Question: Required information Required: 2 - a . Post the beginning balances and adjusting entries to the following T - accounts. 2 - b . Prepare

Required information Required:

a Post the beginning balances and adjusting entries to the following Taccounts.

b Prepare an adjusted trial balance as of December

Complete this question by entering your answers in the tabs below.

Req

Post the beginning balances and adjusting entries to the following T accounts.

Note: Enter your answers in thousands, not in dollars ie should be entered as Complete this question by entering your answers in the tabs below.

Req

Req B

Prepare an adjusted trial balance as of December

Note: Enter your answers in thousands, not in dollars ie should be entered as

tableMINT CLEANING INCORPORATED,Adjusted Trial Balance,,in thousands of dollarsDebit,CreditAccount Titles,,

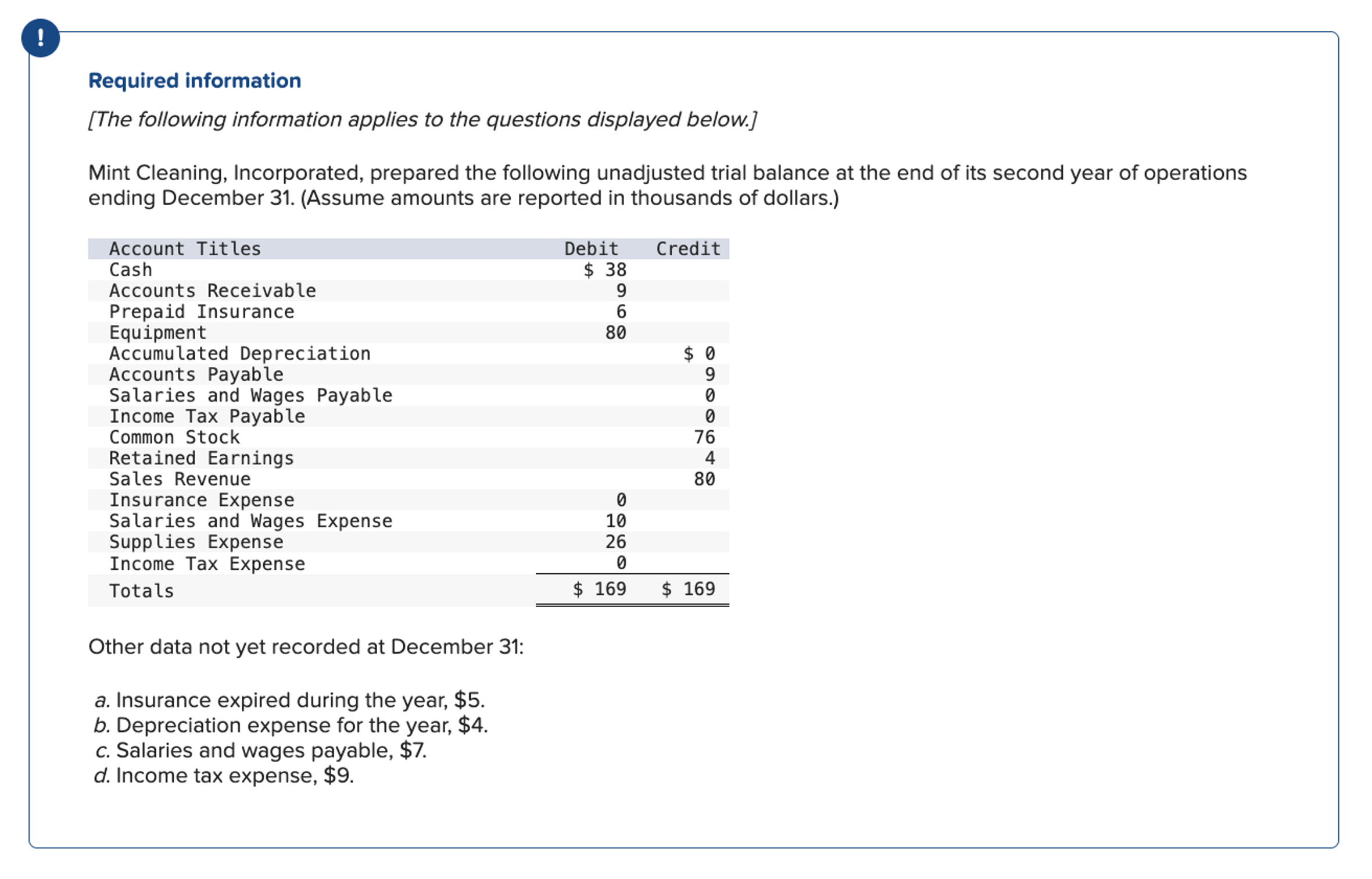

The following information applies to the questions displayed below.

Mint Cleaning, Incorporated, prepared the following unadjusted trial balance at the end of its second year of operations

ending December Assume amounts are reported in thousands of dollars.

Other data not yet recorded at December :

a Insurance expired during the year, $

b Depreciation expense for the year, $

c Salaries and wages payable, $

d Income tax expense, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock