 7-50 Part-a a. Assuming Adrian has no other capital gains or losses, how much of the loss is Adrian able to deduct on her year 4 tax return? Deductible loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts