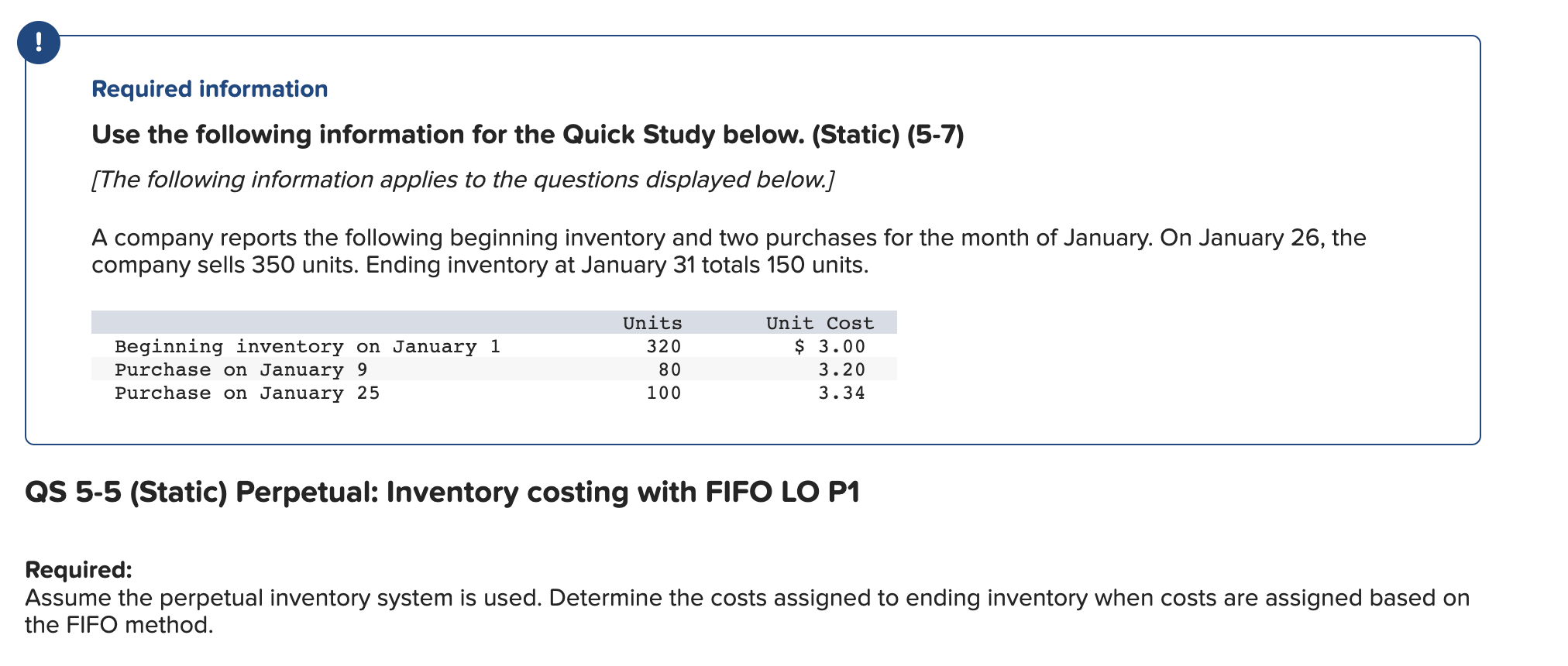

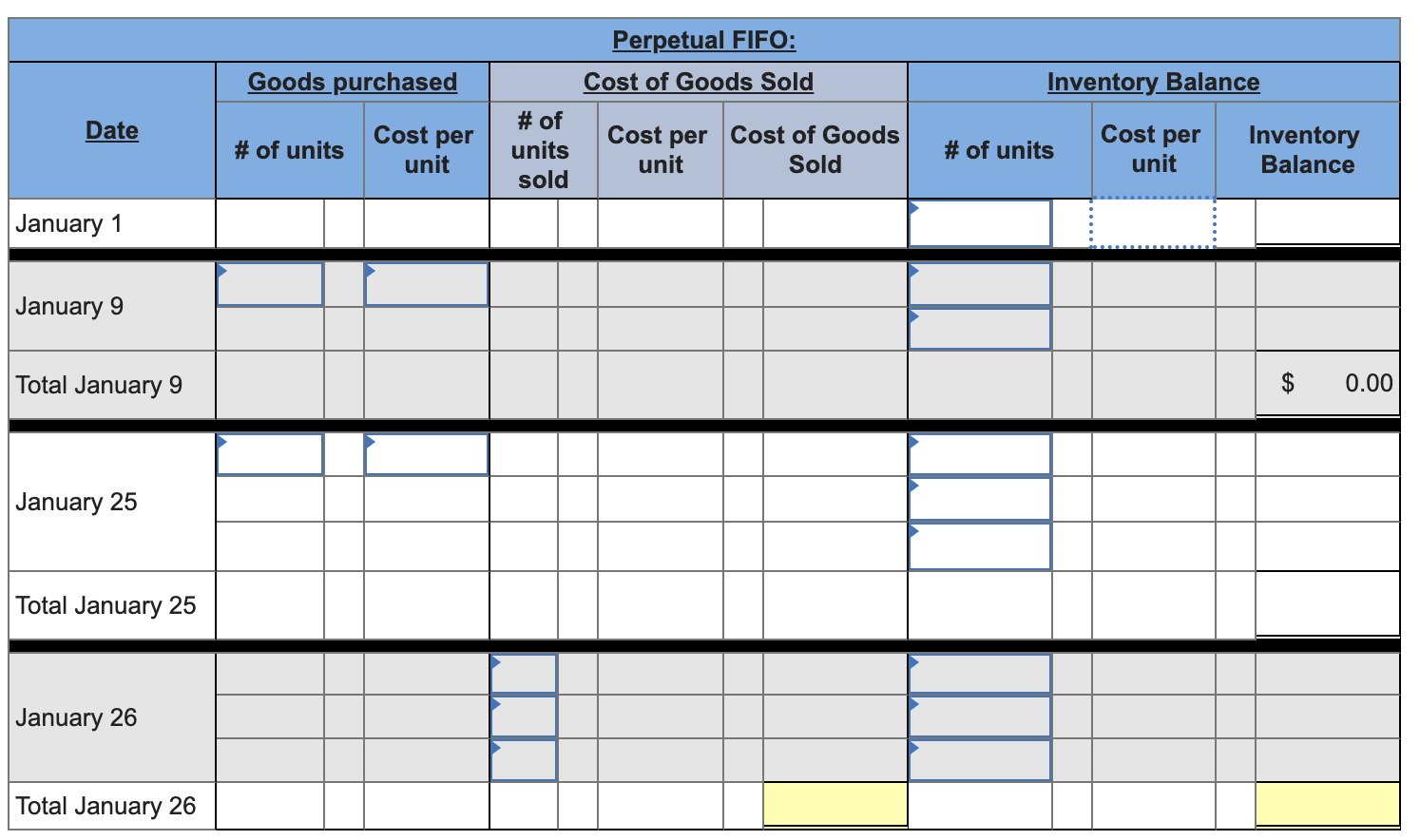

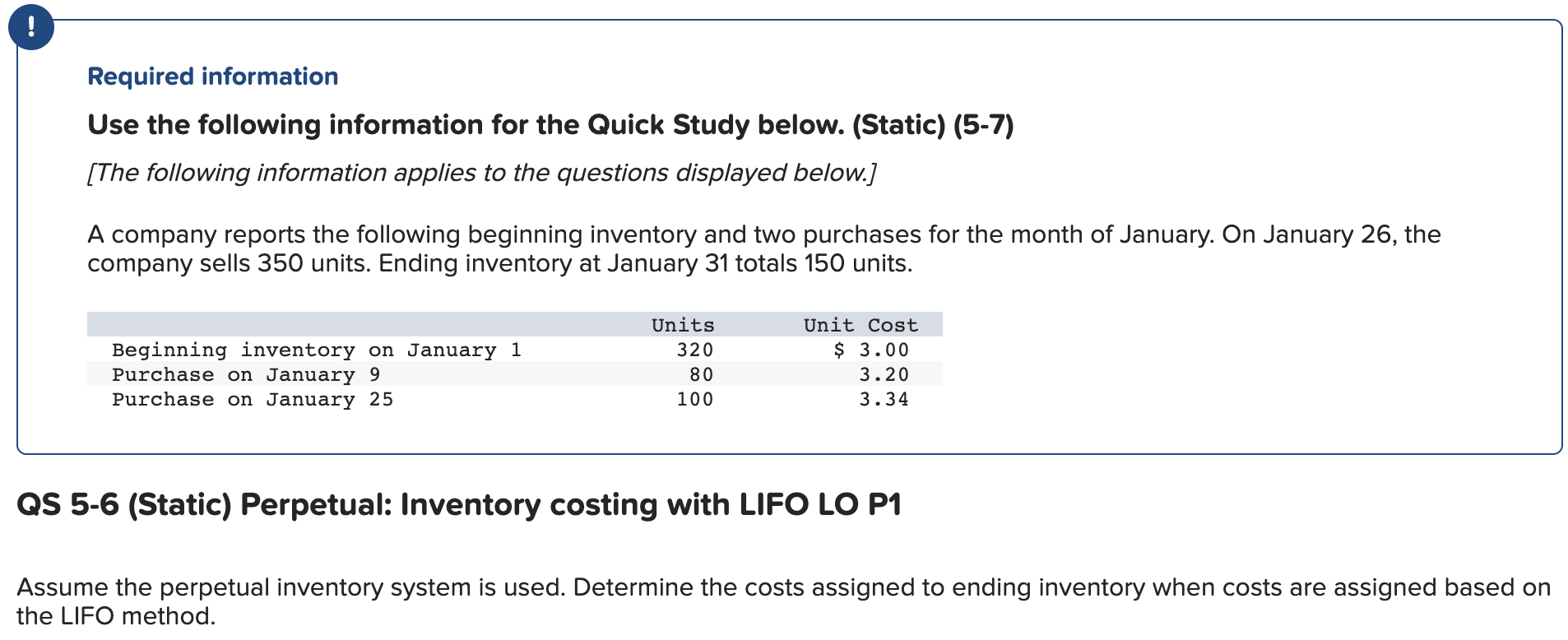

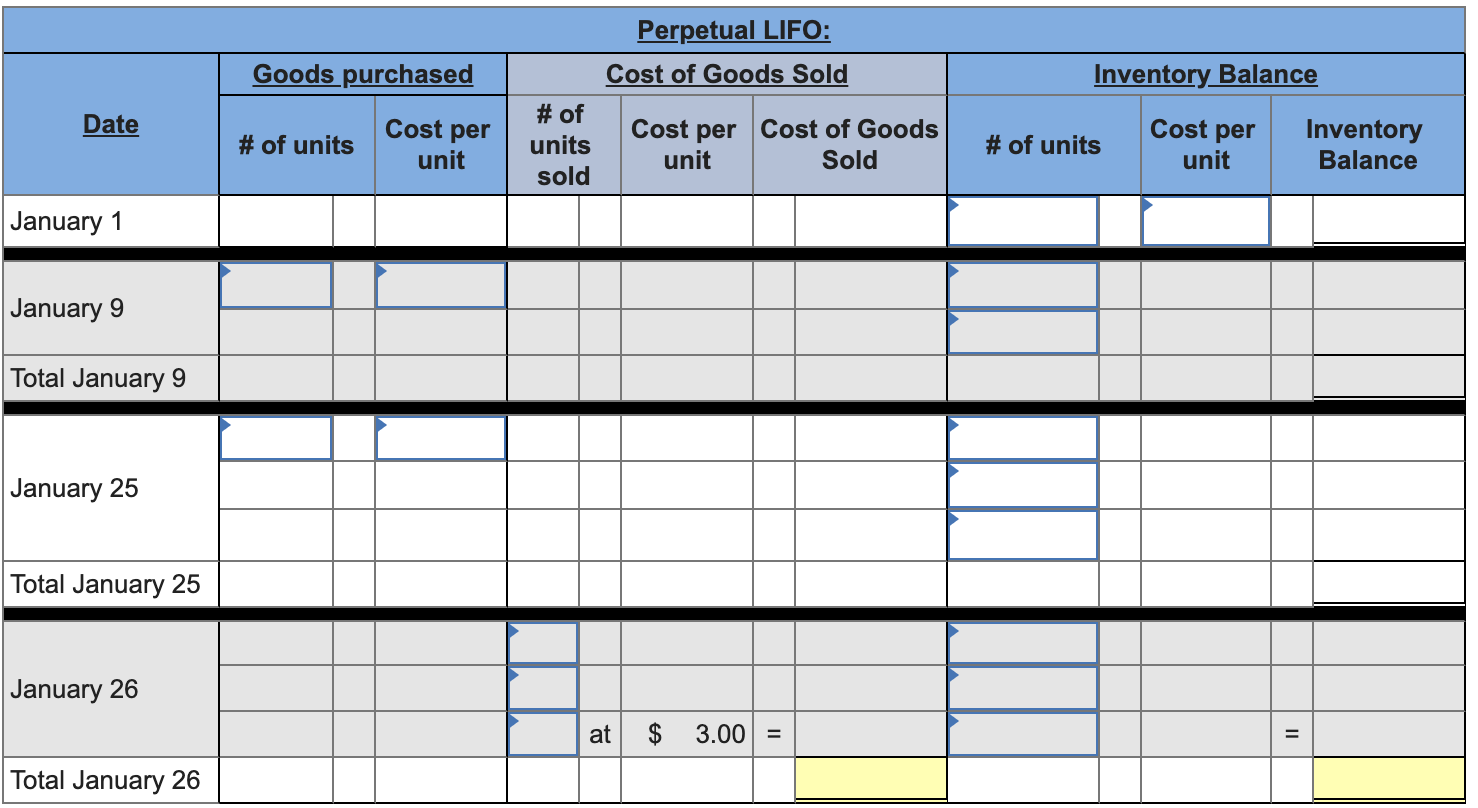

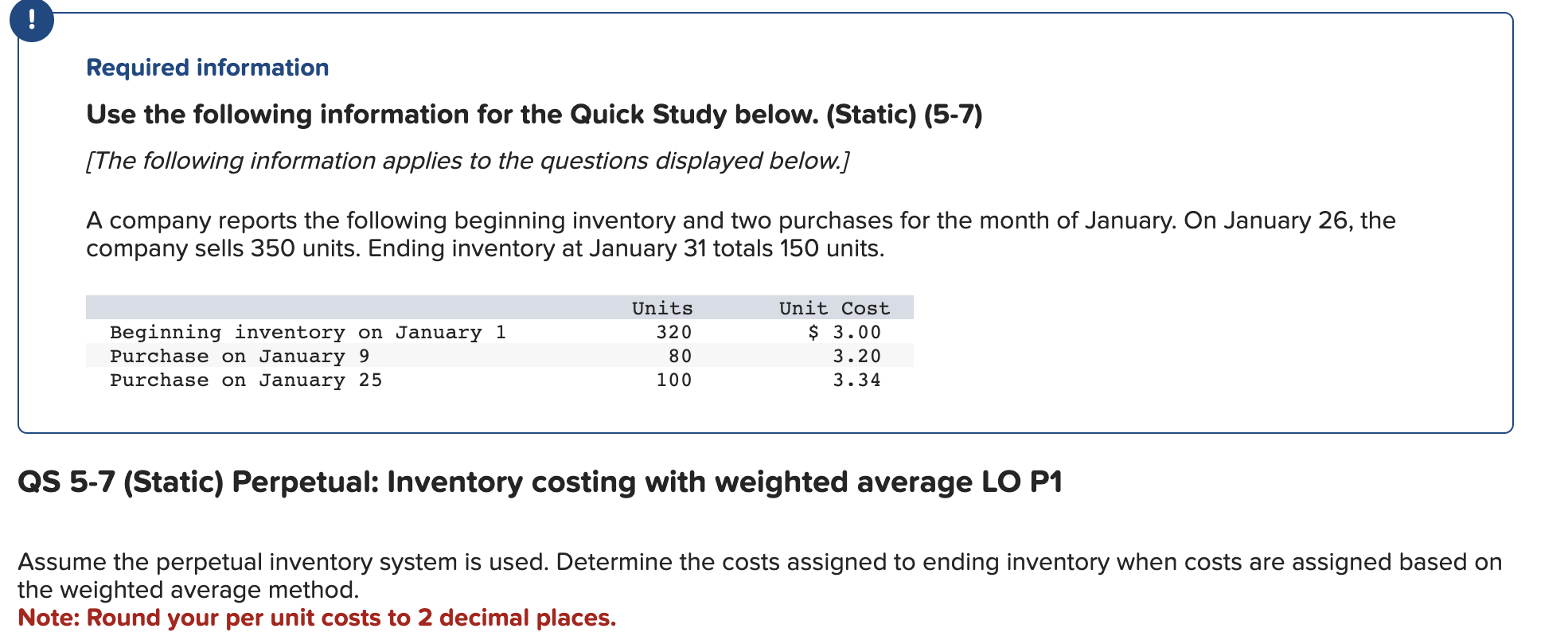

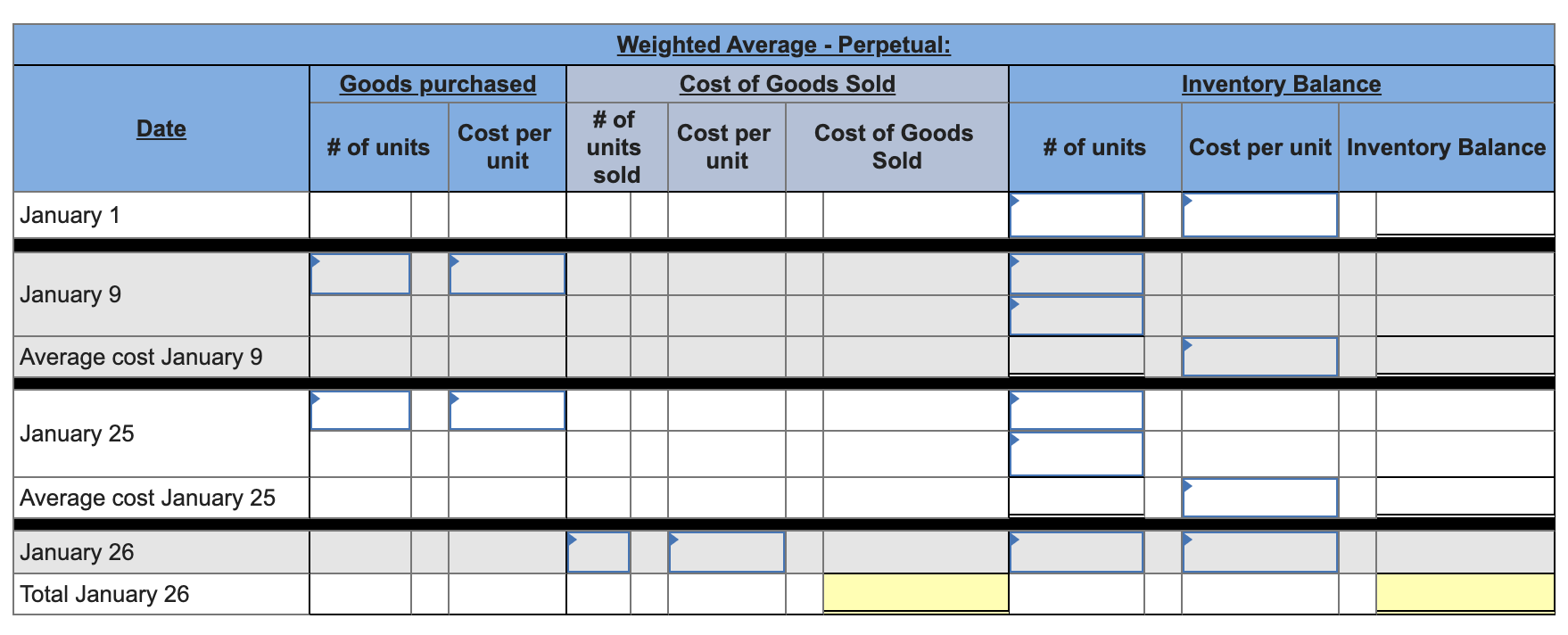

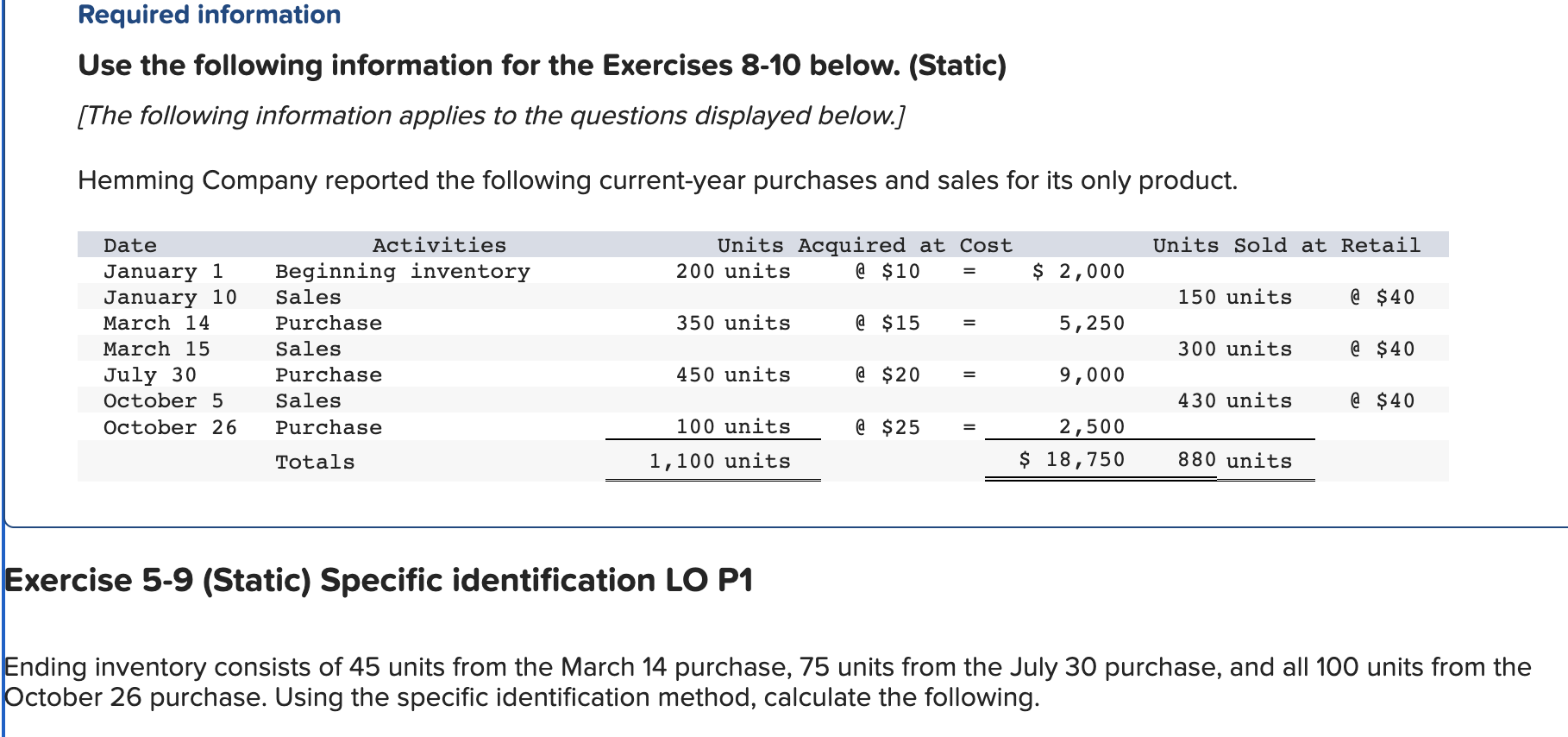

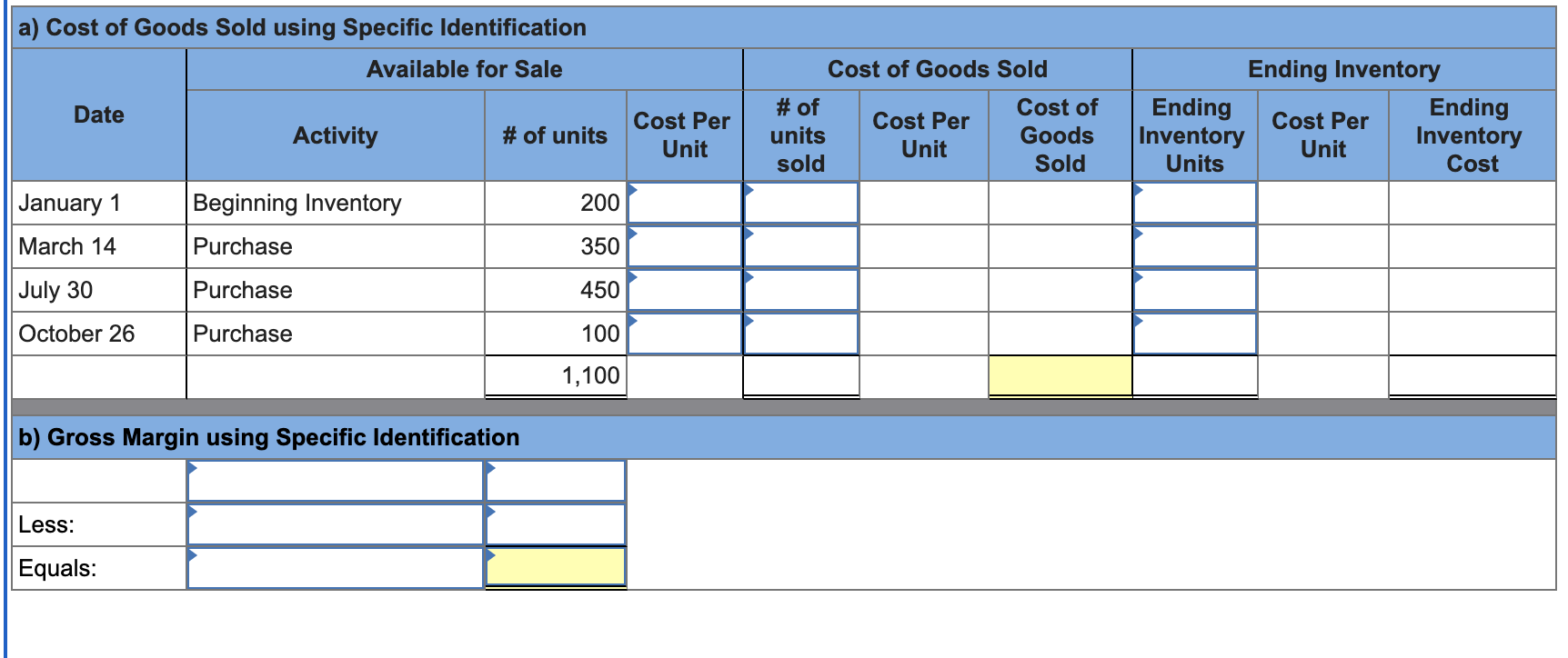

Question: Required information Use the following information for the Quick Study below. (Static) (5-7) [The following information applies to the questions displayed below] A company reports

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts