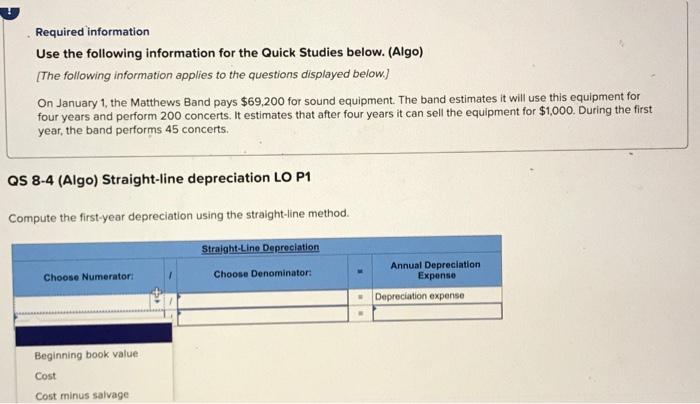

Question: Required information Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below] On January 1, the

![(Algo) [The following information applies to the questions displayed below] On January](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dca4420f7b8_00166dca441a4539.jpg)

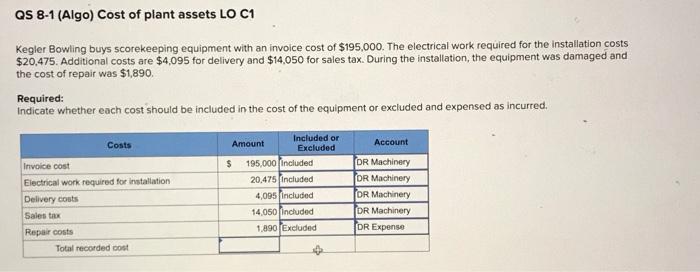

Required information Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below] On January 1, the Matthews Band pays $69,200 for sound equipment. The band estimates it will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During the first year, the band performs 45 concerts. QS 8-4 (Algo) Straight-line depreciation LO P1 Compute the first-year depreciation using the straight-line method. Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On January 1, the Matthews Band pays $69,200 for sound equipment. The band estimates it will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During the first year, the band performs 45 concerts. QS 8-4 (Algo) Straight-line depreciation LO P1 Compute the first-year depreciation using the straight-line method. QS 8-1 (Algo) Cost of plant assets LO C1 Kegler Bowling buys scorekeeping equipment with an invoice cost of $195,000. The electrical work required for the installation costs $20,475. Additional costs are $4,095 for delivery and $14,050 for sales tax. During the installation, the equipment was damaged and the cost of repair was $1,890. Required: Indicate whether each cost should be included in the cost of the equipment or excluded and expensed as incurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts