Question: Required information Use the following information for the Problems below. ( Algo ) [ The following information applies to the questions displayed below. ] Phoenix

Required information

Use the following information for the Problems below. Algo

The following information applies to the questions displayed below.

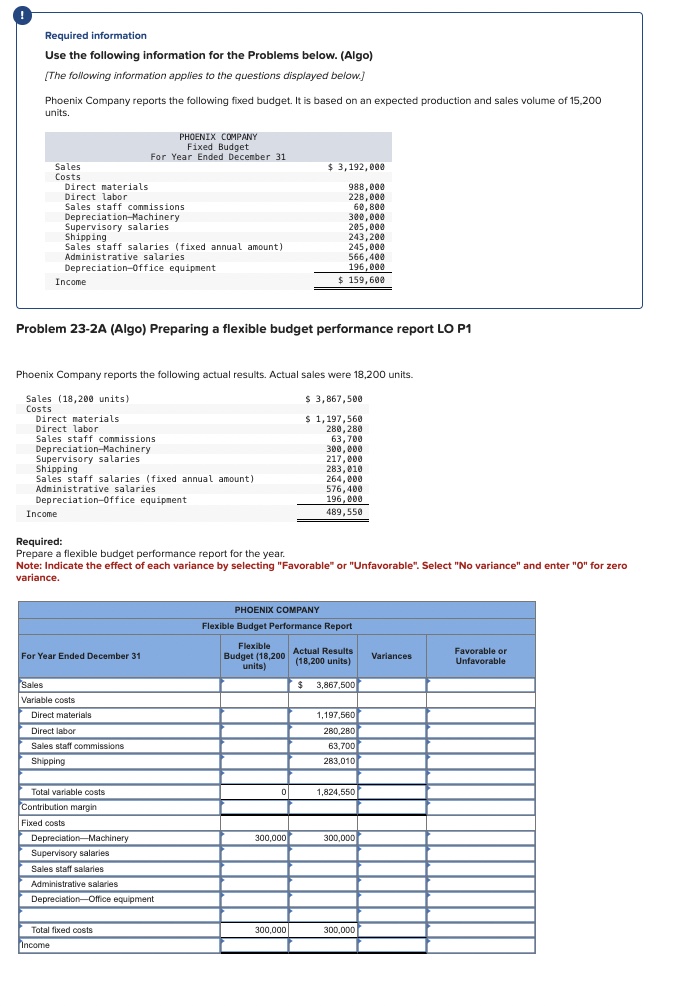

Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of units.

begintabularcc

hline multicolumnlbegintabularl

PHOENIX COMPANY

Fixed Budget

For Year Ended December

endtabular

hline Sales & $

hline Costs &

hline Direct materials &

hline Direct labor &

hline Sales staff comnissions &

hline DepreciationMachinery &

hline Supervisory salaries &

hline Shipping &

hline Sales staff salaries fixed annual amount &

hline Administrative salaries &

hline Depreciationffice equipnent &

hline Income & $

hline

endtabular

Problem A Algo Preparing a flexible budget performance report LO P

Phoenix Company reports the following actual results. Actual sales were units.

begintabularlr

Sales units & $

Costs & $

Direct materials &

Direct labor &

Sales staff comnissions &

DepreciationMachinery &

Supervisory salaries &

Shipping &

Sales staff salaries fixed annual amount &

Administrative salaries &

Depreciationffice equipment &

Income &

endtabular

Required:

Prepare a flexible budget performance report for the year.

Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select No variance" and enter O for zero variance. PLEASE SHOW EQUATIONS ON HOW TO SOLVE

begintabularccccc

hline multicolumncPHOENIX COMPANY

hline multicolumncFlexible Budget Performance Report

hline For Year Ended December & Flexible Budget

units & Actual Results units & Variances & Favorable or Unfavorable

hline Sales & & $ & &

hline Variable costs & & & &

hline Direct materials & & & &

hline Direct labor & & & &

hline Sales staff commissions & & & &

hline Shipping & & & &

hline & & & &

hline Total variable costs & & & &

hline Contribution margin & & & &

hline Fixed costs & & & &

hline DepreciationMachinery & & & &

hline Supervisory salaries & & & &

hline Sales staff salaries & & & &

hline Administrative salaries & & & &

hline DepreciationOffice equipment & & & &

hline & & & &

hline Total fixed costs & & & &

hline Income & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock