Question: ! Required information Use the following information for the Quick Studies below. ( Static ) [ The following information applies to the questions displayed below.

Required information

Use the following information for the Quick Studies below. Static

The following information applies to the questions displayed below.

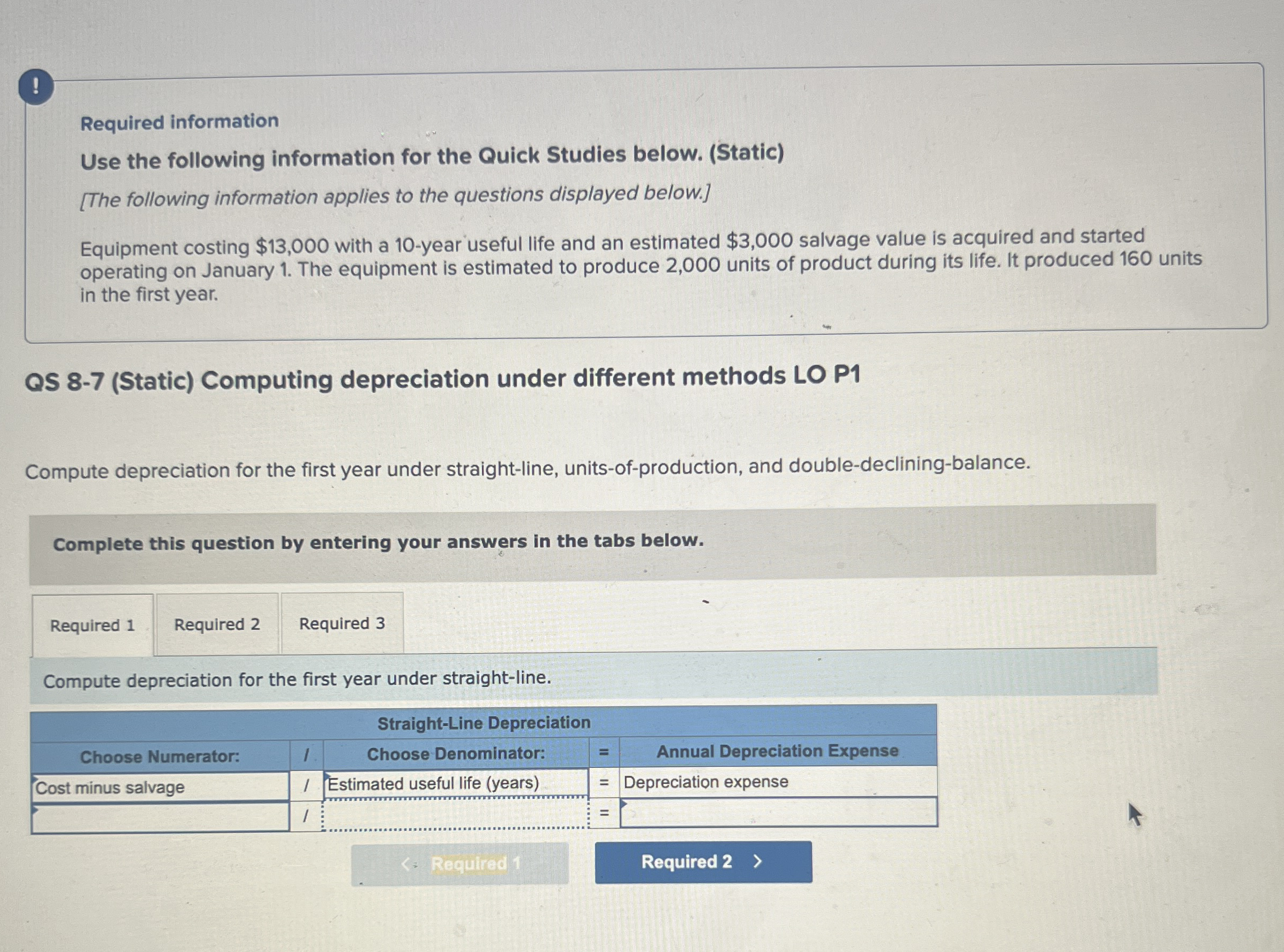

Equipment costing $ with a year useful life and an estimated $ salvage value is acquired and started operating on January The equipment is estimated to produce units of product during its life. It produced units in the first year.

QS Static Computing depreciation under different methods LO P

Compute depreciation for the first year under straightline, unitsofproduction, and doubledecliningbalance.

Complete this question by entering your answers in the tabs below.

Required

Required

Required

Compute depreciation for the first year under unitsofproduction.

Select formula for the depreciation rate of Units of Production:

Cost Salvage value Total units of production

Calculate the first year depreciation expense:

tableDepreciation per unit,Units in first year,Depreciation in first year,

Required information

Use the following information for the Quick Studies below. Static

The following information applies to the questions displayed below.

Equipment costing $ with a year useful life and an estimated $ salvage value is acquired and started operating on January The equipment is estimated to produce units of product during its life. It produced units in the first year.

QS Static Computing depreciation under different methods LO P

Compute depreciation for the first year under straightline, unitsofproduction, and doubledecliningbalance.

Complete this question by entering your answers in the tabs below.

Required

Compute depreciation for the first year under straightline.

tableStraightLine DepreciationChoose Numerator:,Choose Denominator:,Annual Depreciation ExpenseCost minus salvage,Estimated useful life yearsDepreciation expenseP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock