Question: Required information Problem 8 - 7 7 ( LO 8 - 5 ) ( Algo ) [ The following information applies to the questions displayed

Required information

Problem LO Algo

The following information applies to the questions displayed below.

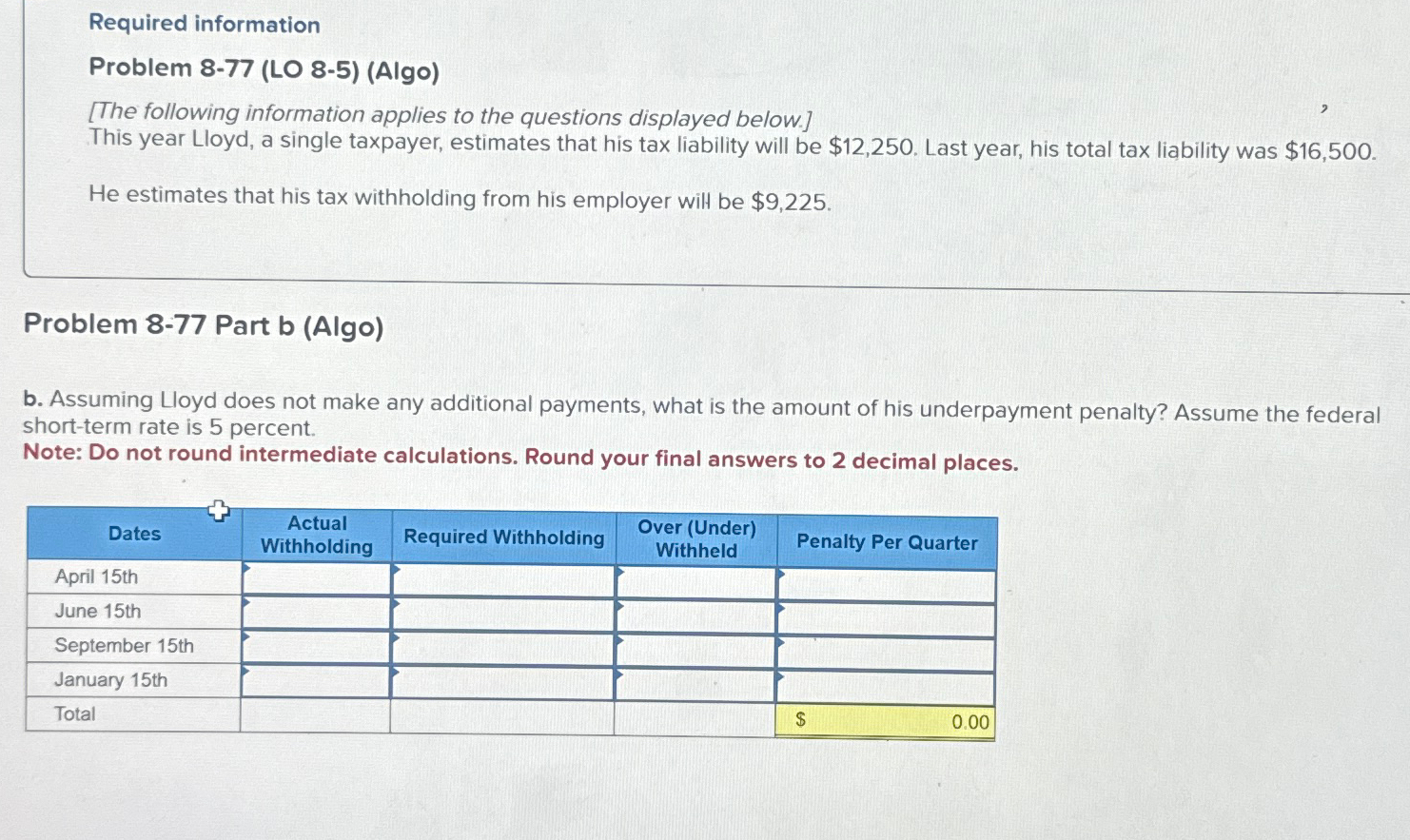

This year Lloyd, a single taxpayer, estimates that his tax liability will be $ Last year, his total tas was $

He estimates that his tax withholding from his employer will be $

Problem Part b Algo

b Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal shortterm rate is percent.

Note: Do not round intermediate calculations. Round your final answers to decimal places.

tableDatestableActualWithholdingRequired Withholding,tableOver UnderWithheldPenalty Per QuarterApril thJune thSeptember thJanuary thTotal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock