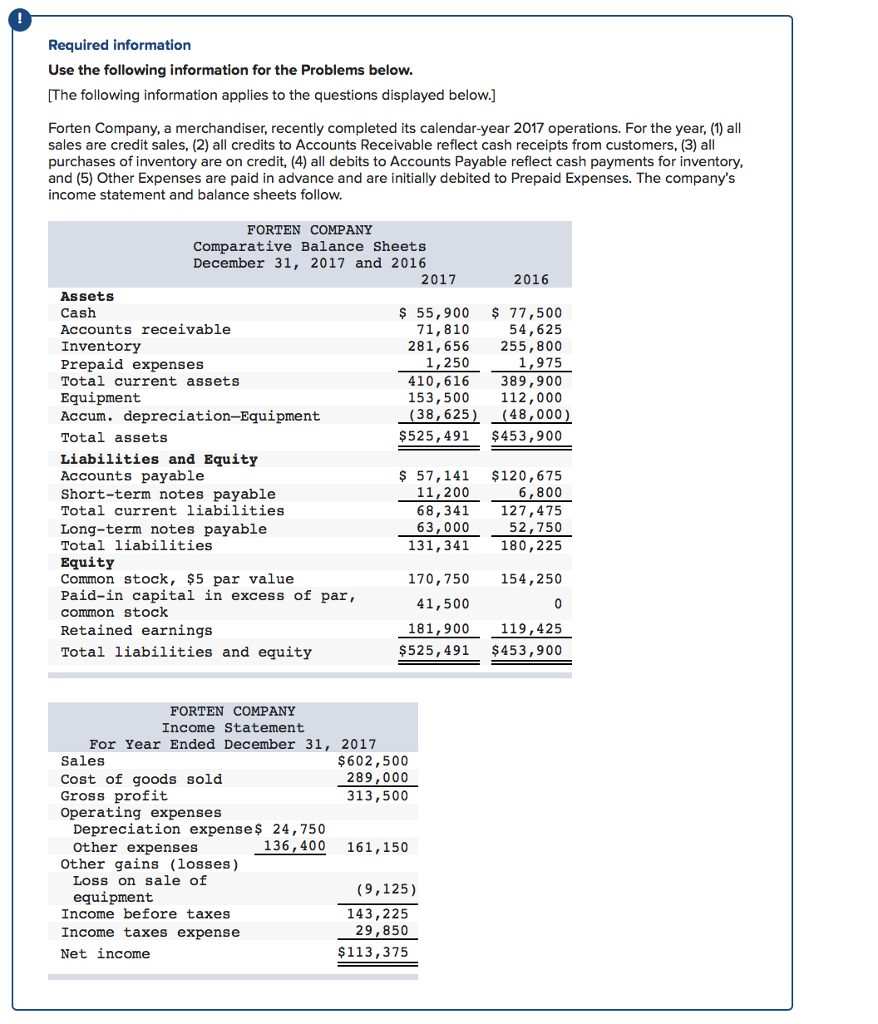

Question: Required information Use the following information for the Problems below. The following information applies to the questions displayed below.] Forten Company, a merchandiser, recently completed

![following information applies to the questions displayed below.] Forten Company, a merchandiser,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7bf1c3c711_34766f7bf1bb5eee.jpg)

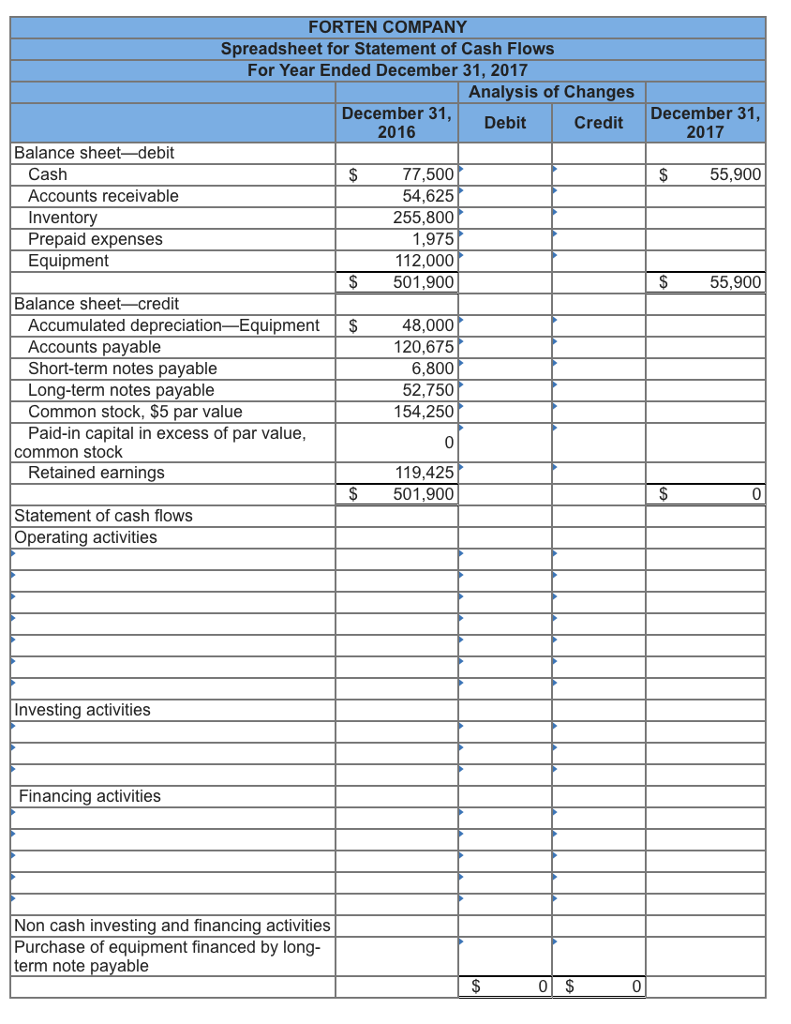

Required information Use the following information for the Problems below. The following information applies to the questions displayed below.] Forten Company, a merchandiser, recently completed its calendar-year 2017 operations. For the year, (1) al sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. The company's income statement and balance sheets follow FORTEN COMPANY Comparative Balance Sheets December 31, 2017 and 2016 2017 2016 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets $ 55,900 77,500 54,625 281,656 255,800 1.975 389,900 153,500 112,000 (38,625) (48.00 $525,491 $453,900 71,810 1,250 410,616 Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $ 57,141 $120,675 6,800 68,341127,475 63,000_ 52,750 131,341 180,225 11,200 170,750 154,250 41,500 181,900 119,425 $525,491 $453,900 FORTEN COMPANY Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses $602,500 289,000 313,500 Depreciation expenses 24,750 Other expenses 136,400 161,150 Other gains (losses) Loss on sale of equipment (9,125) Income before taxes Income taxes expense Net income 143,225 29,850 $113,375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts