Question: Required information Required information Problem 7 - 7 ( Static ) Calculate depreciation of property and equipment and amortization of intangible assets ( LO 7

Required information Required information

Problem Static Calculate depreciation of property and equipment and amortization of intangible

assets LO

The following information applies to the questions displayed below.

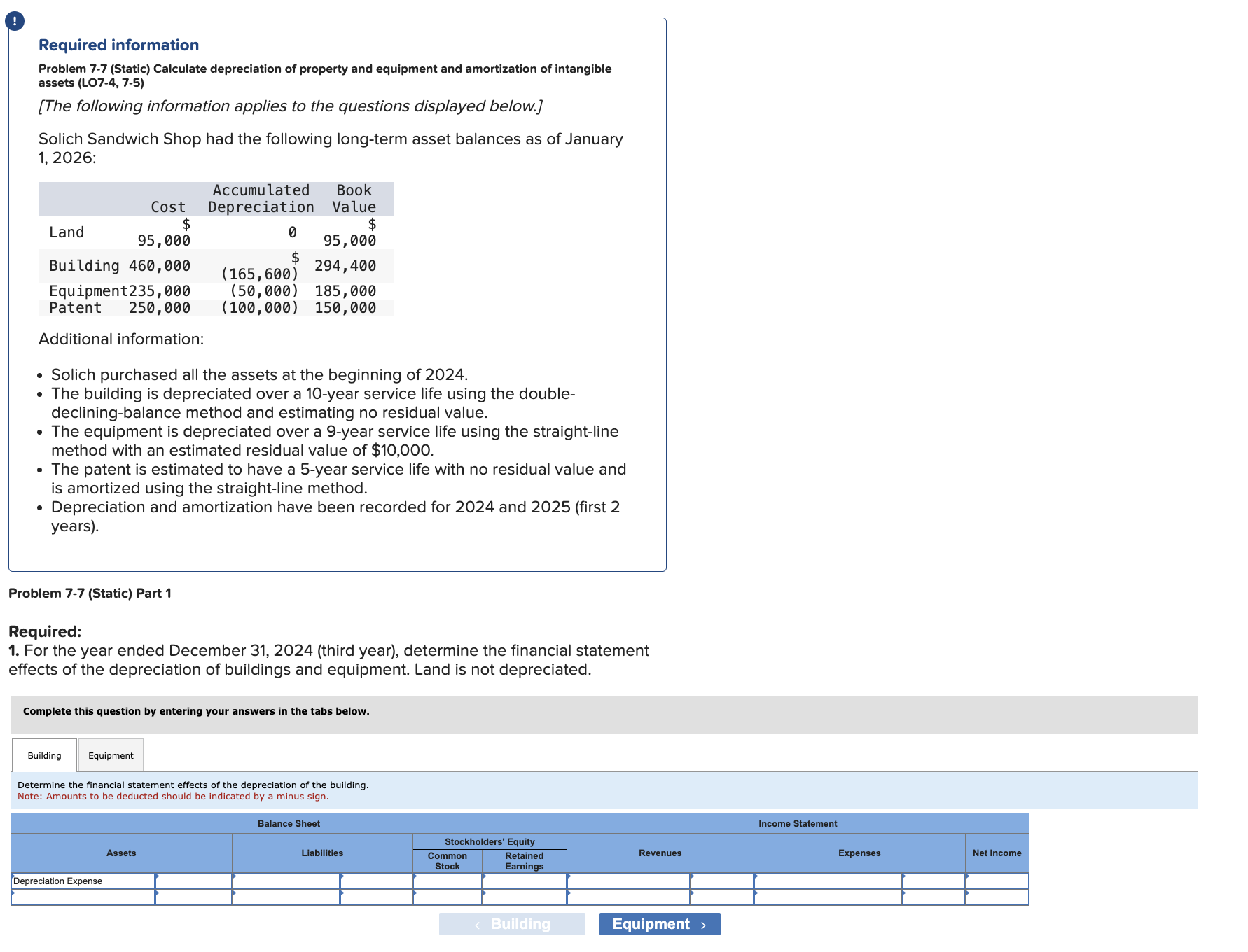

Solich Sandwich Shop had the following longterm asset balances as of January

:

Additional information:

Solich purchased all the assets at the beginning of

The building is depreciated over a year service life using the double

decliningbalance method and estimating no residual value.

The equipment is depreciated over a year service life using the straightline

method with an estimated residual value of $

The patent is estimated to have a year service life with no residual value and

is amortized using the straightline method.

Depreciation and amortization have been recorded for and first

years

Problem Static Part

Required:

For the year ended December third year determine the financial statement

effects of the depreciation of buildings and equipment. Land is not depreciated.

Complete this question by entering your answers in the tabs below.

Equipment

Determine the financial statement effects of the depreciation of the building.

Note: Amounts to be deducted should be indicated by a minus sign. Required information

Problem Static Calculate depreciation of property and equipment and amortization of intangible

assets LO

The following information applies to the questions displayed below.

Solich Sandwich Shop had the following longterm asset balances as of January

:

Additional information:

Solich purchased all the assets at the beginning of

The building is depreciated over a year service life using the double

decliningbalance method and estimating no residual value.

The equipment is depreciated over a year service life using the straightline

method with an estimated residual value of $

The patent is estimated to have a year service life with no residual value and

is amortized using the straightline method.

Depreciation and amortization have been recorded for and first

years

Problem Static Part

Required:

For the year ended December third year determine the financial statement

effects of the depreciation of buildings and equipment. Land is not depreciated.

Complete this question by entering your answers in the tabs below.

Problem Static Calculate depreciation of property and equipment and amortization of intangible

assets LO

The following information applies to the questions displayed below.

Solich Sandwich Shop had the following longterm asset balances as of January

:

Additional information:

Solich purchased all the assets at the beginning of

The building is depreciated over a year service life using the double

decliningbalance method and estimating no residual value.

The equipment is depreciated over a year service life using the straightline

method with an estimated residual value of $

The patent is estimated to have a year service life with no residual value and

is amortized using the straightline method.

Depreciation and amortization have been recorded for and first

years

Problem Static Part

Required:

For the year ended December third year determine the financial statement

effects of the depreciation of buildings and equipment. Land is not depreciated.

Complete this question by entering your answers in the tabs below.

Equipment

Determine the financial statement effects of the depreciation of the building.

Note: Amounts to be deducted should be indicated by a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock