Question: Required information Use the following information for the Quick Study below. ( Algo ) [ The following information applies to the questions displayed below. ]

Required information

Use the following information for the Quick Study below. Algo

The following information applies to the questions displayed below.

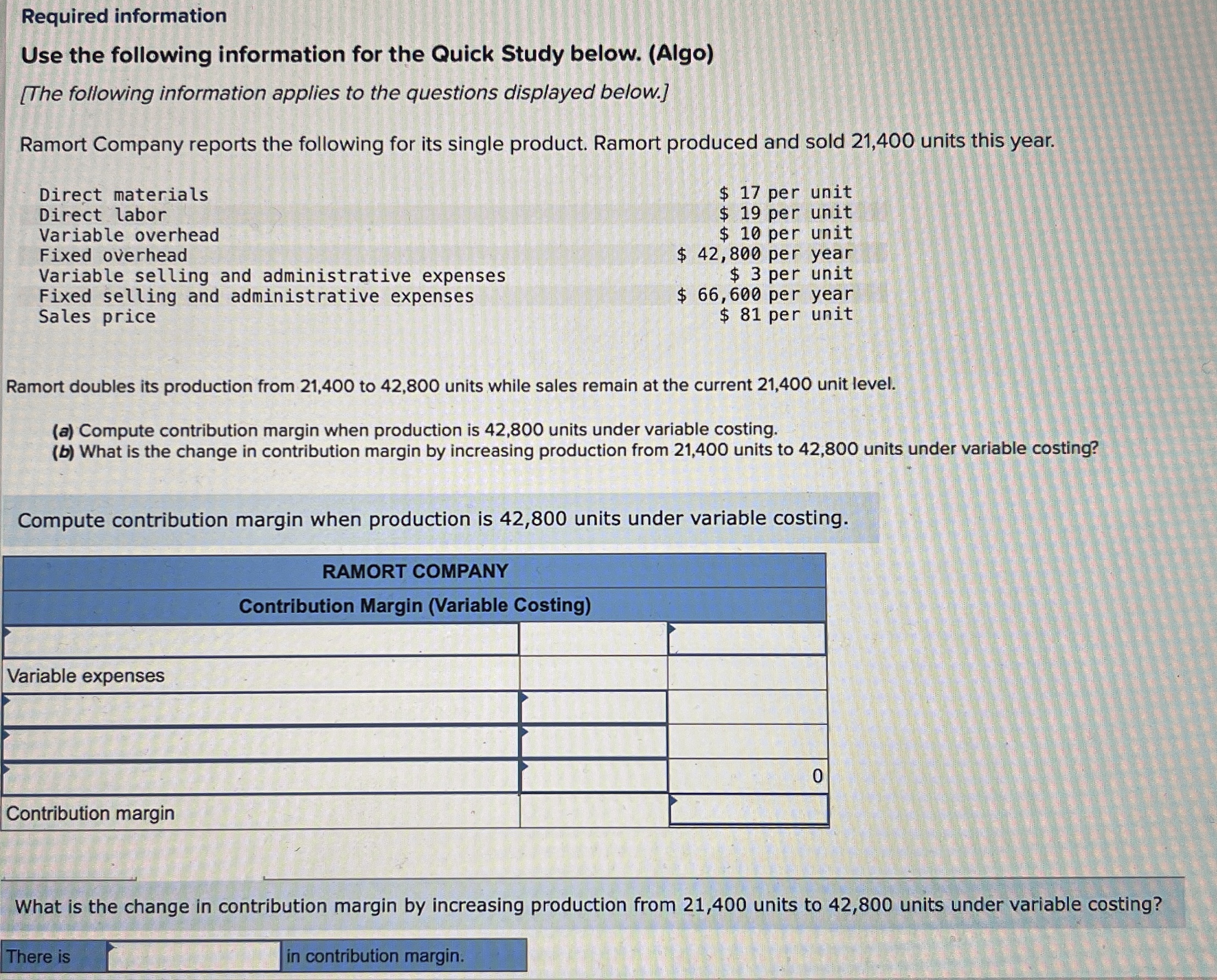

Ramort Company reports the following for its single product. Ramort produced and sold units this year.

tableDirect materials,$ per unitDirect labor,$ per unitVariable overhead,$ per unitFixed overhead,$ per yearVariable selling and administrative expenses,$ per unitFixed selling and administrative expenses,$ per yearSales price,$ per unit

Ramort doubles its production from to units while sales remain at the current unit level.

a Compute contribution margin when production is units under variable costing.

b What is the change in contribution margin by increasing production from units to units under variable costing?

Compute contribution margin when production is units under variable costing.

tableRAMORT COMPANY,Contribution Margin Variable CostingVariable expenses,,Contribution margin,,

What is the change in contribution margin by increasing production from units to units under variable costing?

There is

in contribution margin.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock