Question: ( ! ) Required information [ The following information applies to the questions displayed below. ] Part 4 of 4 0 / 8 . 3

Required information

The following information applies to the questions displayed below.

Part of

points awarded

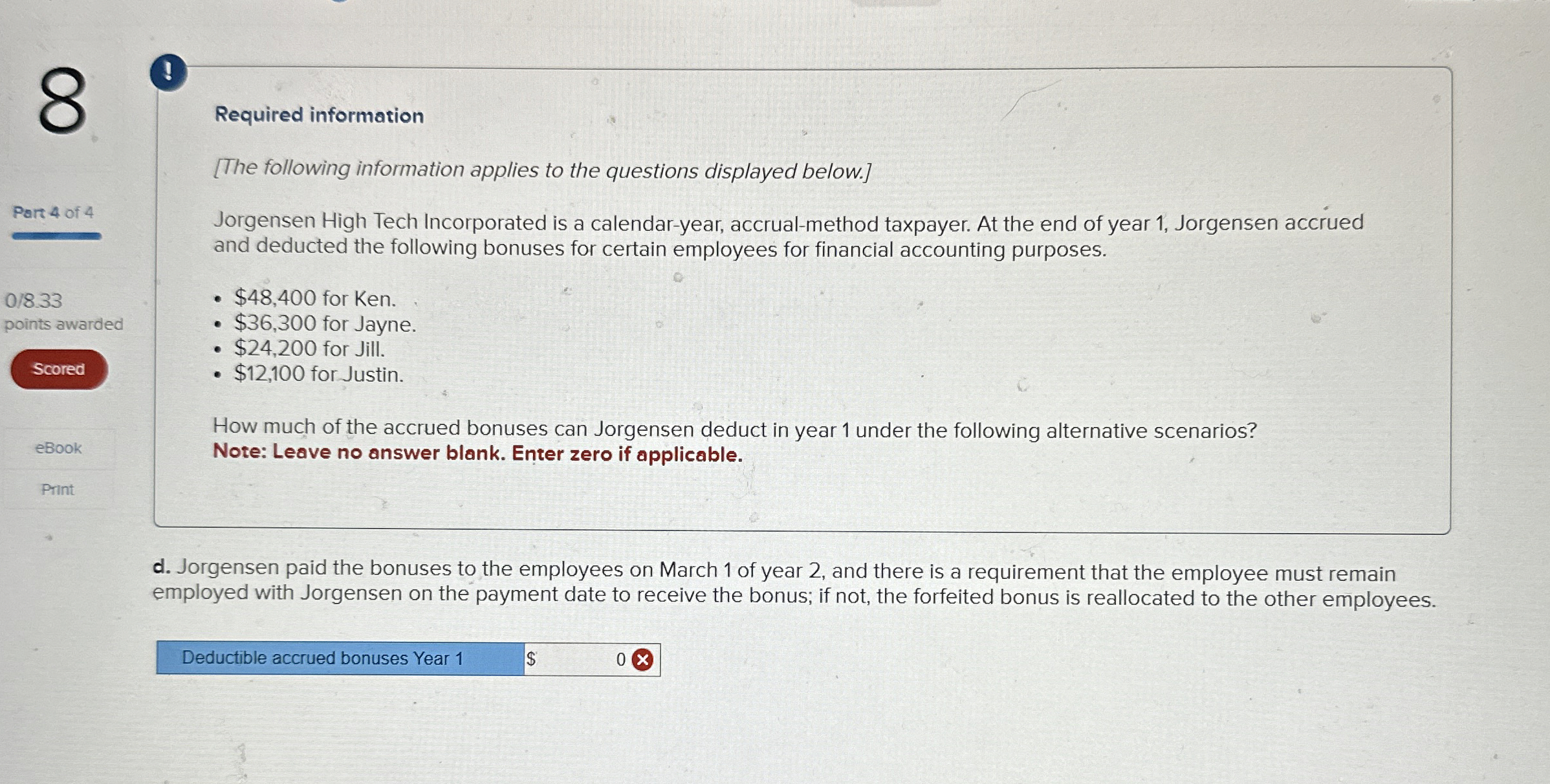

Jorgensen High Tech Incorporated is a calendaryear, accrualmethod taxpayer. At the end of year Jorgensen accrued and deducted the following bonuses for certain employees for financial accounting purposes.

$ for Ken.

$ for Jayne.

$ for Jill.

$ for Justin.

How much of the accrued bonuses can Jorgensen deduct in year under the following alternative scenarios?

Note: Leave no answer blank. Enter zero if applicable.

d Jorgensen paid the bonuses to the employees on March of year and there is a requirement that the employee must remain employed with Jorgensen on the payment date to receive the bonus; if not, the forfeited bonus is reallocated to the other employees.

Deductible accrued bonuses Year

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock