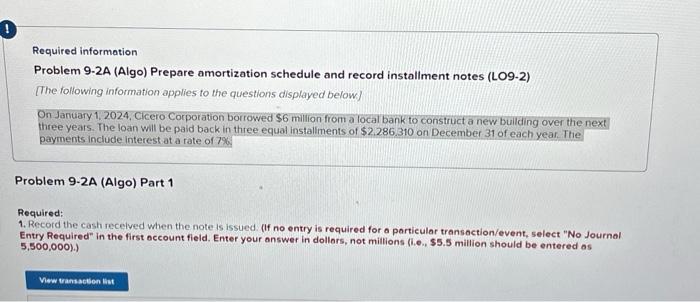

Question: Required information Problem 9-2A (Algo) Prepare amortization schedule and record installment notes (LO9-2) [The following information applies to the questions displayed below] On January 1,

![notes (LO9-2) [The following information applies to the questions displayed below] On](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8ab0508988_16466e8ab049ba31.jpg)

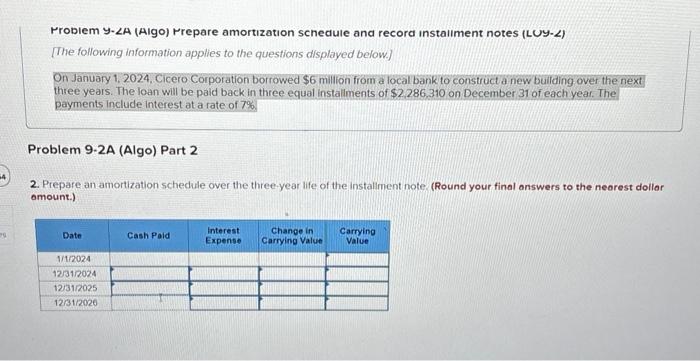

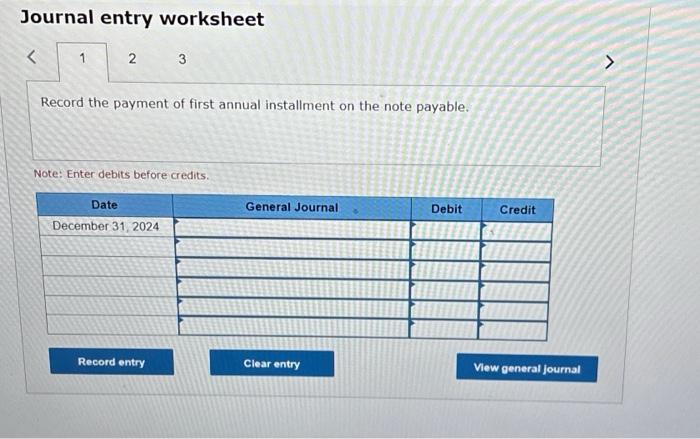

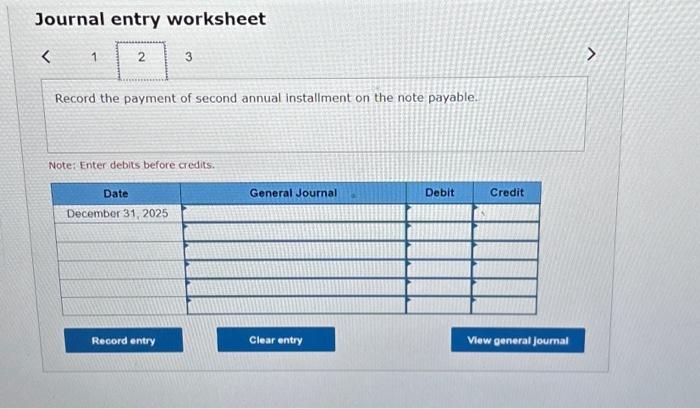

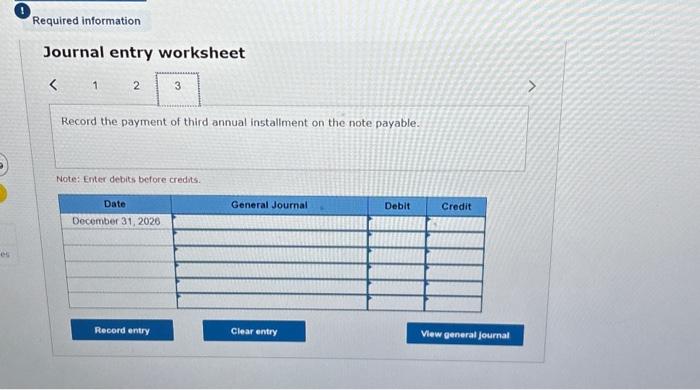

Required information Problem 9-2A (Algo) Prepare amortization schedule and record installment notes (LO9-2) [The following information applies to the questions displayed below] On January 1, 2024, Cicero Corporation borrowed $6 million from a local bank to construct a new bullding over the next three years. The loan will be paid back in three equal installiments of $2,286.310 on December 31 of each year. The payments include interest at a rate of 7% roblem 9-2A (Algo) Part 1 Required: 1. Record the cash recelved when the note is issued. (If no entry is required for a particular transoction/event, select "No Journal Entry Required" in the first occount field. Enter your answer in dollors, not millions (i.e., $5.5 million should be entered as 5,500,000).) Journal entry worksheet Record the receipt of cash from the issue of the note payable. Note: Enter debits before credits. Frobiem y- A (Aigo) rrepare amortization schedule and record instaliment notes (LUY-L) [The following information applies to the questions displayed below.] On January 1, 2024, Cicero Corporation borrowed $6 million from a local bank to construct a new bullding over the next three years. The loan will be paid back in three equal installments of $2,286,310 on December 31 of each year. The payments include interest at a rate of 7%. Problem 9-2A (Algo) Part 2 2. Prepare an amortization schedule over the three-year life of the installment note. (Round your final answers to the neorest dollor omount.) Journal entry worksheet Record the payment of first annual installment on the note payable. Note: Enter debits before credits. Journal entry worksheet Record the payment of second annual installment on the note payable. Note: Enter debits before credits. Journal entry worksheet Record the payment of third annual instaliment on the note payable. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts