Question: Required information Use the following information for the Quick Study below. Trey Monson starts a merchandising business on December 1 and enters into the following

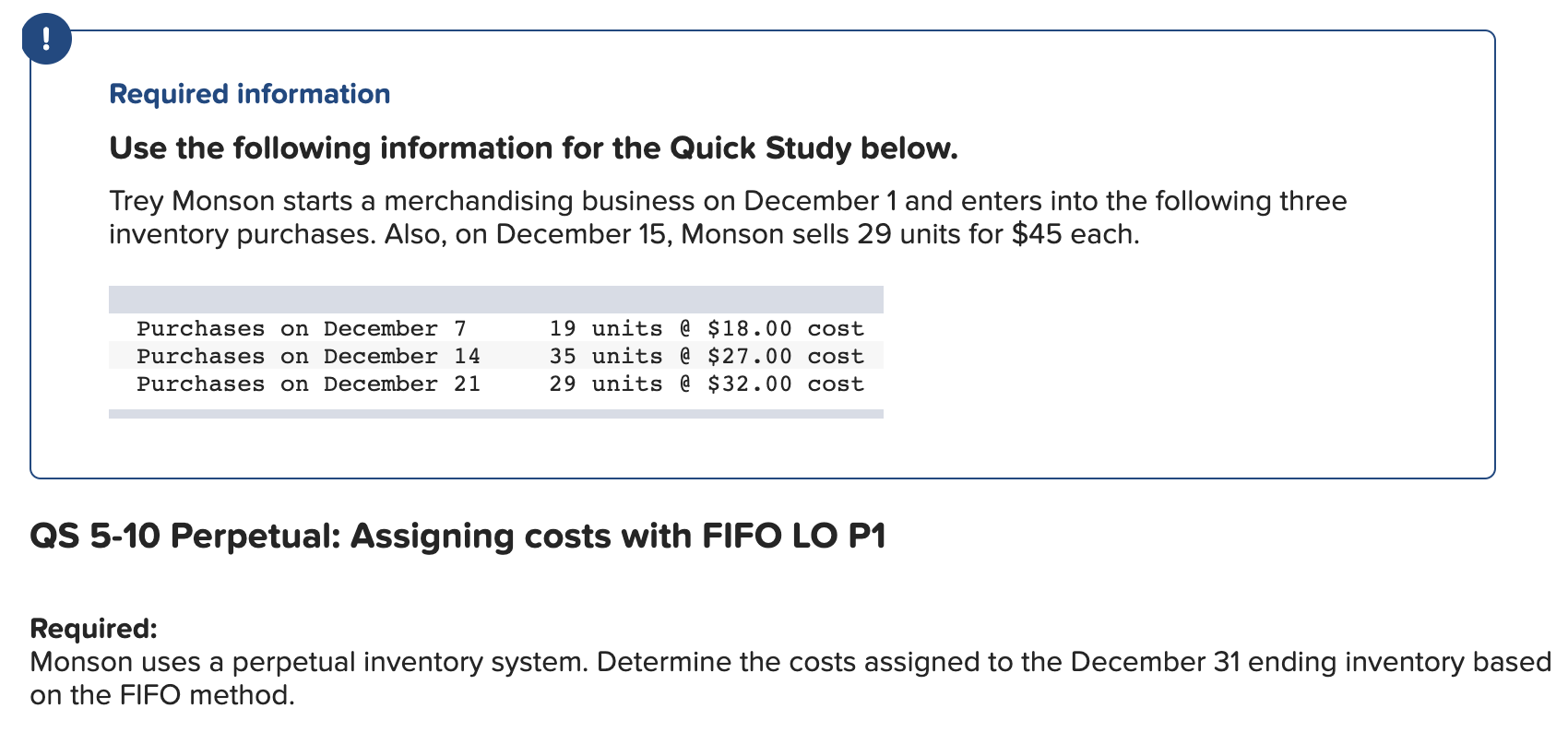

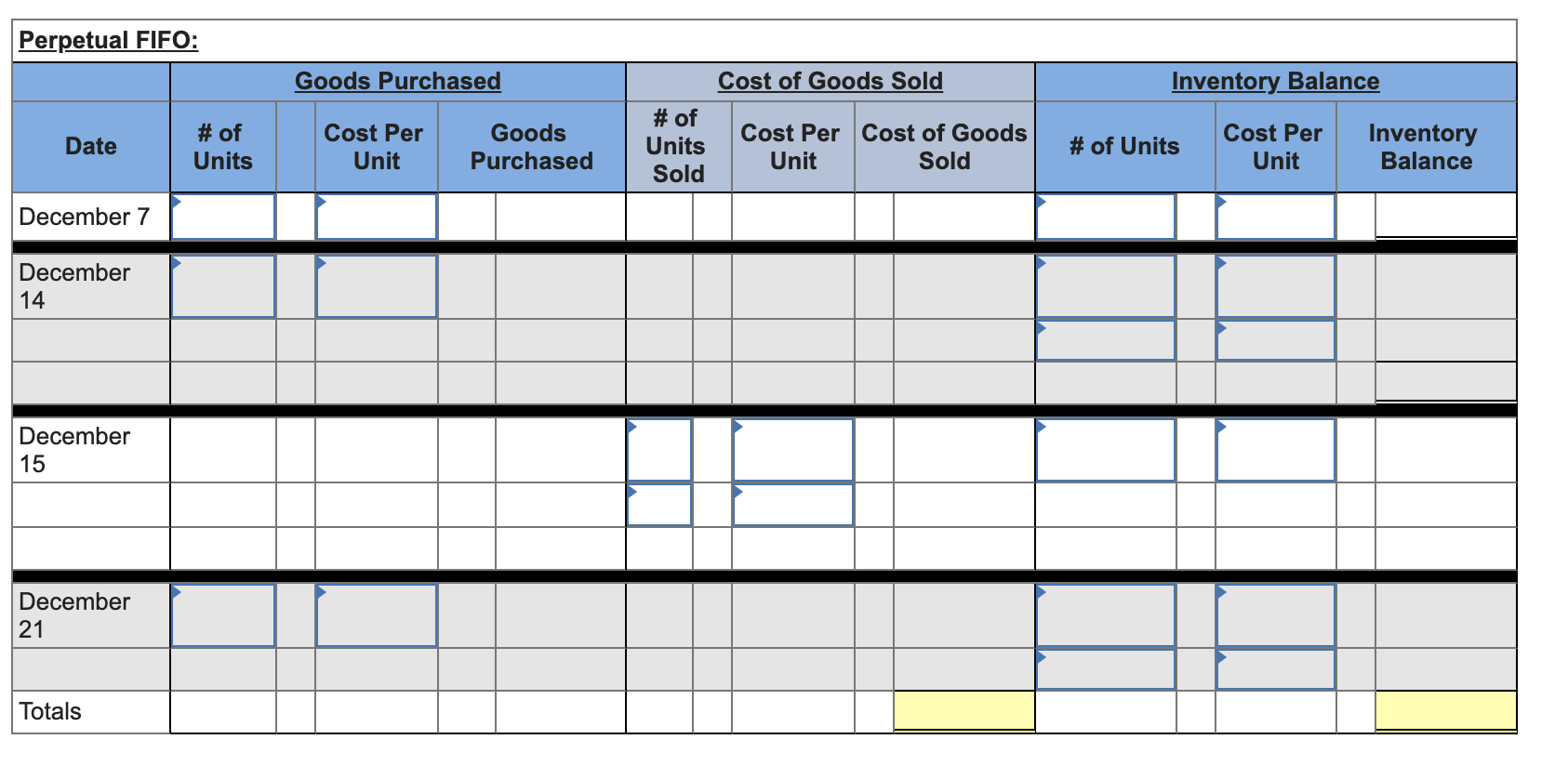

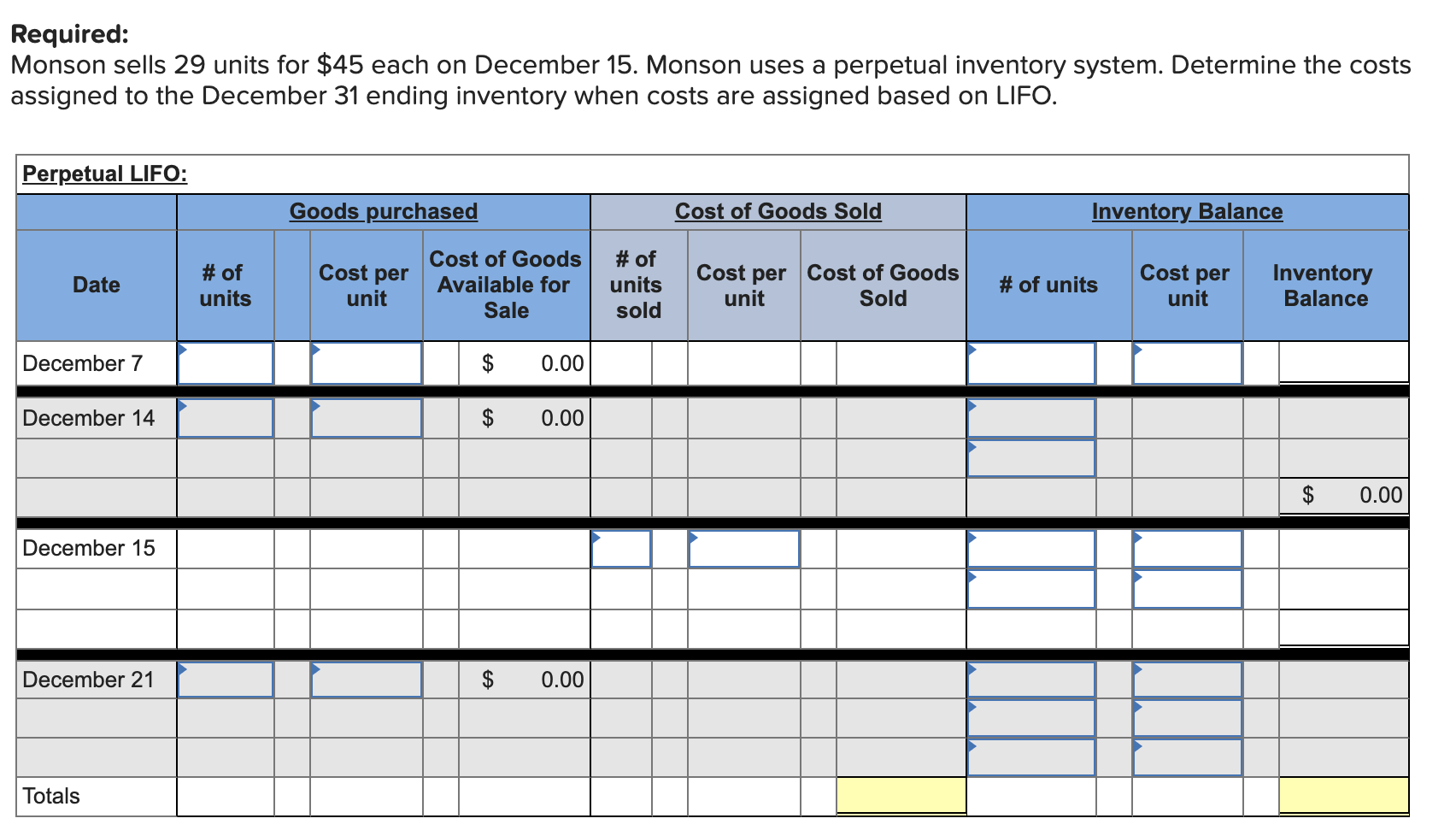

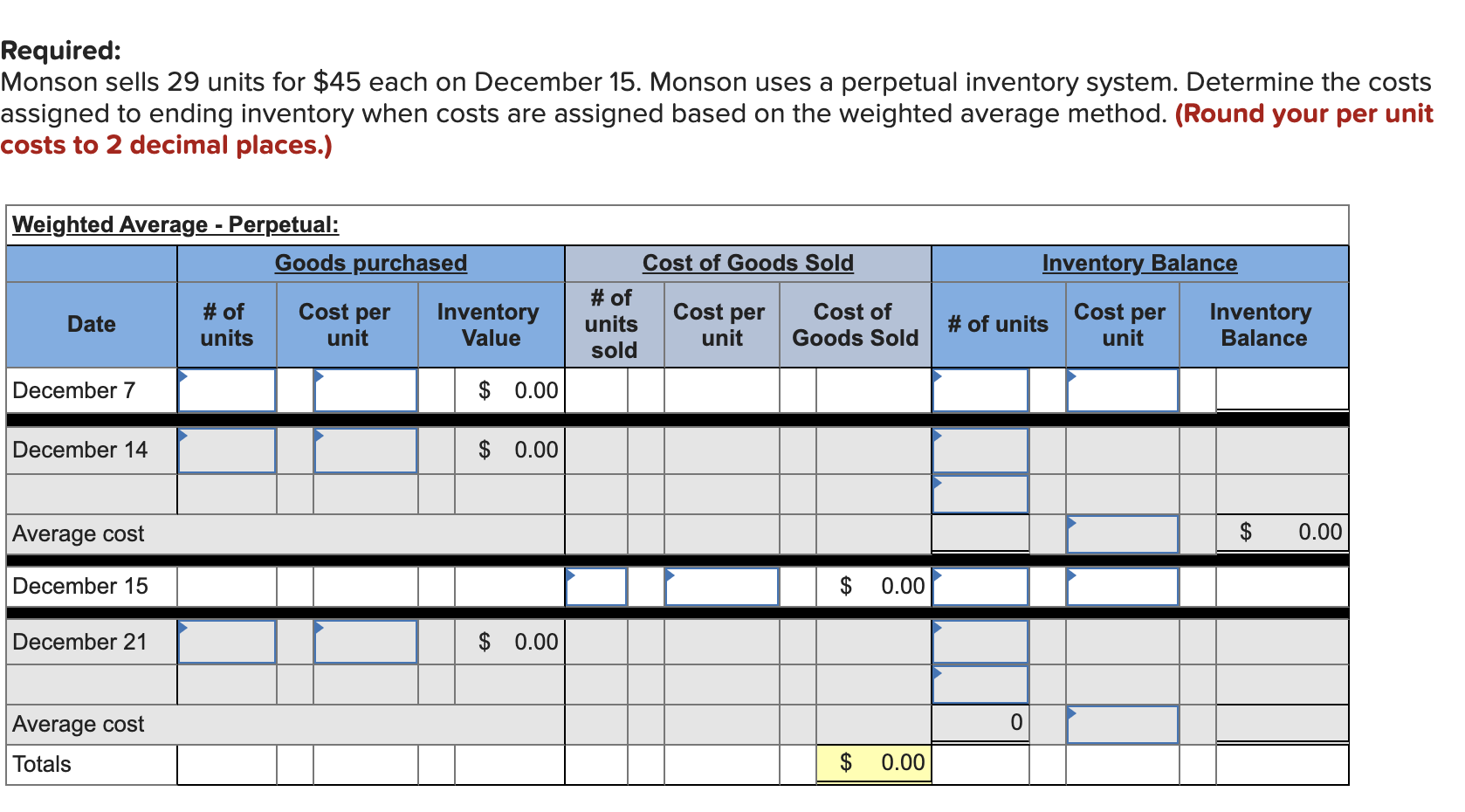

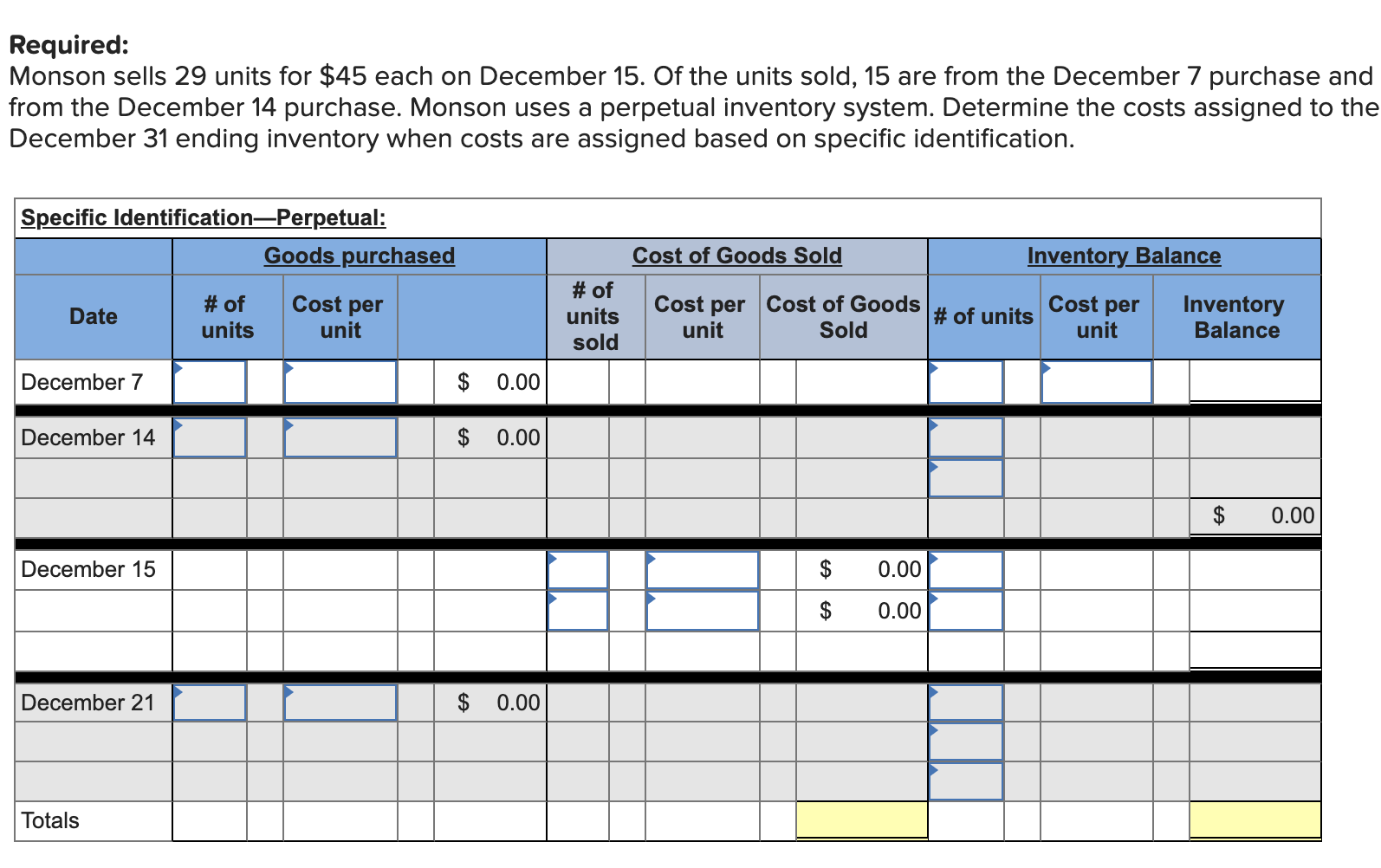

Required information Use the following information for the Quick Study below. Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Also, on December 15, Monson sells 29 units for $45 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 19 units @ $18.00 cost 35 units @ $27.00 cost 29 units @ $32.00 cost QS 5-10 Perpetual: Assigning costs with FIFO LO P1 Required: Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory based on the FIFO method. Perpetual FIFO: Goods Purchased Inventory Balance # of Units Date Cost Per Unit Cost of Goods Sold # of Cost Per Cost of Goods Units Unit Sold Sold Goods Purchased # of Units Cost Per Unit Inventory Balance December 7 December 14 December 15 December 21 Totals Required: Monson sells 29 units for $45 each on December 15. Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory when costs are assigned based on LIFO. Perpetual LIFO: Goods purchased Cost of Goods Sold Inventory Balance Date # of units Cost per unit Cost of Goods Available for Sale # of units sold Cost per Cost of Goods unit Sold # of units Cost per unit Inventory Balance December 7 $ 0.00 December 14 $ 0.00 $ 0.00 December 15 December 21 $ 0.00 Totals Required: Monson sells 29 units for $45 each on December 15. Monson uses a perpetual inventory system. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round your per unit costs to 2 decimal places.) Weighted Average - Perpetual: Goods purchased Cost of Goods Sold Inventory Balance Cost per Cost per Cost per Date # of units Inventory Value # of units sold Cost of Goods Sold # of units Inventory Balance unit unit unit December 7 $ 0.00 December 14 $ 0.00 Average cost $ 0.00 December 15 $ 0.00 December 21 $ 0.00 Average cost 0 Totals $ 0.00 Required: Monson sells 29 units for $45 each on December 15. Of the units sold, 15 are from the December 7 purchase and from the December 14 purchase. Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory when costs are assigned based on specific identification. Specific Identification-Perpetual: Goods purchased Cost of Goods Sold Inventory Balance Cost per Date # of units # of units sold Cost per Cost of Goods unit Sold # of units Cost per unit Inventory Balance unit December 7 $ 0.00 December 14 $ 0.00 $ 0.00 December 15 $ 0.00 0.00 December 21 $ 0.00 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts