Question: Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below. Park Co. is considering an

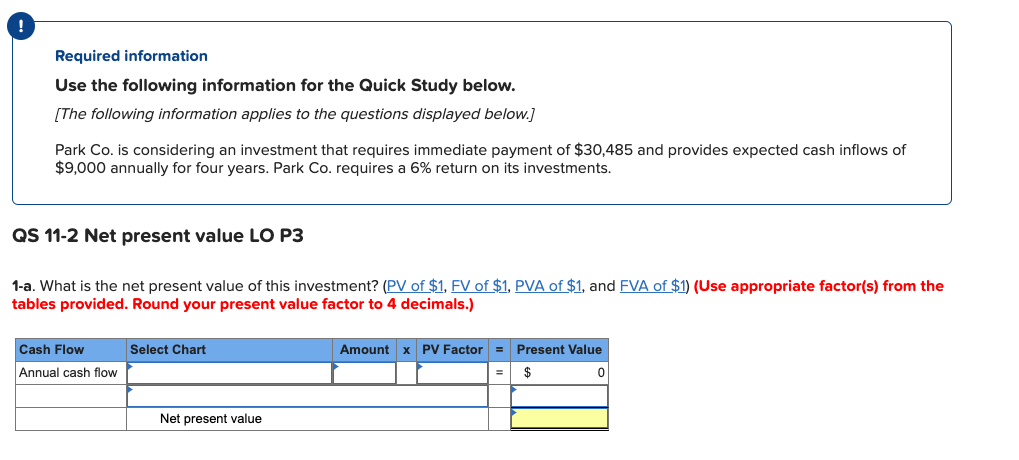

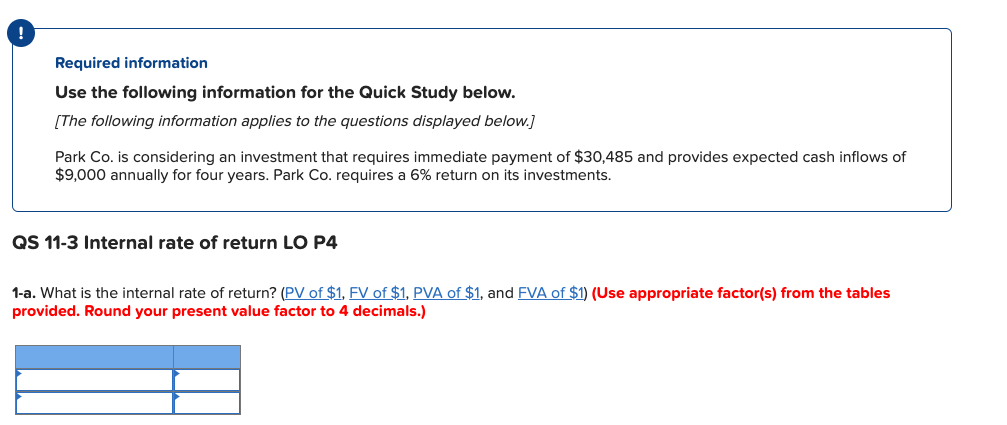

Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below. Park Co. is considering an investment that requires immediate payment of $30,485 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 6% return on its investments. QS 11-2 Net present value LO P3 1-a. What is the net present value of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) Select Chart Amount * PV Factor = Present Value Cash Flow Annual cash flow Net present value 1-b. Based on NPV alone, should Park Co. invest? Yes O No Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below.) Park Co. is considering an investment that requires immediate payment of $30,485 and provides expected cash inflows of $9,000 annually for four years. Park Co. requires a 6% return on its investments. QS 11-3 Internal rate of return LO P4 1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Based on its internal rate of return, should Park Co. make the investment? Yes O No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts