Question: Required information Skip t o question [ T h e following information applies t o the questions displayed below. ] Amy i s evaluating the

Required information

Skip question

following information applies the questions displayed below.

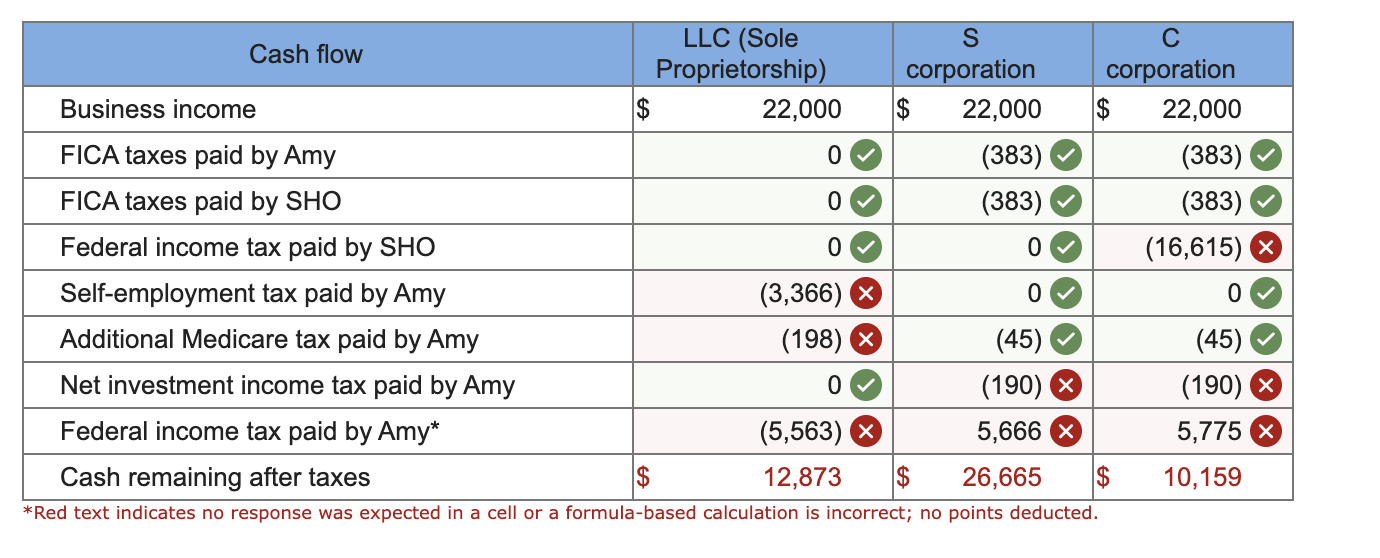

Amy evaluating the cash flow consequences organizing her business entity SHO a sole proprietorship corporation, corporation. She used the following assumptions make her calculations:

For all entity types, the business reports $ business income before deducting compensation paid Amy and payroll taxes SHO pays Amy's behalf.

All entities use the cash method accounting.

Amy organizes SHO corporation corporation, SHO will pay Amy $ annual salary the salary reasonable for purposes this problem For both the and corporations, Amy will pay percent FICA tax her salary and SHO will also pay percent FICA tax Amy's salary FICA tax paid the entity deductible the entity

Amy's marginal ordinary income tax rate percent, and her income tax rate qualified dividends and net capital gains percent.

Amy's marginal selfemployment tax rate percent.

Amy pays percent additional Medicare tax salary and net earnings from selfemployment her salary and net earnings from selfemployment are over the threshold for the tax

Amy pays percent net investment income tax dividends and net capital gains AGI her joint tax return over the threshold more than any net investment income she receives

Assume that for purposes the qualified business income deduction, the business income not from a specified service and neither the wagebased nor the taxable income applies the deduction.

SHO formed corporation corporation, SHO will distribute all its earnings after paying entity level taxes and after deducting salary and related FICA taxes paid Amy.

Fill the cells the table below identify cash flows associated with the income from the business the business formed proprietorship corporation, corporation for tax purposes. Enter cash outflows negative numbers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock