Question: Required information Section Break ( 8 - 1 1 ) [ The following information apples to me questionat diplayed below ] A pension fund manager

Required information

Section Break

The following information apples to me questionat diplayed below

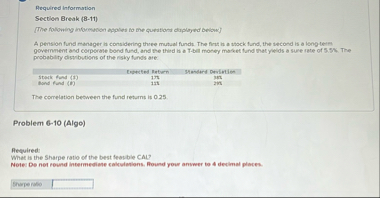

A pension fund manager it considering three mutual funds. The first in a stock fund, the second is a longtere government and corporate bondfund, and the thand is a Tball money mateet fund that yelds a sure rate of The prebatity distbutions of the rishy funds are:

tableTropted fridin,Phandart Davintionstopit fand Nonst fad Im

The comelation between the fund returns is

Problem Algo

Required

What is the Sharpe ratio of the best feasbie CAL?

Noter bo not round intermediane calculations. Round your anvwer to deelimal places.

Thare ratio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock