Question: Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below.) A company is investing in

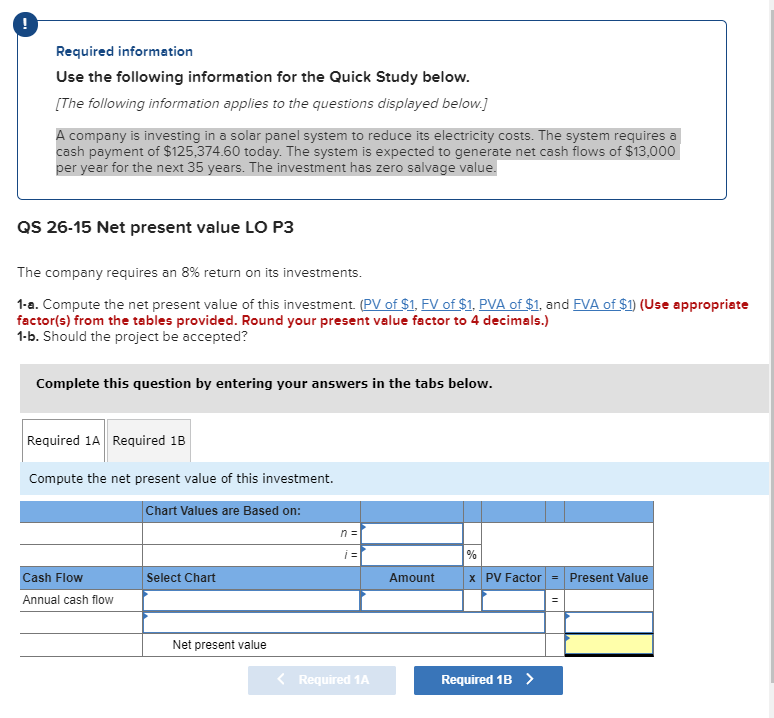

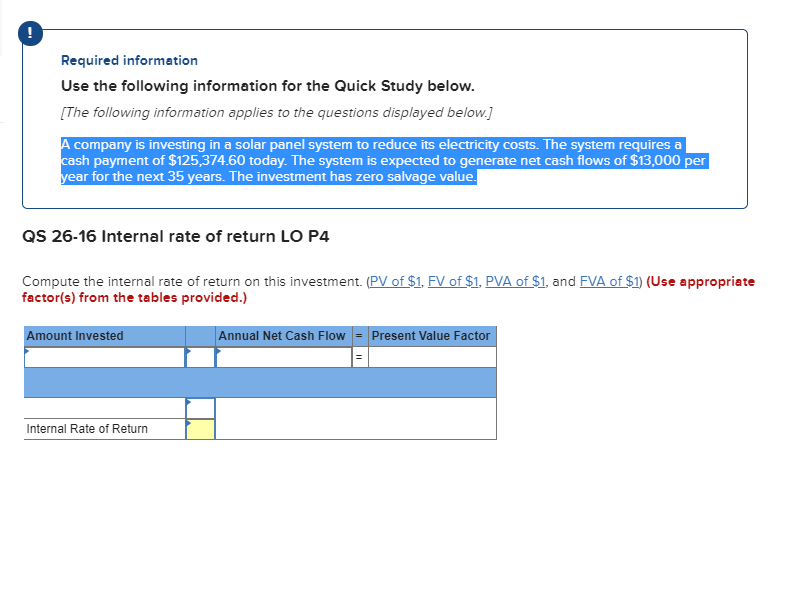

Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below.) A company is investing in a solar panel system to reduce its electricity costs. The system requires a cash payment of $125,374.60 today. The system is expected to generate net cash flows of $13,000 per year for the next 35 years. The investment has zero salvage value. QS 26-15 Net present value LO P3 The company requires an 8% return on its investments. 1-a. Compute the net present value of this investment (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Should the project be accepted? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Compute the net present value of this investment. Chart Values are Based on: n = % Cash Flow Select Chart Amount x PV Factor Present Value Annual cash flow Net present value Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.] A company is investing in a solar panel system to reduce its electricity costs. The system requires a cash payment of $125,374.60 today. The system is expected to generate net cash flows of $13,000 per year for the next 35 years. The investment has zero salvage value. QS 26-16 Internal rate of return LO P4 Compute the internal rate of return on this investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Amount Invested Annual Net Cash Flow Present Value Factor Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts