Question: Required information Use the following information for the Problems below. The following information applies to the questions displayed below! Selk Steel Co, which began operations

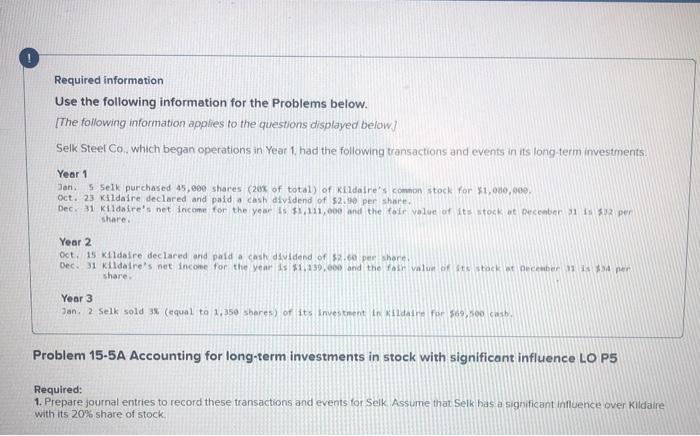

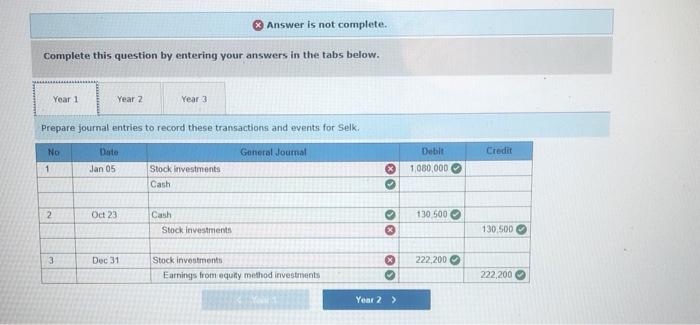

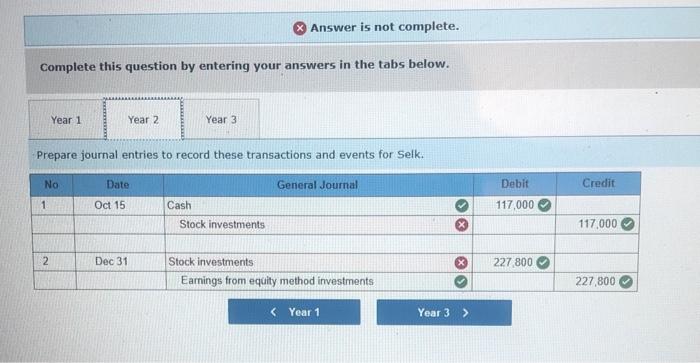

Required information Use the following information for the Problems below. The following information applies to the questions displayed below! Selk Steel Co, which began operations in Year 1 had the following transactions and events in its long term investments Year 1 Jan 5 Selk purchased 45,000 shares (20% of total of Kildare common stock for $1,000,000 oct. 23 Kildaire declared and paid a cash dividend of $2.90 per share. Dec. 31 Kildare's net income for the year $1,111,000 and the tale value of its stock December 31 32 per share. Year 2 Oct. 15 Kildare declared and paid a cash dividend of $2.00 per share Dec 31 Kildaire's net income for the year $1.239.000 and the fair value of its stock December 11 share Year 3 Jan. 2 Selk sold 3 equal to 1.350 Shares of its investment in Kildare for $69.00 wib Problem 15-5A Accounting for long-term investments in stock with significant influence LO P5 Required: 1. Prepare journal entries to record these transactions and events for Selk Assume that Selk has a significant influence over Kildaire with its 20% share of stock Answer is not complete. Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. No General Journal Credit Date Jan 05 Debit 1,080,000 1 Stock investments Cash 2 Oct 23 130 500 Cash Stock investments 130.500 3 Dec 31 222 200 Stock investments Earnings from equity method investments 222,200 Year 2 > X Answer is not complete. Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare journal entries to record these transactions and events for Selk. No Date General Journal Credit Debit 117,000 1 Oct 15 Cash Stock investments 117.000 2 Dec 31 X 227 800 Stock investments Earnings from equity method investments 227,800 Year 1 Year 3 > Answer is not complete. Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year Prepare journal entries to record these transactions and events for Salk. No Date Debit Credit 1 Jan 02 69.500 General Joumal Cash Gain on sale of stock investments Stock Investments 1350 68,150 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts