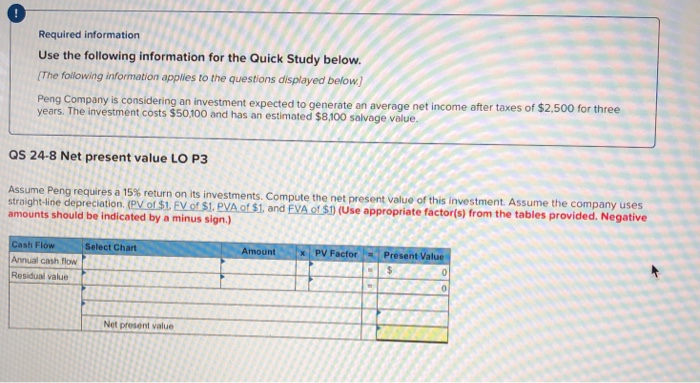

Question: Required information Use the following information for the Quick Study below The following information applies to the questions displayed below) Peng Company is considering an

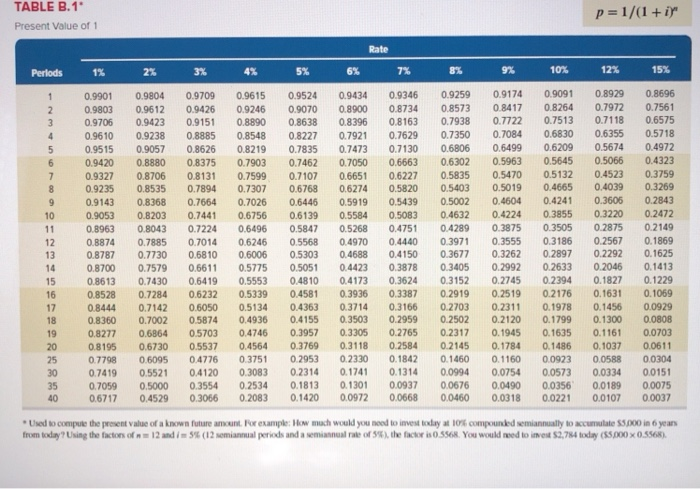

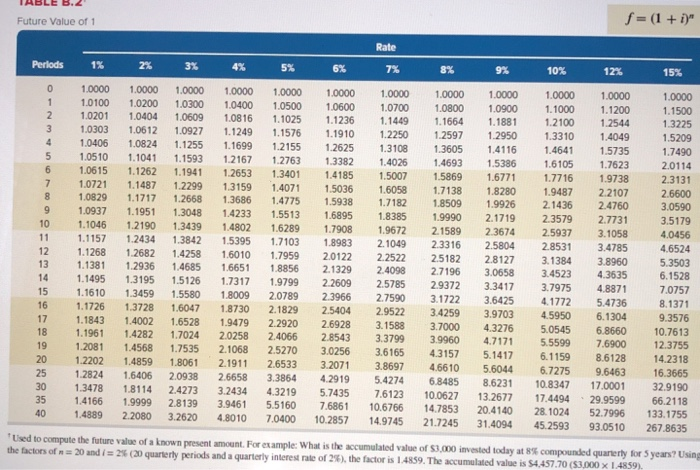

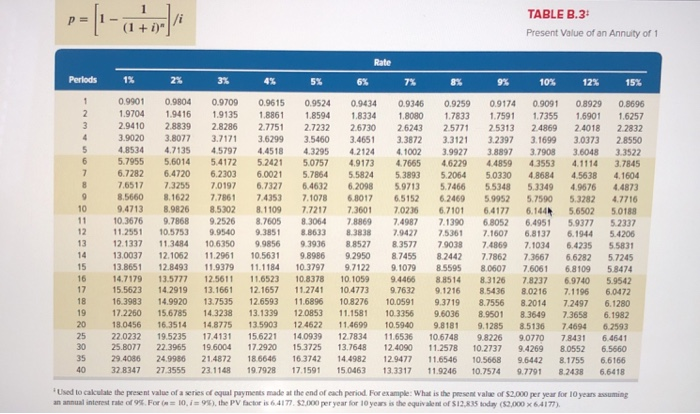

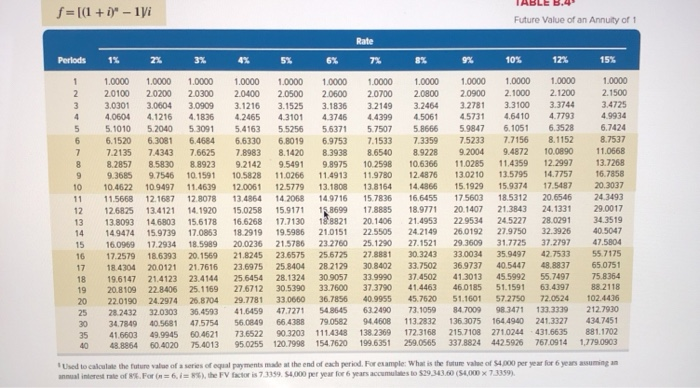

Required information Use the following information for the Quick Study below The following information applies to the questions displayed below) Peng Company is considering an investment expected to gen years. The investment costs $50,100 and has an estimated $8,100 salvage value erate an average net income after taxes of $2,500 for three QS 24-8 Net present value LO P3 Assume Peng requires a 15% return on its investments. Compute th amounts should be indicated by a minus sign.) e net present value of this investment. Assume the company uses Amount_i1xIN Factor Select Chart Present Value Annual cash flow Residual value Net present value TABLE B.1 p=1/(1 + ir Present Value of1 9% 10% 12% 15% 5% 7% 4% Periods 0.9901 0.9804 0.9709 0.9615 0.95240.94340.93460.92590.9174 0.9091 08929 0.8696 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 ORA 17 08264 07972 07561 0.9706 0.9423 0.9151 0.8890 0.8638 08396 0.8163 0.7938 0.7722 07513 0.7118 0.6575 4 0.9610 0.9238 0.8885 0.8548 08227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6355 0.5718 0.9515 0.90570.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 05674 0.4972 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5066 0.4323 0.9327 0.8706 08131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4523 0.3759 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 0.9 1 43 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 OA241 0.3606 0.2843 10 0.9053 0.8203 07441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3220 0.2472 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.2875 0.2149 12 0.8874 0.7885 0.7014 06246 05568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2567 0.1869 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2292 0.1625 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 02046 0.1413 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.1827 01229 16 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1631 0.1069 17 08444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1456 0.0929 18 0.8360 0.7002 05874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1300 00808 19 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.1161 0.0703 20 0.8195 0.6730 05537 0.4564 03769 03118 0.2584 0.2145 0.1784 01486 0.1037 00611 25 07798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 00588 0.0304 30 0.7419 0.5521 0.4120 0.3083 0.2314 0741 0.1314 00994 0.0754 0.0573 0.0334 00151 35 0.7059 0.5000 0.3554 0.2534 0.1813 0.1301 0.0937 0.0676 0.0490 00356 0.0189 0.0075 40 0.6717 04529 0.3066 0.2083 0.1420 00972 00668 0460 0.0318 0022 0.0107 00037 , Used tocompue te present value of a known future amunt. For example. Ik w much would yu no d to imest kday at 10% con punkd en annually to Krum late Sip on 6yan fruen today? Using factors of E 12 andi m 5% ( 12 Mmiar nual per ds and a Nemaannual rak' of 5% ), Ele factr iso 5568 vou would noed to me 1 S2 784 today ($5,000 0.5568). f-I +i uture Value of 1 Rate 15% 12% 9% 10% 1% Periods 0000 1.0000 1.0000 1.0000 1.0000 10000 10000 10000 0000 10000 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 0456 4.6524 5.3503 6.1528 7.0757 8.1371 9.3576 545 6.8660 10.761:3 5.5599 7.6900 12.3755 14.2318 10100 1.0200 1.0300 10400 1.0500 10600 10700 0800 10900 1.1000 1.1200 0201 1.0404 1.0609 1.0816 1.1025 1.1236 1.1449 1.1664 1.1881 0303 10612 10927 .1249 1.1576 1.1910 12250 1 10406 1.0824 1.1255 11699 1.2155 1.2625 3108 13605 14116 1.4641 15735 10510 1.1041 1.1593 12167 1.2763 13382 1.4026 14693 1.5386 1.2100 1.2544 2597 1.2950 1.3310 1.4049 6105 1.7623 9487 2.2107 2.3579 2.7731 1.0615 1.1262 1.1941 1.2653 1.3401 1.4185 15007 15869 1.6771 1.7716 19738 .0721 1.1487 1.2299 1.3159 1.4071 15036 1.6058 17138 1.8280 10937 1.1951 1.3048 1.4233 15513 16895 1.8385 19990 2.1719 1.1157 1.2434 1.3842 1.5395 1.7103 1.8983 2.1049 2.3316 2.5804 28531 3.4 10829 1.1717 1.2668 13686 1.4775 1.5938 1.7182 18509 1.9926 2.1436 24760 1.1268 1.2682 1.4258 1.6010 17959 20122 22522 25182 28127 3.1384 3.8960 1.1610 1.3459 1.5580 18009 2.0789 23966 2.7590 31722 3.6425 9 10 1.1046 12190 13439 14802 16289 1908 19672 21589 2.3674 25937 3.1058 12 13 1.1381 1.2936 14685 1.6651 18856 2.1329 2.4098 2.7196 3.0658 3.4523 4.3635 14 1.1495 13195 1.5126 1.7317 19799 22609 25785 29372 3.3417 15 16 17 18 19 1.1726 1.3728 16047 18730 2.1829 2.5404 2.9522 34259 3.9703 45950 1.1843 1.4002 1.6528 19479 2.2920 2.6928 3.1588 37000 4.3276 5 1.1961 1.4282 17024 2.0258 2.4066 2.8543 3.3799 39960 4.717 1.2081 1.4568 17535 2.1068 2.5270 3.0256 3.6165 4.3157 5.1417 6.1304 20 1.2202 1.4859 1.8061 2.1911 26533 3.2071 38697 46610 5.6044 25 1.2824 1.6406 2.0938 2.6658 3.3864 42919 5.4274 6.8485 8.6231 10 6.7275 9.6463 16 4.2919 5.4274 68485 8.6231 10.8347 170001 32.9190 2434 4.3219 57435 7.6123 10.0627 13.2677 174494 29.9599 66.2118 3.9461 5.5160 7.6861 10.6766 14.7853 204140 28.1024 52.7996 133.1755 13478 1.8114 24273 3. 1.4166 1.9999 28139 5.5160 30 35 1.4889 2.2080 3.2620 8010 7.0400 10.2857 14.9745 21.7245 31.4094 45.2593 93.0510 267.8635 alue of a known present amount. For example: what is the accumulated value of 53,000 invested today at 8% com pun ed quiery or s year than, 20 and i-: 2% (20 quarenty periods and a quarterly interest rate of 2%. the actor i the factors of n s l 4859.The accumulated value is SA57, 70 (SOO x 14S TABLE B.3 Present Value of an Annuity of 1 Periods 1% 4% 5% 12% 15% 0.9901 09804 0.9709 0.9615 09524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 1.9704 1.9416 19135 1.8861 1.8594 18334 1.8080 .7833 1.7591 1.7355 1.6901 1.6257 2.9410 2.8839 2.8286 2.775 2.7232 26730 26243 25771 2.5313 24869 24018 2.2832 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.0373 2.8550 5 4.8534 4.7135 45797 4.4518 4.3295 42124 41002 3.9927 3.8897 3.7908 3.6048 3.3522 6 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.1114 3.7845 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.5638 4.1604 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 55348 5.3349 49676 4.4873 9 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 62469 5.9952 5.7590 5.3282 47716 0 9.4713 8.9826 8.5302 8.1109 7.7217 7.36017.0236 67101 64177 6.144 56502 5.0188 11 10.3676 9.7868 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 68052 6.4951 5.9377 5.2337 12 11.2551 10.5753 99540 9.3851 88633 8.3838 79427 7.5361 7.1607 6.8137 6.1944 5.4206 13 12.1337 11.3484 106350 99856 9.3936 88527 83577 7903 7.4869 7.1034 6.4235 5.5831 14 13.0037 12.1062 11.2961 10.5631 9.8986 92950 87455 82442 7.7862 7.3667 66282 5.7245 15 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 91079 8.5595 8.0607 7.6061 6.8109 5.8474 16 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 88514 8.3126 7.8237 6.9740 5.9542 15.5623 14.2919 13.166 12.1657 11.2741 10.47739.7632 9.12168.5436 8.0216 7.1196 6.0472 18 16.3983 14.9920 13.7535 12.6593 11.6896 103276 10.0591 93719 87556 82014 12497 6290 17.2260 15.6785 14.323813.1339 120853 111581 10.3356 9.6036 8.9501 8.3649 7.3658 6.1982 20 18.0456 16.3514 148775 35903 124622 11.4699 10.5940 9.8181 9.1285 8.5136 74694 6.2593 25 22.0232 19.5235 17.4131 15.6221 14.0939 12.7834 116536 106748 98226 9.0770 7.8431 6.4641 30 25.8077 22.3965 19.6004 17.2920 15.3725 13.7648 124090 11.2578 10.2737 9.4269 8.05526.5660 35 29.4086 249986 214872 18.6646163742 14.4982129477 11.6546 10.5668 9.6442 8.1755 6.6166 40 32.8347 27.3555 23.1148 19.7928 17.159 15.0463 13.3317 119246 10.7574 9.7791 82438 6.6418 Used to cakculale the present value of a series of equal payments made at the end of each period For example: What is the present value of $2000 per year for 10 years assuming anannual interest rat of gs. For (azio,is9%.the PV bchr is 6 41mson per year for loyer, ith' equiar, of Sizes sday (000 x A41m Future Value of an Annuity of 12% ts 1% 0000 1.0000 1.0000 1.0000 10000 10000 10000 10000 10000 0000 10000 0301 3.0604 3.0909 3.1216 3.1525 3.1836 3.2149 3.2464 3.2781 3.3100 3.3744 3.4725 2 2.0100 2.0200 2.0300 2.0400 2.0500 2.0600 2.0700 2.0800 2.0900 2.1000 2.1200 2.1500 4 4.0604 4.1216 4.1836 .2465 43101 43746 4.4399 45061 45731 4.6410 4.77934.9934 5 5.1010 52040 309 5.4163 55256 5.6371 5.7507 5866 5.98476.10516.35286.7424 6 6.1520 63081 6.4684 6.6330 68019 6.9753 7.1533 7.3359 7.5233 7.7156 8.1152 8.7537 7.2135 7.4343 7.6625 78983 8.1420 8.3938 8.6540 89228 9.2004 9.4872 10.0890 11.0668 8 8.2857 8583 88923 9.2142 9.5491 9.8975 10.2598 10.6366 110285 11.4359 12.2997 13.7268 9 9.3685 9.7546 10.1591 10.5828 110266 11.4913 11.9780 12.4876 13.0210 13.5795 14.775716.7858 10 10.4622 109497 11.4639 120061 125779 13.1808 1384 14.4866 15.1929 15.9374 17.548720.3037 11 115668 12.1687 12.8078 13.4864 14.2068 149716 57836 16.6455 175603 18.5312 20.6546 24.3493 12 126825 134121 14.1920 15.0258 15.9171 158699 178885 18.977 20.1407 21.3843 24.1331 29.0017 13 13.8093 146803 15.6178 16.6268 17.7130 1 8821 20.1406 21.4953 229534 24.5227 aos1 343519 14 149474 159739 17.0853 18.2919 19.5986 21015 225505 24.2149 26.0192 27.9750 32.3926 405047 15 16.0969 17.2934 18.5989 20.0236 21.5786 23.276025.1290 27.1521 29.3609 31.7725 37.2797 47.5804 6 17.2579 18.6393 20.1569 21.8245 23.6575 25.6725 27.8881 30.3243 330034 35.9497 42.7533 55.7175 17 184304 200121 21.7616 23.6975 25.8404 28.2129 30.8402 33,7502 36.9737 40.5447 48.8837 65.0751 18 19.6147 21.4123 23.4144 25.6454 28.1324 309057 339990 37.4502 41.3013 455992 55.7497 75.8364 19 20.8109 22.8406 25.1169 27.6712 30.5390 33.7600 37.3790 41.4463 46.0185 51.1591 63.4397 20 22.0190 24.2974 26.8704 29.7781 330660 36.7856 409955 45.7620 51.1601 57.2750 72.0524 102.4436 25 28.2432 32.0303 36.4593 41.6459 47.7271 548645 632490 73.1059 847009 98.3471 133.3339 212.7930 30 34.7849 40.5681 47.5754 56.0849 66.4388 79.0582 944608 1132832 136.3075 164 4940 241.3327 434 7451 35 41.6603 49.9945 60.4621 73.6522 90.3203 1114348 138.2369 172.3168 215.7108 271.0244 431.6635 881.1702 40 48.8864 60.4020 75.4013 95.0255 120.7998 154.7620 199.631 259.0565 337.8824 4425926 767.0914 1,779.0903 Used to caloulate the future vale of a series of equal payments made at the end of each period. For example: What is the future valee of $4,000 per year for 6 years asuming an annual interest rate of 8%. For(n=6, 8%),the FV factor is 73359. S400 per year for 6 years acumulaestoS29343 to (sum 73359)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts