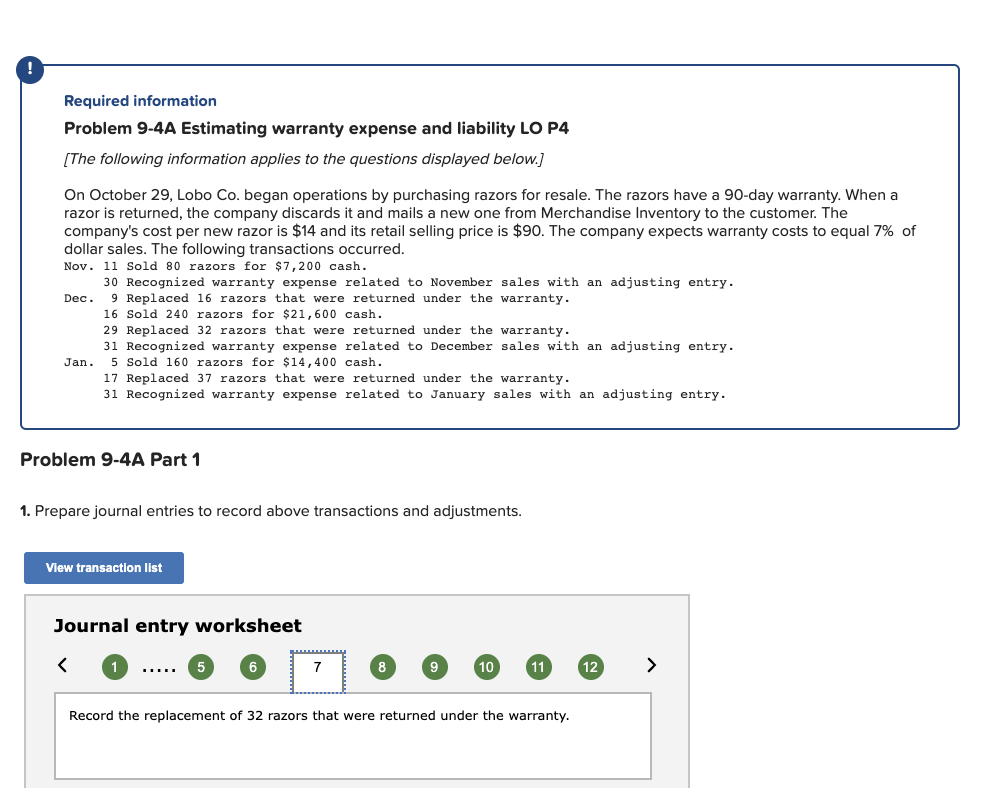

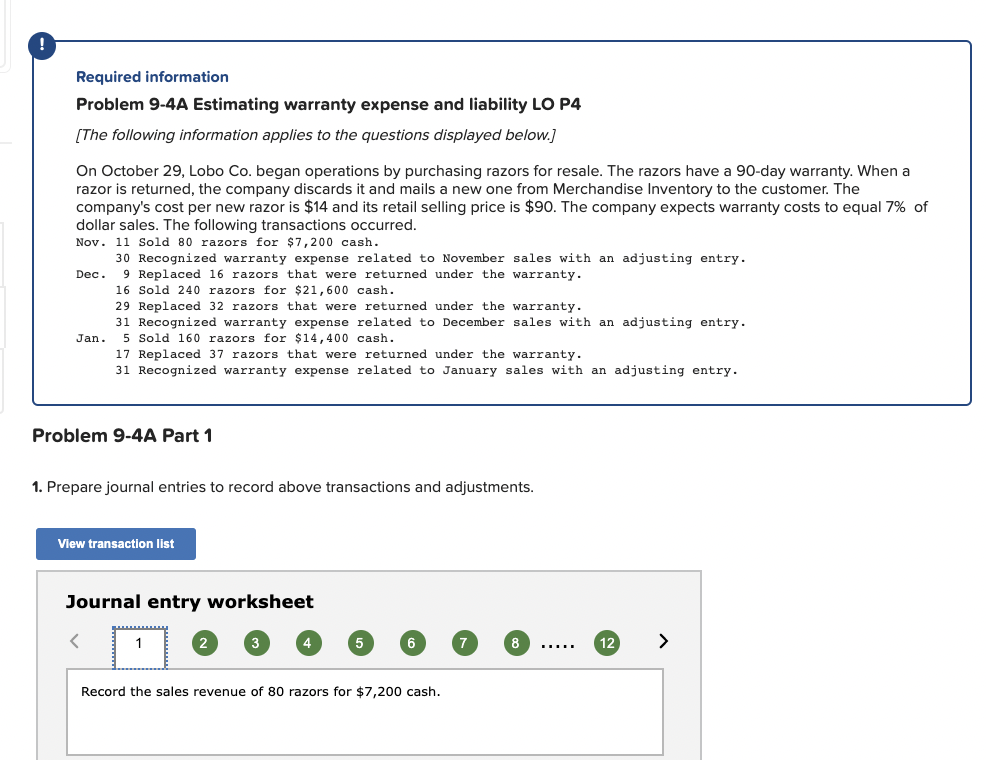

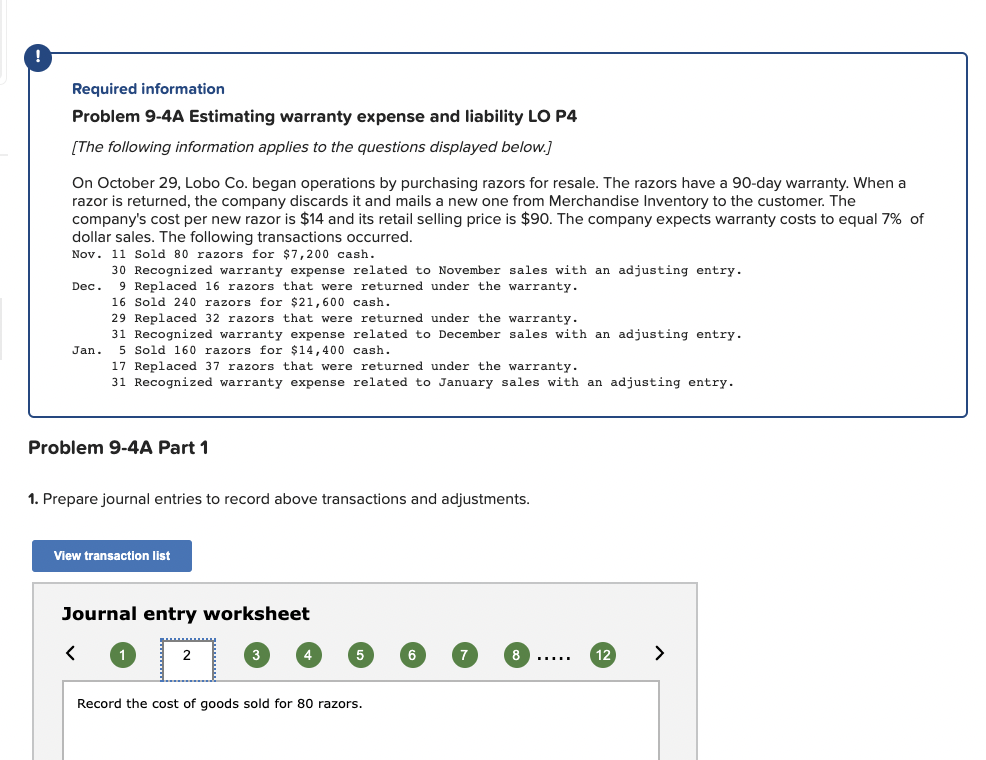

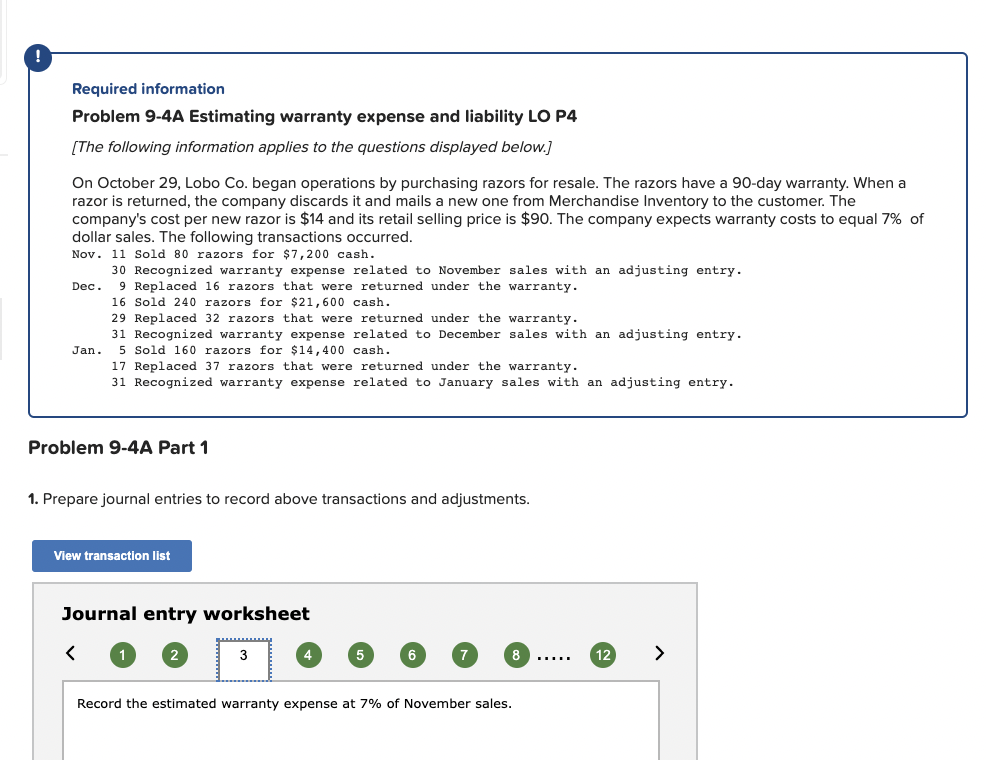

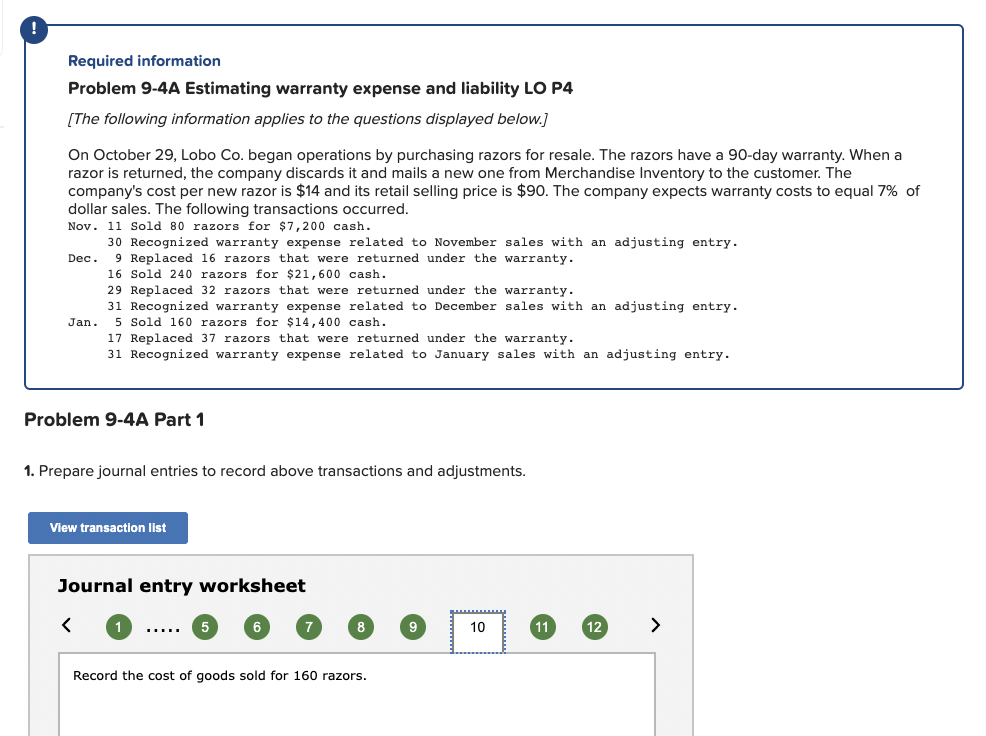

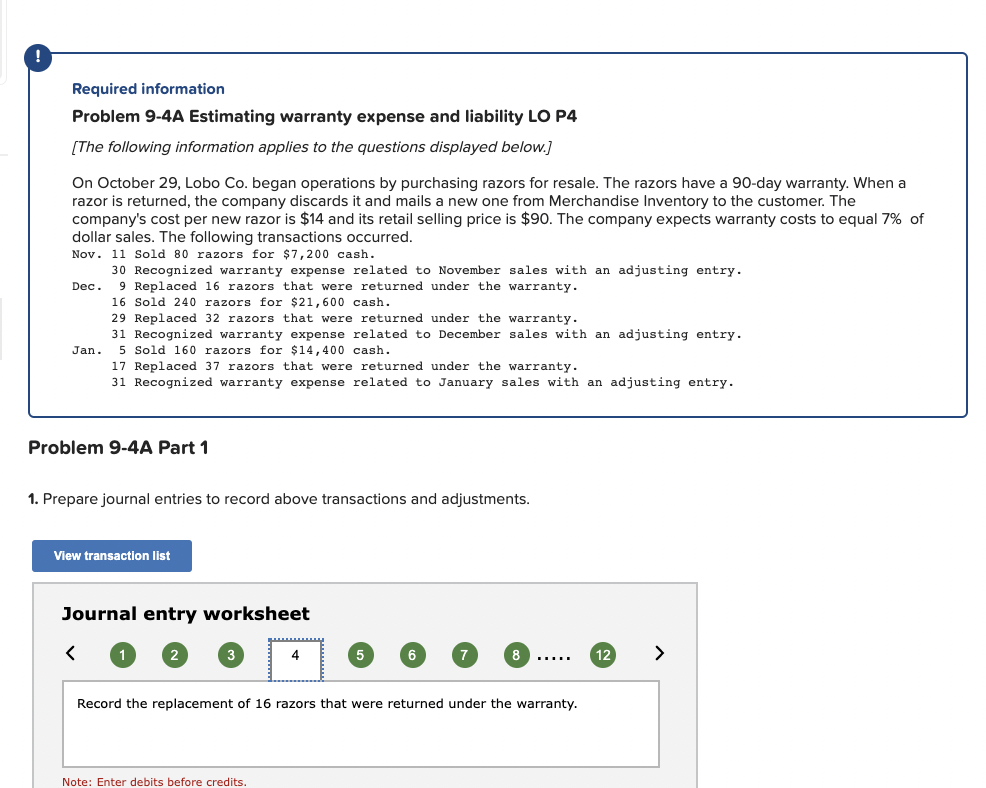

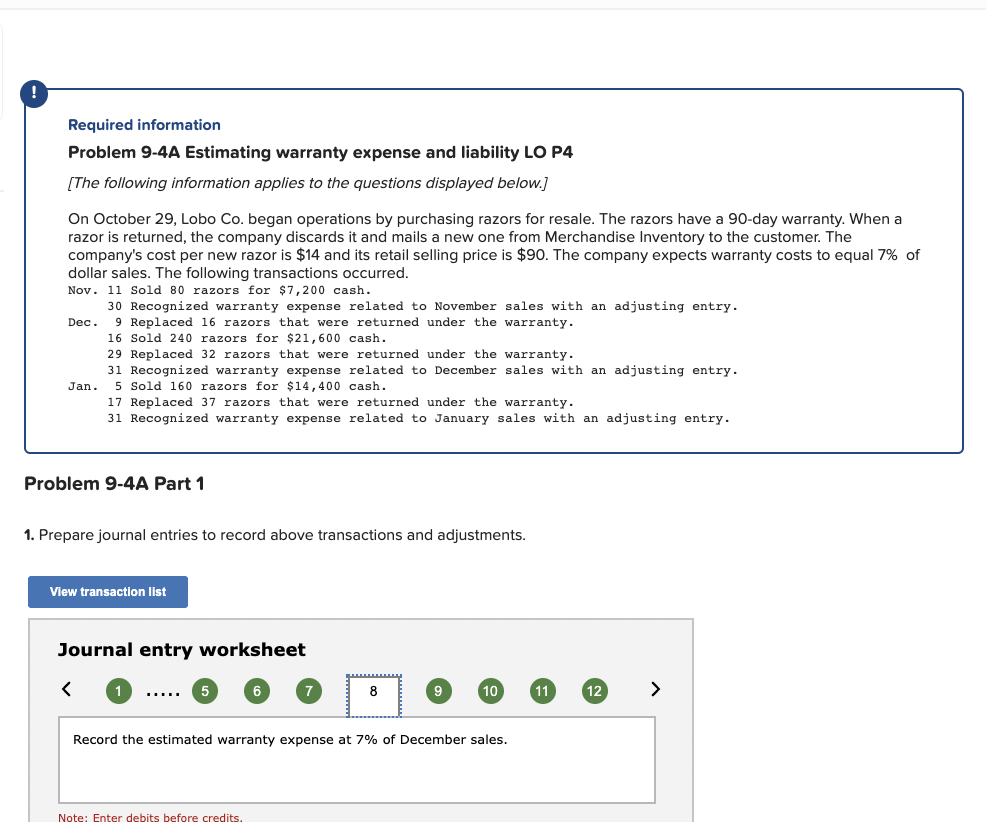

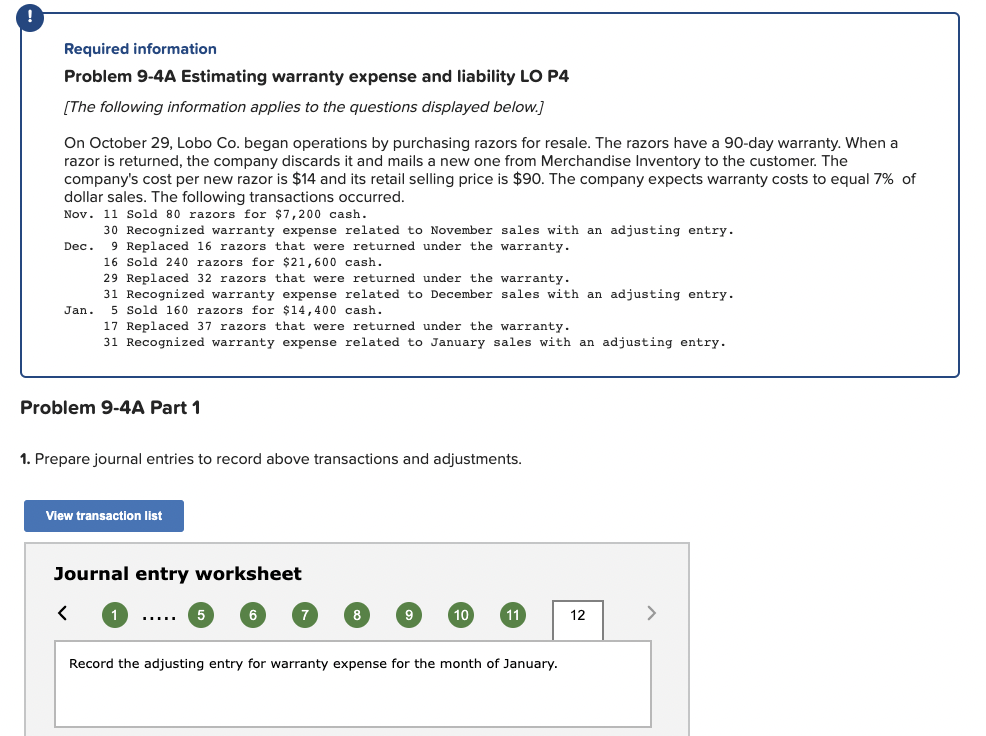

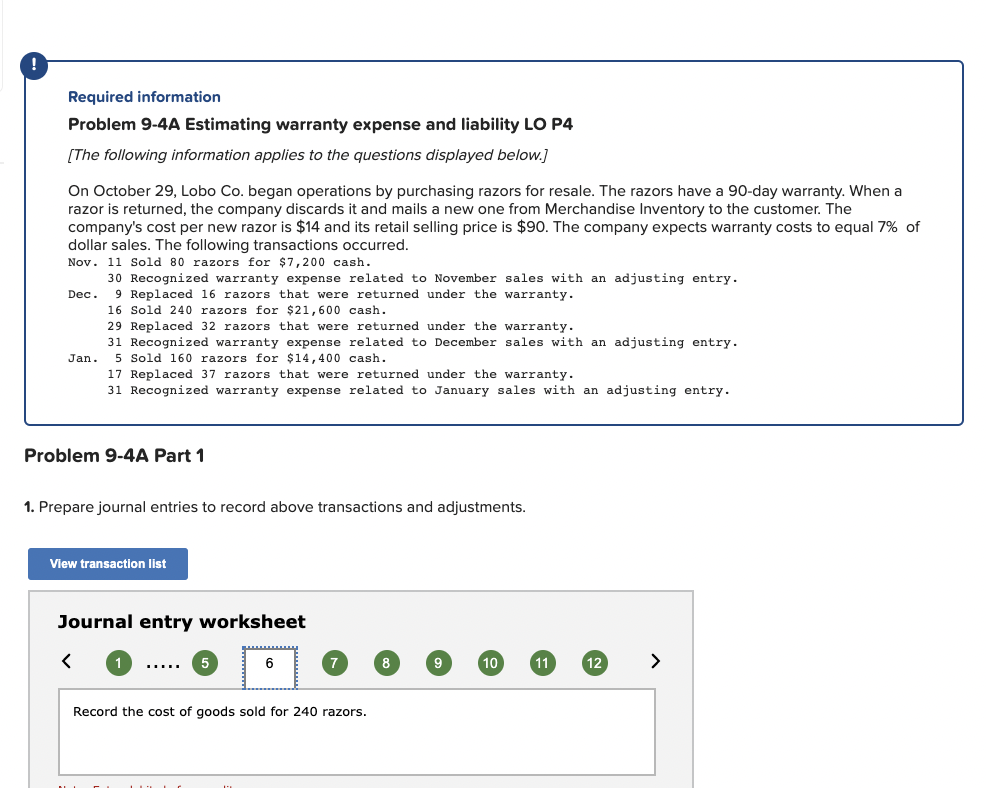

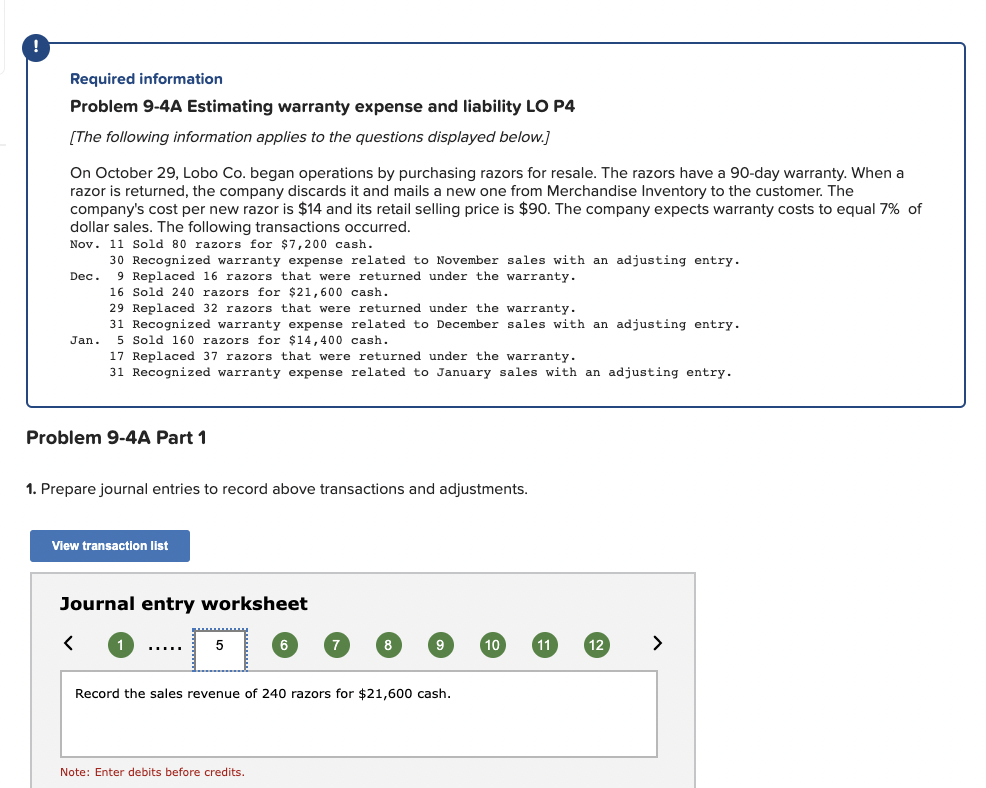

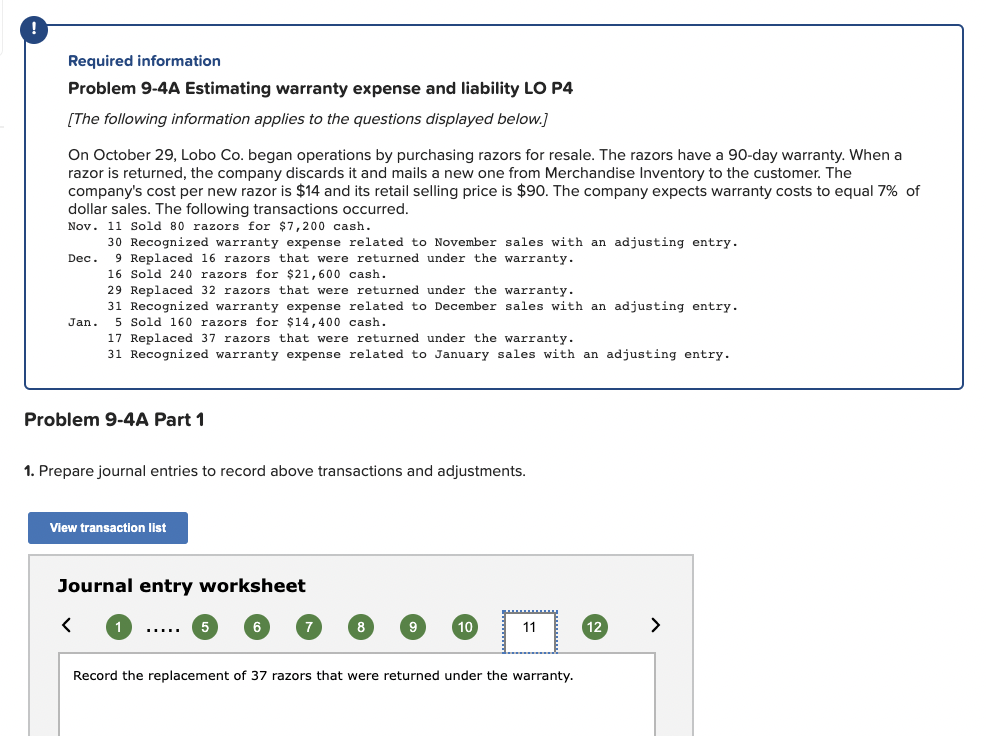

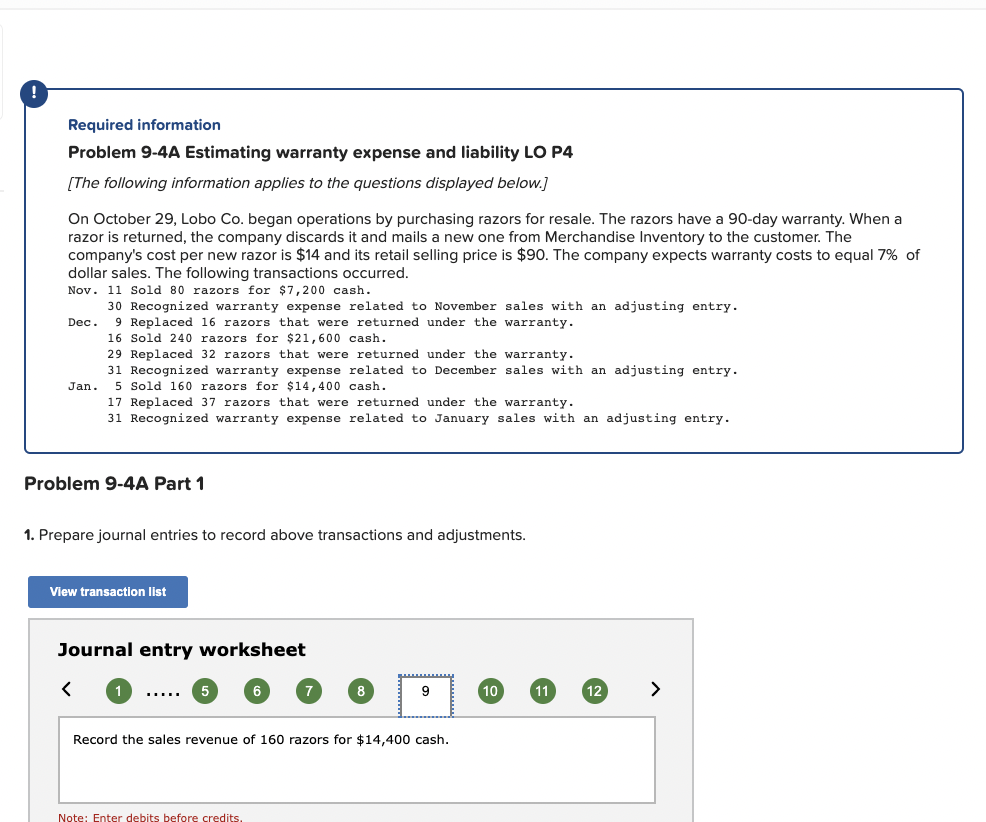

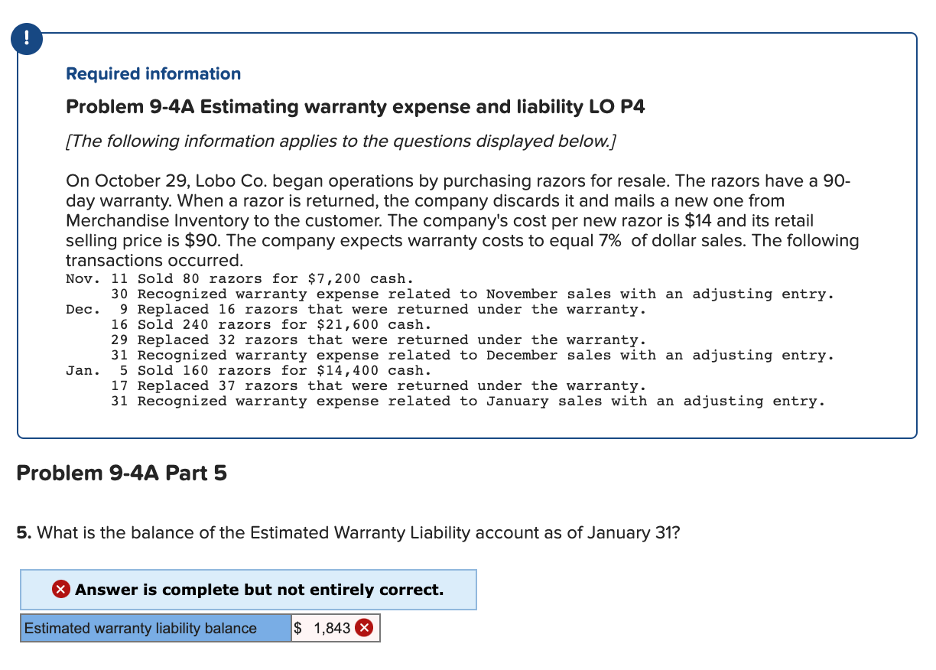

Question: Required information Problem 9-4A Estimating warranty expense and liability LO P4 {The following information applies to the questions displayed below} On October 29, Lobo Co.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock