Question: Required information Use the following information for the Problems below. [The following information applies to the questions displayed below.] Trico Company set the following standard

Required information

Use the following information for the Problems below.

[The following information applies to the questions displayed below.] Trico Company set the following standard unit costs for its single product.

| Direct materials (30 Ibs. @ $4.80 per Ib.) | $ | 144.00 |

| Direct labor (6 hrs. @ $14 per hr.) | 84.00 | |

| Factory overheadvariable (6 hrs. @ $7 per hr.) | 42.00 | |

| Factory overheadfixed (6 hrs. @ $12 per hr.) | 72.00 | |

| Total standard cost | $ | 342.00 |

The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 66,000 units per quarter. The following flexible budget information is available.

| Operating Levels | ||||||

| 70% | 80% | 90% | ||||

| Production in units | 46,200 | 52,800 | 59,400 | |||

| Standard direct labor hours | 277,200 | 316,800 | 356,400 | |||

| Budgeted overhead | ||||||

| Fixed factory overhead | $ | 3,801,600 | $ | 3,801,600 | $ | 3,801,600 |

| Variable factory overhead | $ | 1,940,400 | $ | 2,217,600 | $ | 2,494,800 |

During the current quarter, the company operated at 90% of capacity and produced 59,400 units of product; actual direct labor totaled 303,800 hours. Units produced were assigned the following standard costs.

| Direct materials (1,782,000 Ibs. @ $4.80 per Ib.) | $ | 8,553,600 |

| Direct labor (356,400 hrs. @ $14 per hr.) | 4,989,600 | |

| Factory overhead (356,400 hrs. @ $19 per hr.) | 6,771,600 | |

| Total standard cost | $ | 20,314,800 |

Actual costs incurred during the current quarter follow.

| Direct materials (1,522,000 Ibs. @ $7.30 per lb.) | $ | 11,110,600 |

| Direct labor (303,800 hrs. @ $13.10 per hr.) | 3,979,780 | |

| Fixed factory overhead costs | 2,336,900 | |

| Variable factory overhead costs | 2,637,700 | |

| Total actual costs | $ | 20,064,980 |

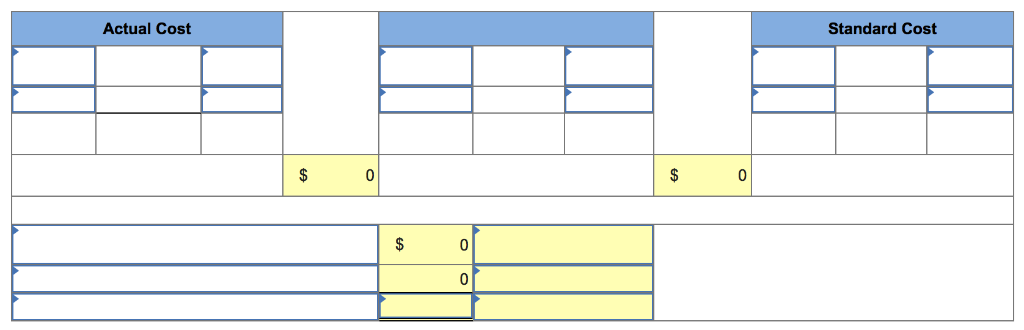

Problem 23-4A Computation of materials, labor, and overhead variances LO P2, P3

Required: 1. Compute the direct materials cost variance, including its price and quantity variances.

2. Compute the direct labor cost variance, including its rate and efficiency variances.

2. Compute the direct labor cost variance, including its rate and efficiency variances.

![information applies to the questions displayed below.] Trico Company set the following](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e59786283a7_56566e59785cee75.jpg) 3. Compute the overhead controllable and volume variances.

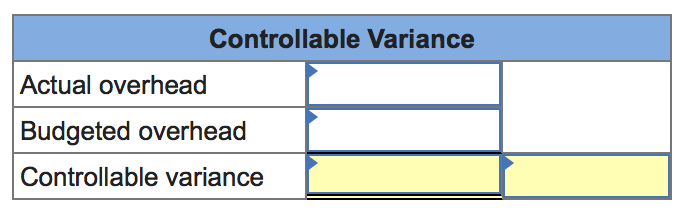

3. Compute the overhead controllable and volume variances.

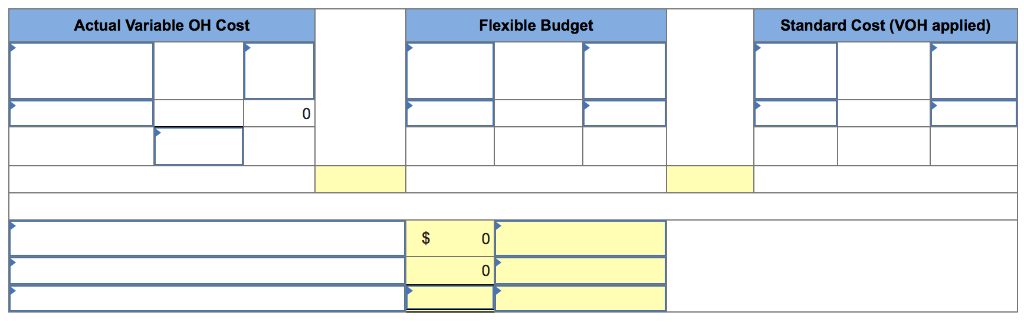

Problem 23-5AA Expanded overhead variances LO P4

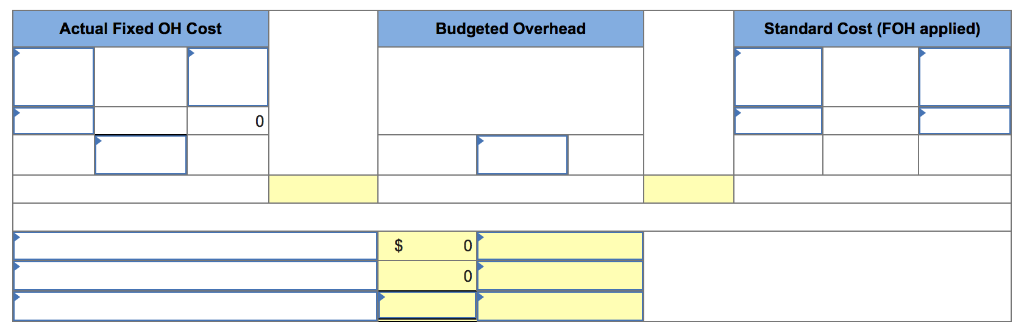

(a) Compute the variable overhead spending and efficiency variances. (Round "cost per unit" and "rate per hour" answers to 2 decimal places.)

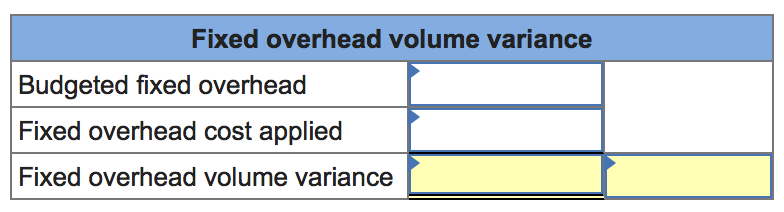

(b) Compute the fixed overhead spending and volume variances. (Round "cost per unit" and "rate per hour" answers to 2 decimal places.)

(b) Compute the fixed overhead spending and volume variances. (Round "cost per unit" and "rate per hour" answers to 2 decimal places.)

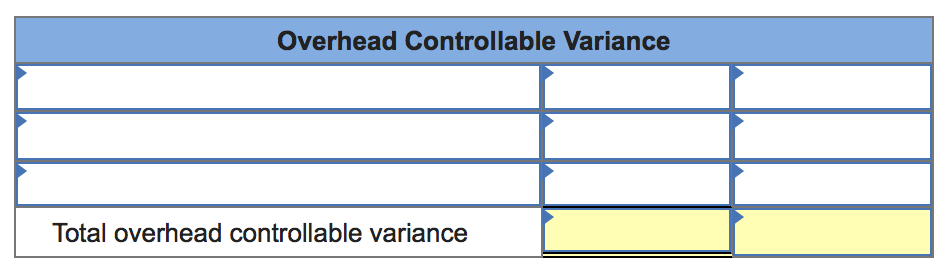

(c) Compute the total overhead controllable variance.

(c) Compute the total overhead controllable variance.

Actual Cost Standard Cost 0 Actual Cost Standard Cost 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts