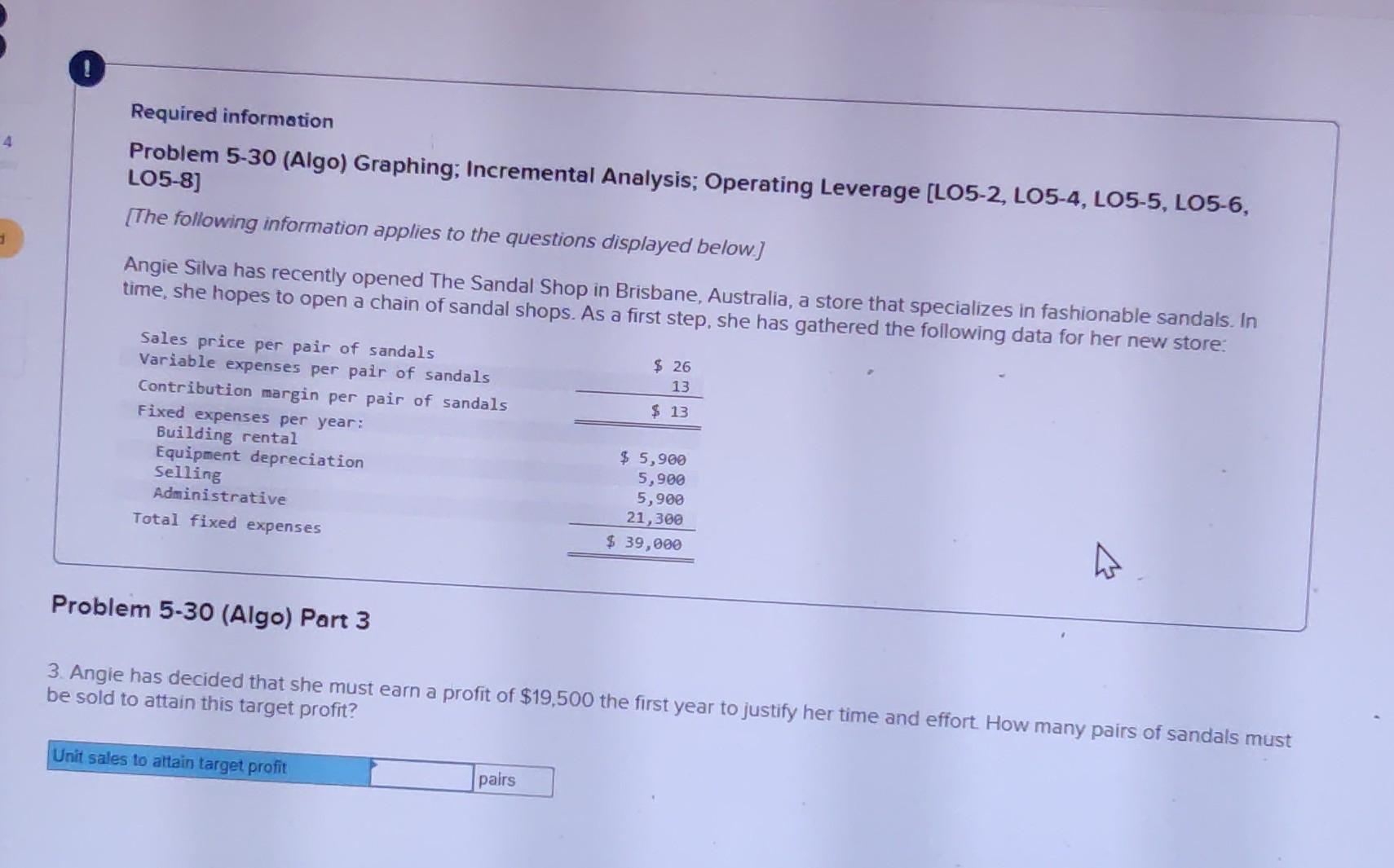

Question: Required informotion Problem 5-30 (Algo) Graphing; Incremental Analysis; Operating Leverage [LO5-2, LO5-4, LO5-5, LO5-6, LO5-8] LO5-8] [The following information applies to the questions displayed below]

![LO5-4, LO5-5, LO5-6, LO5-8] LO5-8] [The following information applies to the questions](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66aa20fde739a_59766aa20fd653ea.jpg)

![displayed below] Angie Silva has recently opened The Sandal Shop in Brisbane,](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66aa20fec081a_59866aa20fe32de6.jpg)

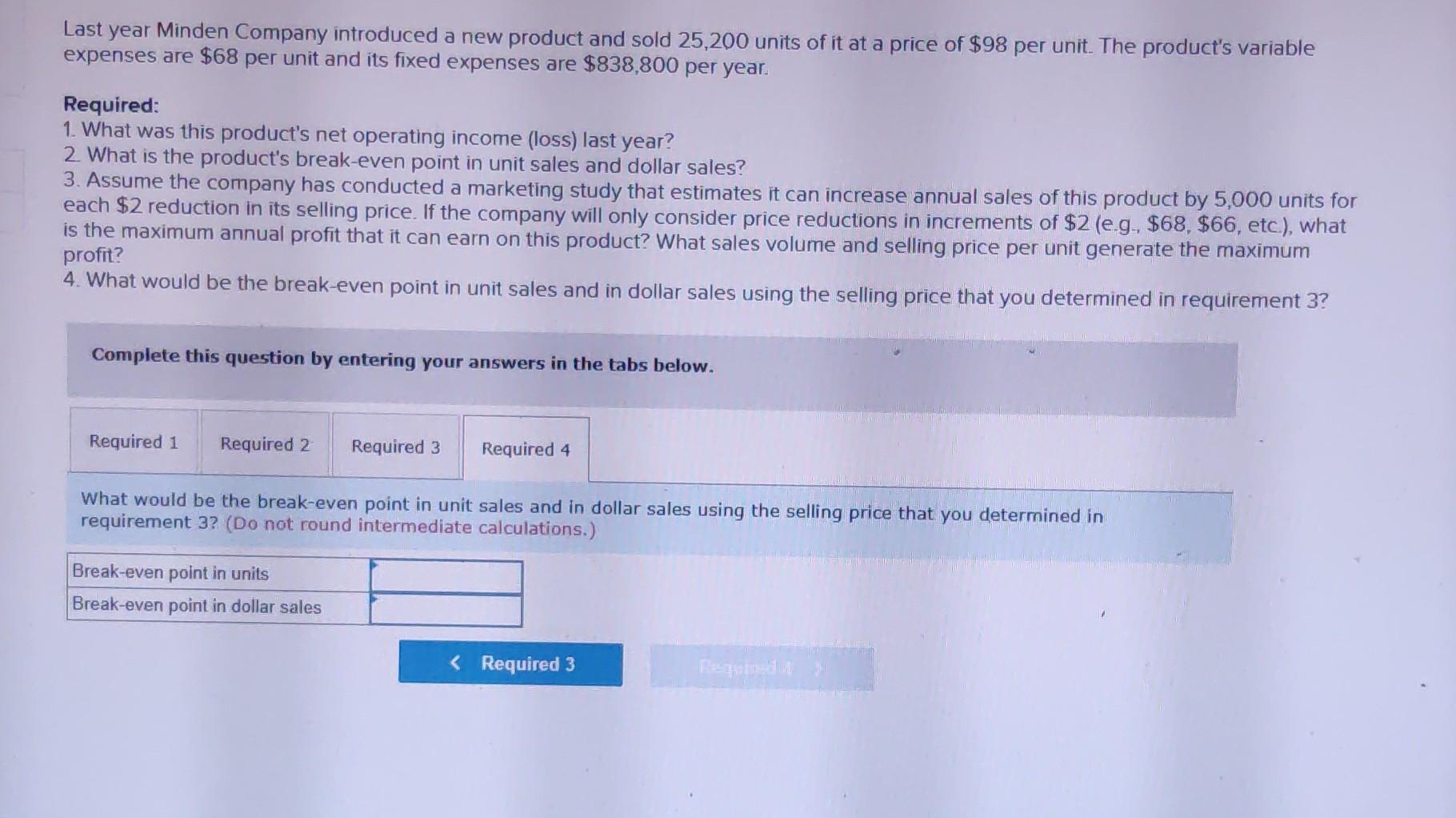

Required informotion Problem 5-30 (Algo) Graphing; Incremental Analysis; Operating Leverage [LO5-2, LO5-4, LO5-5, LO5-6, LO5-8] LO5-8] [The following information applies to the questions displayed below] Angie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals. In time, she hopes to open a chain of sandal shops. As a firct ctan she has gathered the following data for her new store: Problem 5-30 (Algo) Part 3 3. Angie has decided that she must earn a profit of $19,500 the first year to justify her time and effort. How many pairs of sandals must be sold to attain this target profit? Angie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals. In time, she hopes to open a chain of sandal shops. As a first step, she has gathered the following data for her new store: Problem 5-30 (Algo) Part 5 5. Refer to the original data. During the first year, the store sold only 4,000 pairs of sandals and reported the following operating results: a. What is the store's degree of operating leverage? b. Angie is confident that with a more intense sales effort and with a more creative advertising program she can increase unit sales by 50% next year. Using the degree of operating leverage, what would be the expected percentage increase in net operating income if Angie is able to increase unit sales by 50% ? Last year Minden Company introduced a new product and sold 25,200 units of it at a price of $98 per unit. I he product's variable expenses are $68 per unit and its fixed expenses are $838,800 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $68, $66, etc.), wh is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3 ? Complete this question by entering your answers in the tabs below. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g., $68,$66, etc.), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? Last year Minden Company introduced a new product and sold 25,200 units of it at a price of $98 per unit. The product's variable expenses are $68 per unit and its fixed expenses are $838,800 per year. Required: 1. What was this product's net operating income (loss) last year? 2. What is the product's break-even point in unit sales and dollar sales? 3. Assume the company has conducted a marketing study that estimates it can increase annual sales of this product by 5,000 units for each $2 reduction in its selling price. If the company will only consider price reductions in increments of $2 (e.g. $68, $66, etc), what is the maximum annual profit that it can earn on this product? What sales volume and selling price per unit generate the maximum profit? 4. What would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3 ? Complete this question by entering your answers in the tabs below. What would be the break-even point in unit sales and in dollar sales using the selling price that you determined in requirement 3 ? (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts