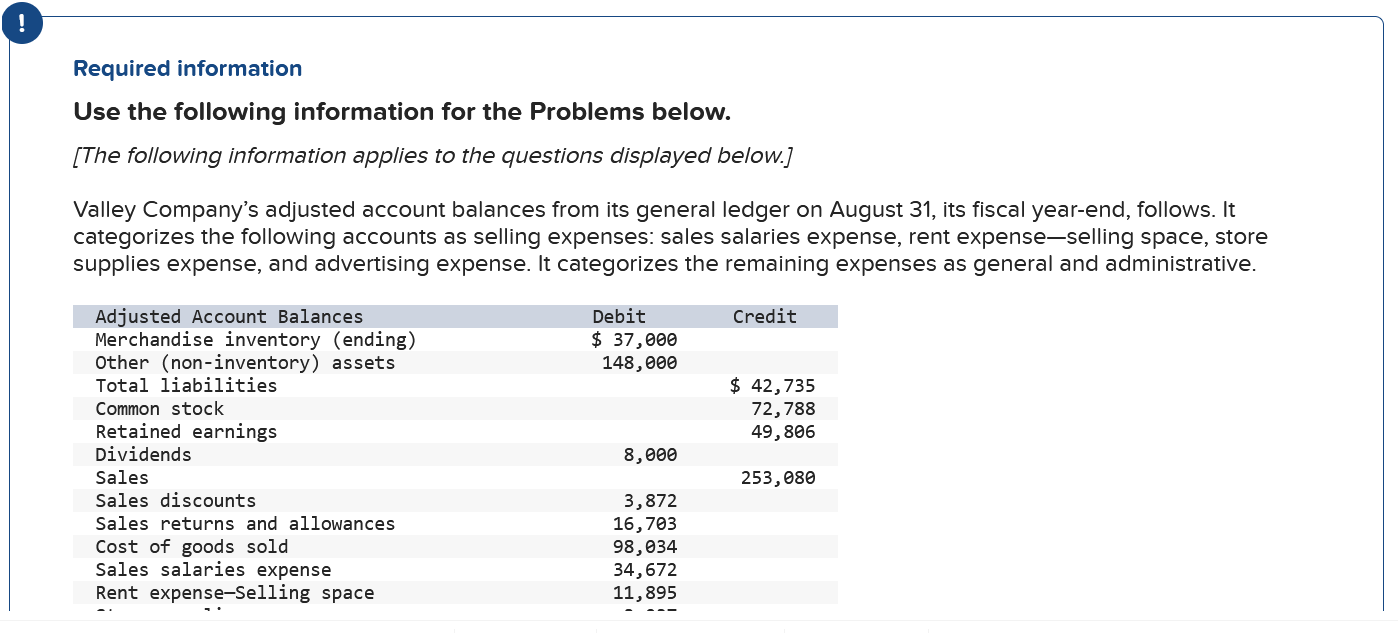

Question: Required information Use the following information for the Problems below. [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from

![following information applies to the questions displayed below.] Valley Company's adjusted account](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e313d383bc2_77866e313d2ef5bd.jpg)

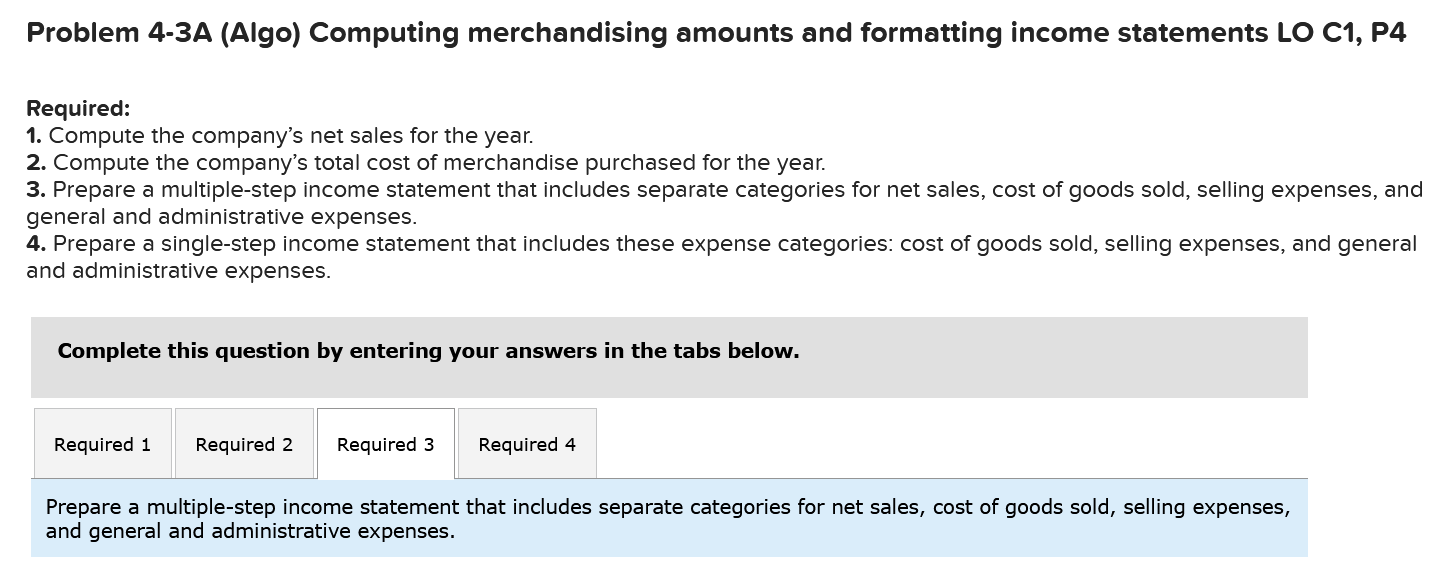

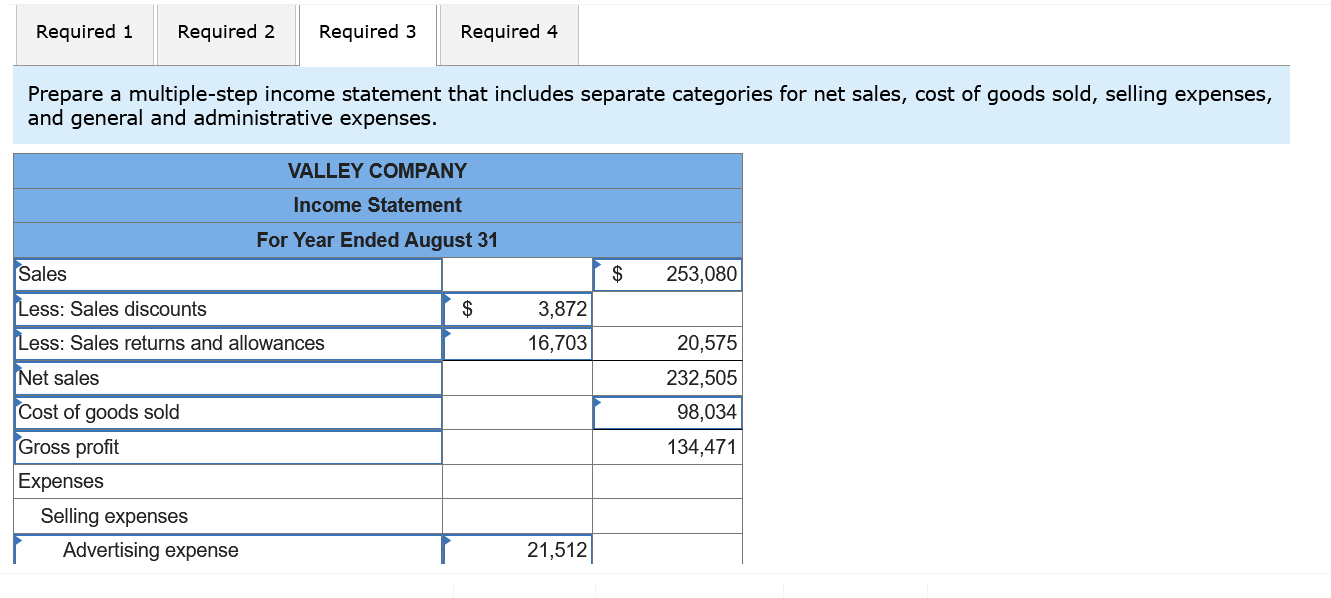

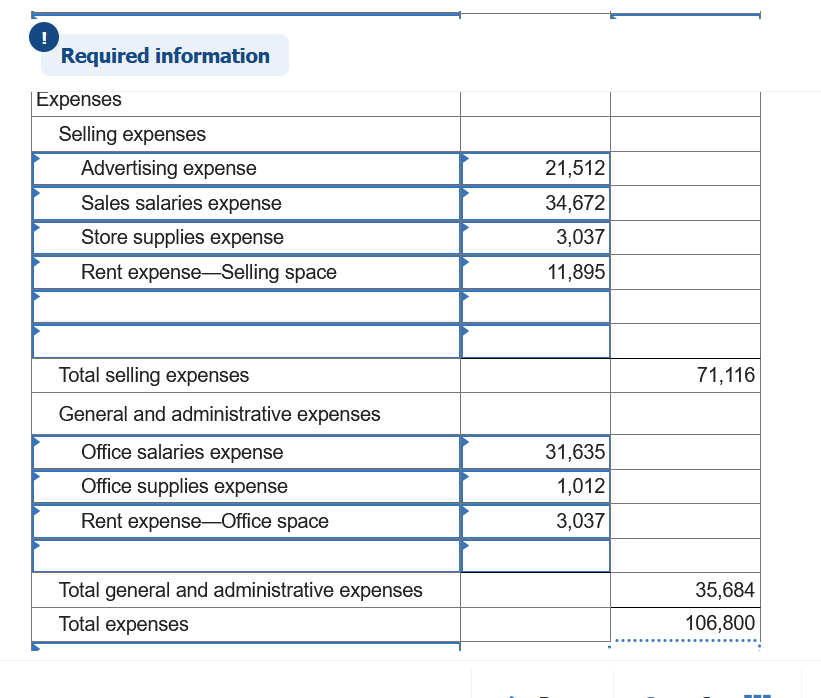

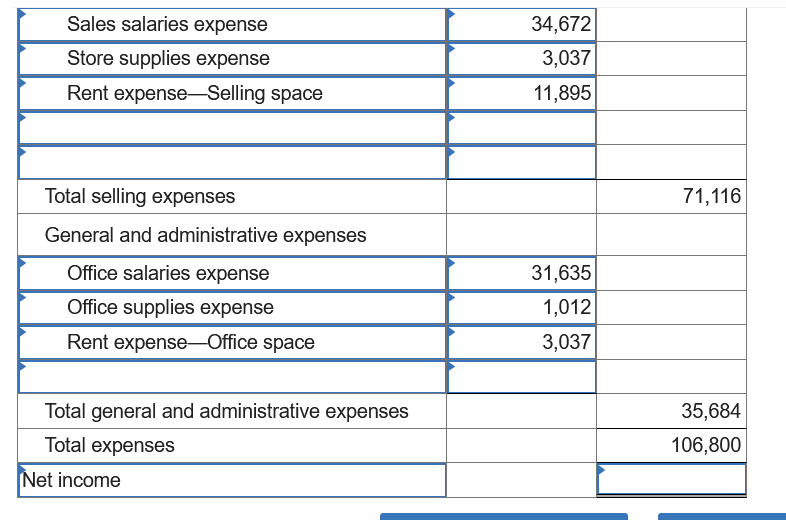

Required information Use the following information for the Problems below. [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $29,859. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. roblem 4-3A (Algo) Computing merchandising amounts and formatting income statements LO C1, P4 Problem 4-3A (Algo) Computing merchandising amounts and formatting income statements LO C1, P4 Required: 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, an general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and genera and administrative expenses. Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. Required information \begin{tabular}{|l|} \hline Expenses \\ \hline Selling expenses \\ \hline Advertising expense \\ \hline Sales salaries expense \\ \hline Store supplies expense \\ \hline Rent expense-Selling space \\ \hline Total selling expenses \\ \hline General and administrative expenses \\ \hline Office salaries expense \\ \hline Office supplies expense \\ \hline Rent expense-Office space \\ \hline Total general and administrative expenses \\ \hline Total expenses \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline & \\ \hline 21,512 & \\ \hline 34,672 & \\ \hline 3,037 & \\ \hline 11,895 & \\ \hline & \\ \hline & \\ \hline 31,635 & \\ \hline 1,012 & \\ \hline 3,037 & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Sales salaries expense & 34,672 & \\ \hline Store supplies expense & 3,037 & \\ \hline Rent expense-Selling space & 11,895 & \\ \hline & & \\ \hline Total selling expenses & & \\ \hline General and administrative expenses & & \\ \hline Office salaries expense & & \\ \hline Office supplies expense & & \\ \hline Rent expense-Office space & & \\ \hline & & \\ \hline Total general and administrative expenses & & \\ \hline Total expenses & & \\ \hline Net income & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts