Question: ! Required information Problem 8 - 7 0 ( LO 8 - 4 ) ( Algo ) [ The following information applies to the questions

Required information

Problem LO Algo

The following information applies to the questions displayed below.

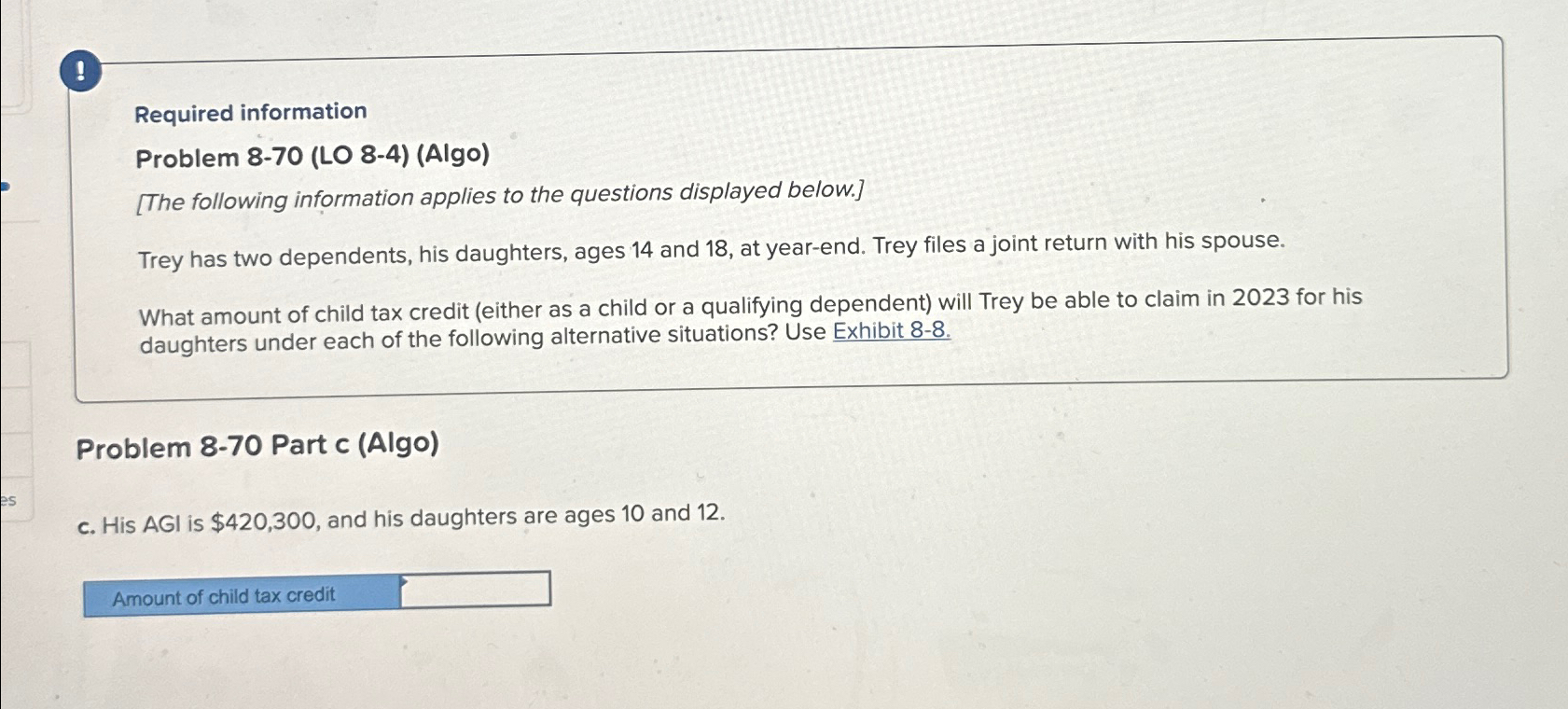

Trey has two dependents, his daughters, ages and at yearend. Trey files a joint return with his spouse.

What amount of child tax credit either as a child or a qualifying dependent will Trey be able to claim in for his daughters under each of the following alternative situations? Use Exhibit

Problem Part c Algo

c His AGI is $ and his daughters are ages and

Amount of child tax credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock