Question: ! Required information Problem 9-1A Record and analyze installment notes (L09-2) [The following information applies to the questions displayed below.) On January 1, 2021. Gundy

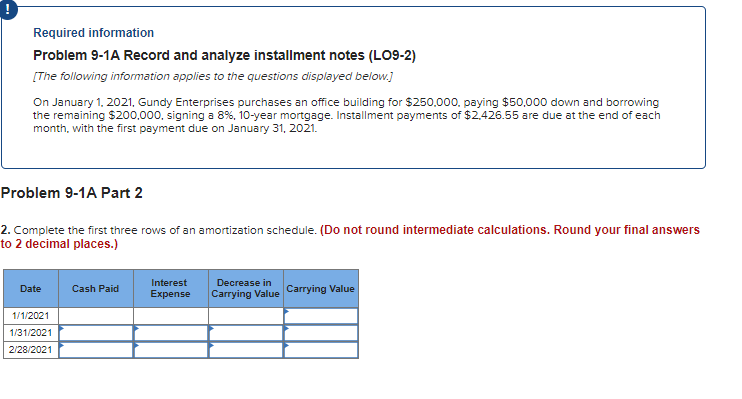

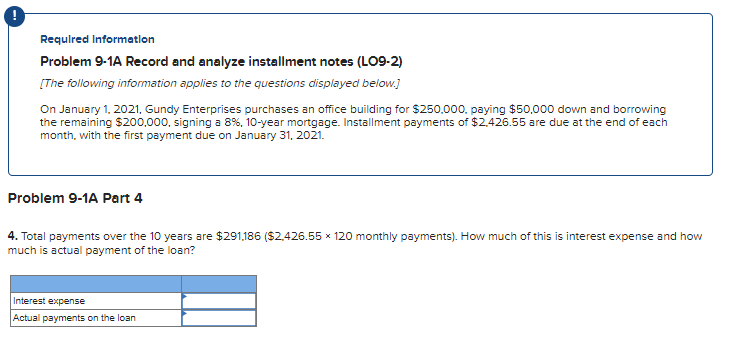

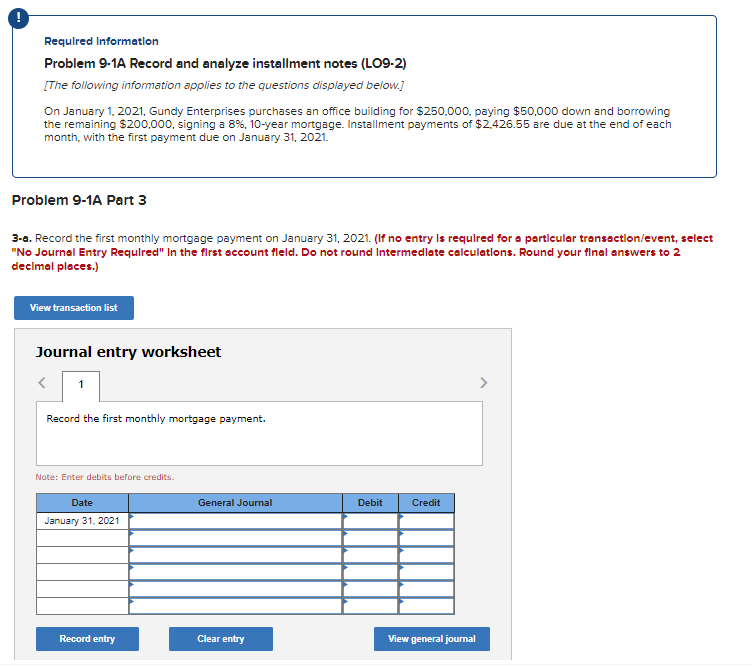

! Required information Problem 9-1A Record and analyze installment notes (L09-2) [The following information applies to the questions displayed below.) On January 1, 2021. Gundy Enterprises purchases an office building for $250.000. paying $50,000 down and borrowing the remaining $200.000, signing a 8%, 10-year mortgage. Installment payments of $2.426.55 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1A Part 2 2. Complete the first three rows of an amortization schedule. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value 1/1/2021 1/31/2021 2/28/2021 ! Required Information Problem 9-1A Record and analyze installment notes (LO9-2) [The following information applies to the questions displayed below.] On January 1, 2021, Gundy Enterprises purchases an office building for $250.000. paying $50.000 down and borrowing the remaining $200,000, signing a 8%, 10-year mortgage. Installment payments of $2.426.55 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1A Part 4 4. Total payments over the 10 years are $291,186 ($2.426.55 x 120 monthly payments). How much of this is interest expense and how much is actual payment of the loan? Interest expense Actual payments on the loan Required Information Problem 9-1A Record and analyze installment notes (L09-2) [The following information applies to the questions displayed below.] On January 1, 2021. Gundy Enterprises purchases an office building for $250.000. paying $50,000 down and borrowing the remaining $200,000, signing a 8%, 10-year mortgage. Installment payments of $2.426.55 are due at the end of each month, with the first payment due on January 31, 2021. Problem 9-1A Part 3 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account fleld. Do not round Intermediate calculations. Round your final answers to 2 decimal places.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts