Question: Required information Problem 8-3A Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.) In January 2018, Mitzu

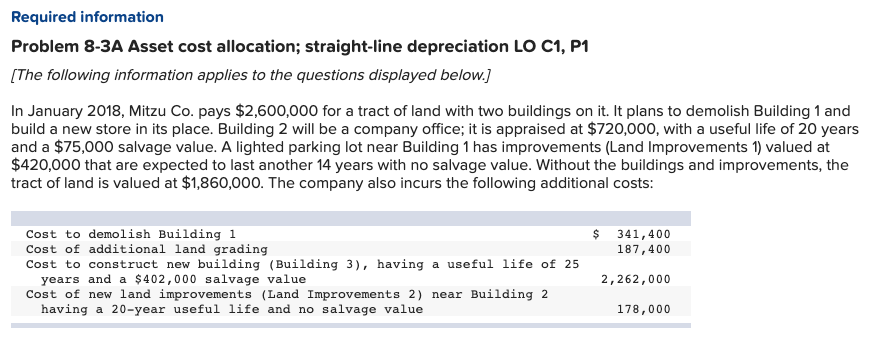

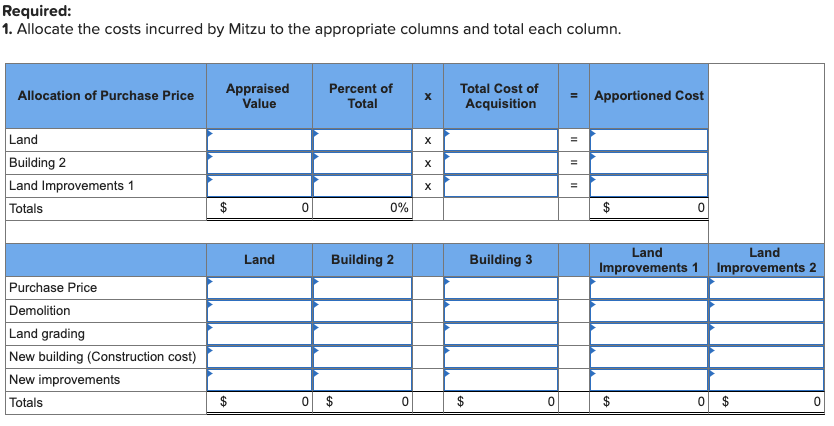

Required information Problem 8-3A Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.) In January 2018, Mitzu Co. pays $2,600,000 for a tract of land with two buildings on it. It plans to demolish Building 1 and build a new store in its place. Building 2 will be a company office; it is appraised at $720,000, with a useful life of 20 years and a $75,000 salvage value. A lighted parking lot near Building 1 has improvements (Land Improvements 1) valued at $420,000 that are expected to last another 14 years with no salvage value. Without the buildings and improvements, the tract of land is valued at $1,860,000. The company also incurs the following additional costs: $ 341,400 187,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct new building (Building 3), having a useful life of 25 years and a $402,000 salvage value Cost of new land improvements (Land Improvements 2) near Building 2 having a 20-year useful life and no salvage value 2,262,000 178,000 Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Allocation of Purchase Price Appraised Value Percent of Total Total Cost of Acquisition = Apportioned Cost Land Building 2 Land Improvements 1 Totals $ 0 0% Land Building 2 Building 3 Land Improvements 1 Land Improvements 2 Purchase Price Demolition Land grading New building (Construction cost) New improvements Totals 0 $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts