Question: Required information Use the following information for Problems 18-20 [The following information applies to the questions displayed below.] On June 1, 2020, Munchkin Corp, recelved

![information applies to the questions displayed below.] On June 1, 2020, Munchkin](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6ec8fc60da_87166e6ec8f693ca.jpg)

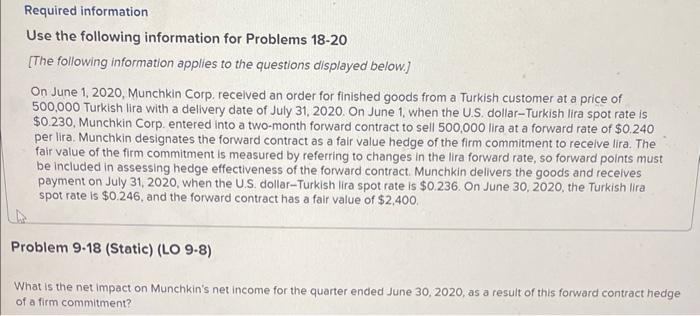

Required information Use the following information for Problems 18-20 [The following information applies to the questions displayed below.] On June 1, 2020, Munchkin Corp, recelved an order for finished goods from a Turkish customer at a price of 500,000 Turkish lira with a dellvery date of July 31, 2020 . On June 1, when the U.S. dollar-Turkish lira spot rate is $0.230, Munchkin Corp. entered into a two-month forward contract to sell 500,000 lira at a forward rate of $0.240 per lira. Munchkin designates the forward contract as a fair value hedge of the firm commitment to recelve lira. The fair value of the firm commitment is measured by referring to changes in the lira forward rate, so forward points must be included in assessing hedge effectiveness of the forward contract. Munchkin delivers the goods and receives payment on July 31, 2020, when the U.S. dollar-Turkish lira spot rate is $0.236. On June 30,2020 , the Turkish lira spot rate is $0.246, and the forward contract has a fair value of $2,400. Problem 9.18 (Static) (LO 9.8) What is the net impact on Munchkin's net income for the quarter ended June 30,2020 , as a result of this forward contract hedge of a firm commitment? Required information $2,400 increase in net income $4,000 decrease in net income so $8,000 increase in net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts