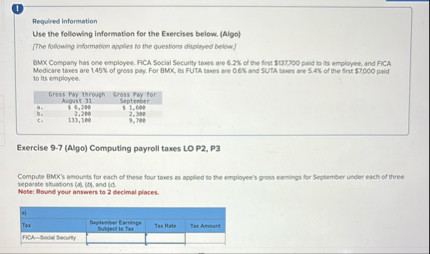

Question: Required information Use the following imformation for the Exercises below, ( Algo ) [ The following information applies to the questions displyyed below ] BMX

Required information

Use the following imformation for the Exercises below, Algo

The following information applies to the questions displyyed below

BMX Compary has Assuming situation a prepare the employer's September journal entry to record salary expense and its related payroll liabilities fo this employee. The employee's federal income taxes withheld by the employer are $ for this pay period.

Complete this question by entering your answers in the tabs below.

Taxes to be Withheld From

General Gross Pay Journal

The employee's federal income taxes withheld by the employer are $ for this pay period. Assuming situation a compute the taxes to be withheld from gross pay for this employee.

Note: Round your answers to decimal places.

tableTaxes to be Withheld From Gross Pay EmployeePaid TaxesSeptember Earnings Subject to Tax,Tax Rate,Tax AmountFederal income tax,,,$

Journal entry worksheet

Prepare the employer's September journal entry to record accrued salary expense and its related payroll liabilities for this employee.

Note: Enter debits before credits.

tableDatoGeneral Journal,Debit,CreditSeplember

Assuming situation a prepare the employer's September journal entry to record the employer's payroll taxes expense and its related liabilities.

Complete this question by entering your answers in the tabs below.

Payroll Taxes Expense

General Journal

Assuming situation a compute the payroll taxes expense.

Note: Round your answers to decimal places.

tableEmployer Payroll taxes,September earnings subject to tax,Tax Rate,Tax Amount$ one employee. FICA Social Security tawes are of the frit $ paid to its employee, and FICA to its employee.

Gress Pay throuph Cross Fay for

Augus

Exercise Algo Computing payroll taxes LO P P

Compute BMOX's amounts for each of these four tases as appled to the employee's goas eanings for Sipbember under each of three seporste shustions ab and c

Nobe: Bound your answers to decimsl places.

tableTaxStulanber Earingu Suldeet is Tax,Tes Rate,Tex AmountFICASoder Smorly,,,tableaTaxSeptember Earnings Subject to Tax,Tax Rate,Tax AmountFICASocial Security,,,FICAMedicare,,,FUTASUTAbTaxSeptember Earnings Subject to Tax,Tax Rate,Tax Amount

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock