Question: Required information (The following information applies to the questions displayed below.] Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the

![Required information (The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e5dfe8ca83b_09666e5dfe84fb1e.jpg)

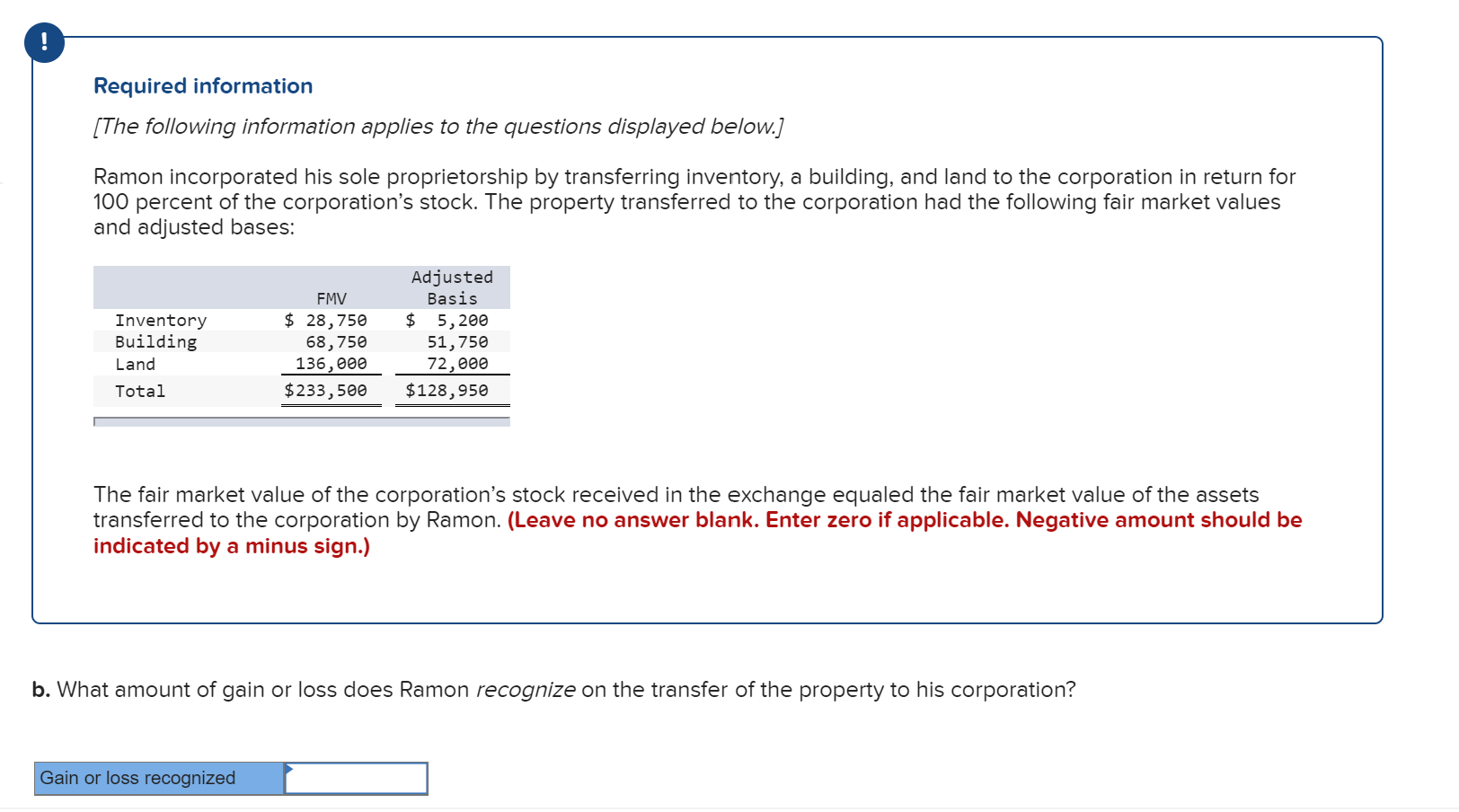

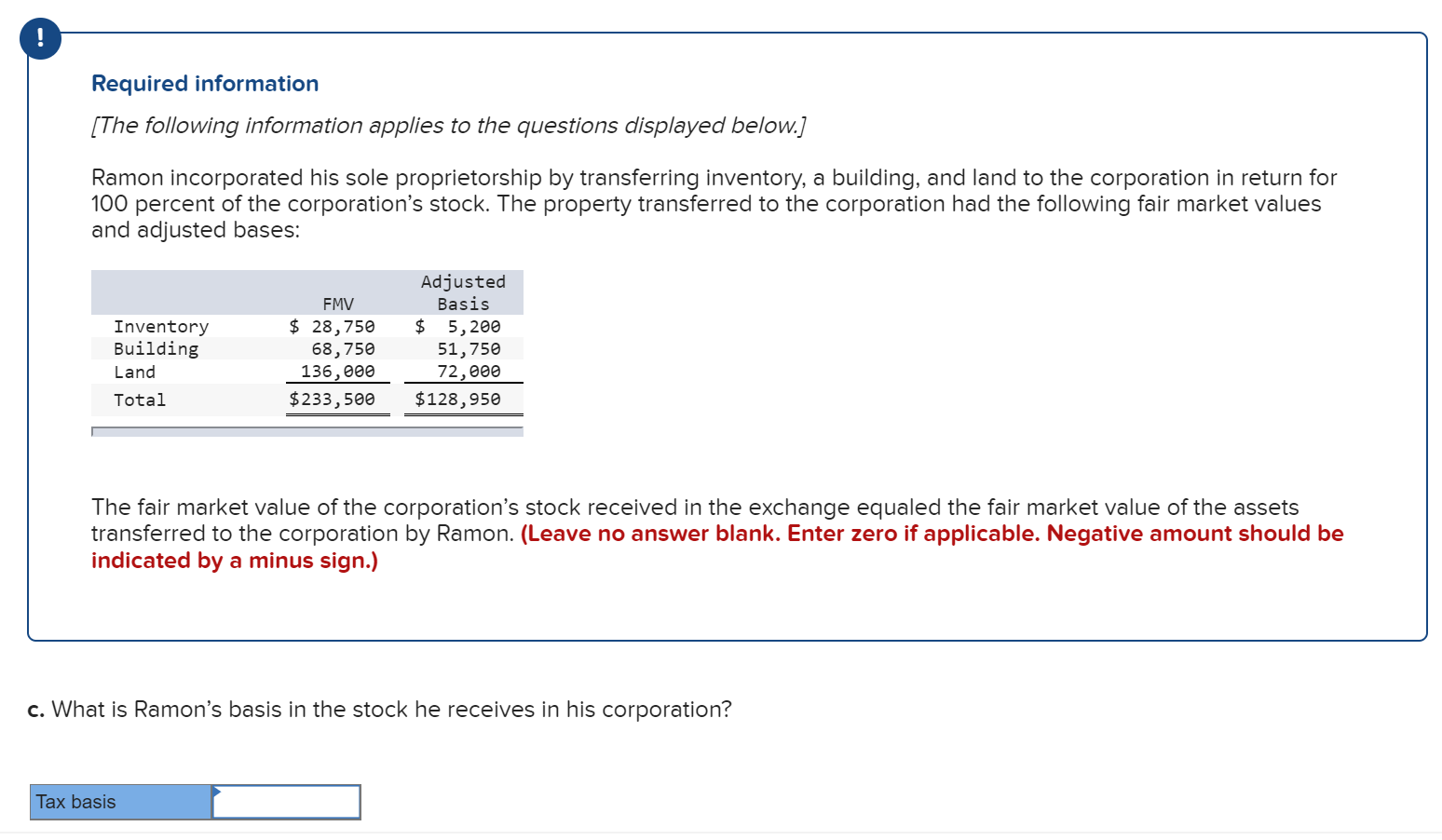

Required information (The following information applies to the questions displayed below.] Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted bases: Inventory Building Land Total FMV $ 28,750 68,750 136,000 $233,500 Adjusted Basis $ 5,200 51,750 72,000 $128,950 The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Ramon. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) a. What amount of gain or loss does Ramon realize on the transfer of the property to his corporation? Gain or loss realized Required information [The following information applies to the questions displayed below.] Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted bases: Inventory Building Land FMV $ 28,750 68,750 136,000 $233,500 Adjusted Basis $ 5,200 51,750 72,000 $ 128,950 Total The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Ramon. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) b. What amount of gain or loss does Ramon recognize on the transfer of the property to his corporation? Gain or loss recognized Required information [The following information applies to the questions displayed below.] Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted bases: Inventory Building Land Total FMV $ 28,750 68,750 136,000 $233,500 Adjusted Basis $ 5,200 51,750 72,000 $128,950 The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Ramon. (Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.) c. What is Ramon's basis in the stock he receives in his corporation? Tax basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts