Question: Required information Problem 8 - 6 3 ( LO 8 - 5 ) ( Algo ) [ The following information applies to the questions displayed

Required information

Problem LO Algo

The following information applies to the questions displayed below.

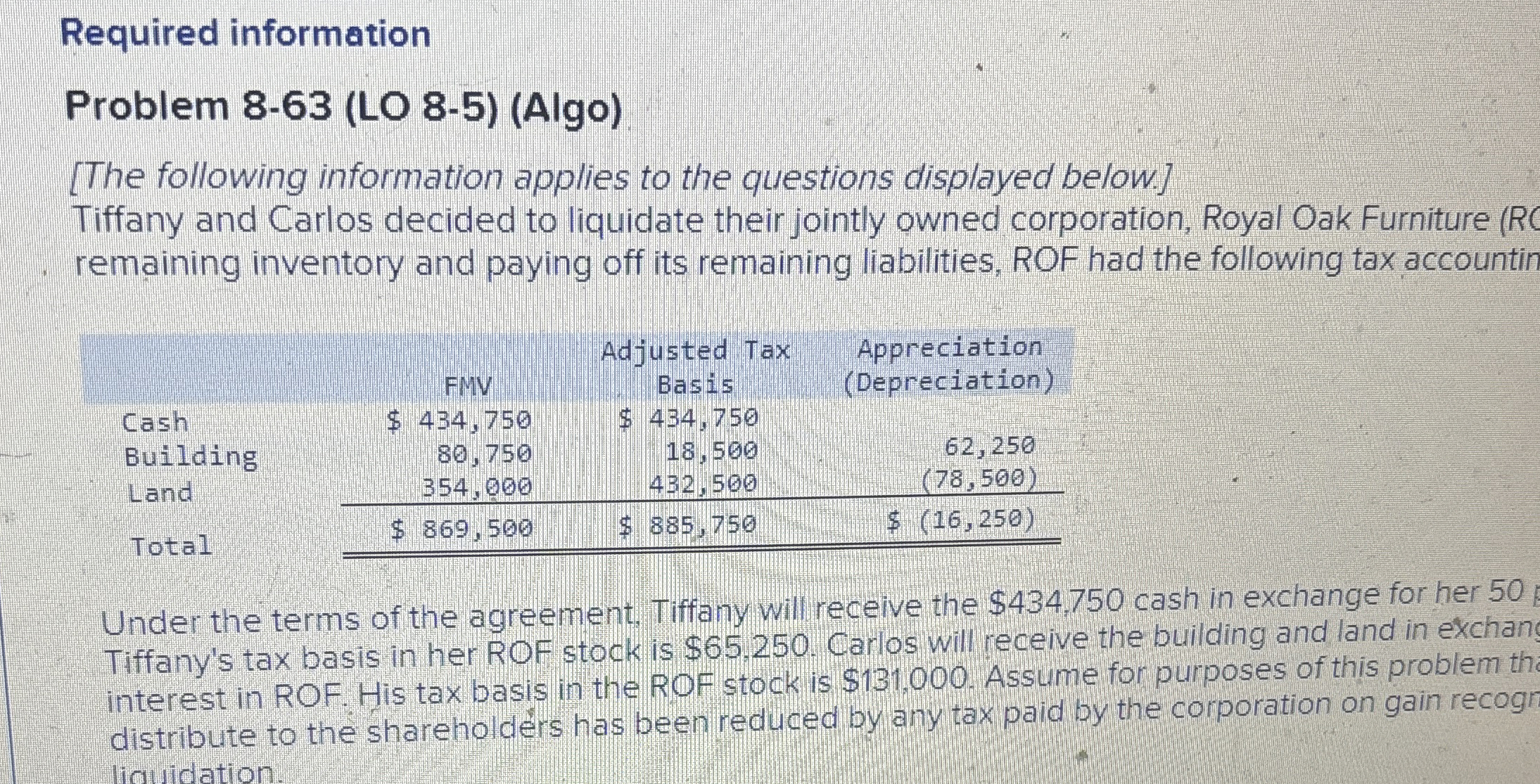

Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture

remaining inventory and paying off its remaining liabilities, ROF had the following tax accountin

Under the terms of the agreement, Tiffany will receive the $ cash in exchange for her

Tiffany's tax basis in her ROF stock is $ Carlos will receive the building and land in exchan

interest in ROF. His tax basis in the ROF stock is $ Assume for purposes of this problem th

distribute to the shareholders has been reduced by any tax paid by the corporation on gain recogr

liauidation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock