Question: Required intormation Tableau DA 17-3 (Static): Mini-Case, Computing and assigning overhead costs using activity-based costing LOP3 Chrom Company manufactures two models, the XL and RD.

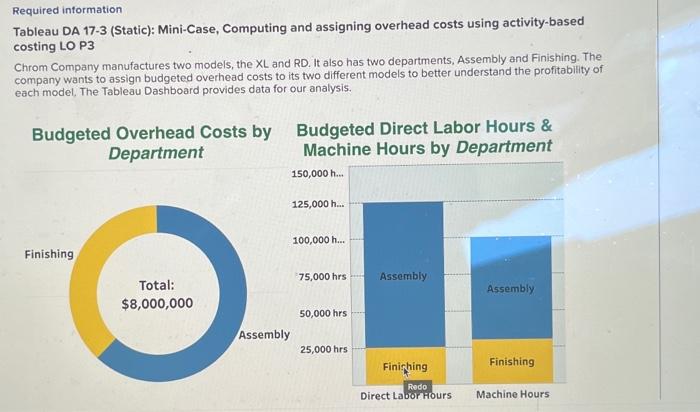

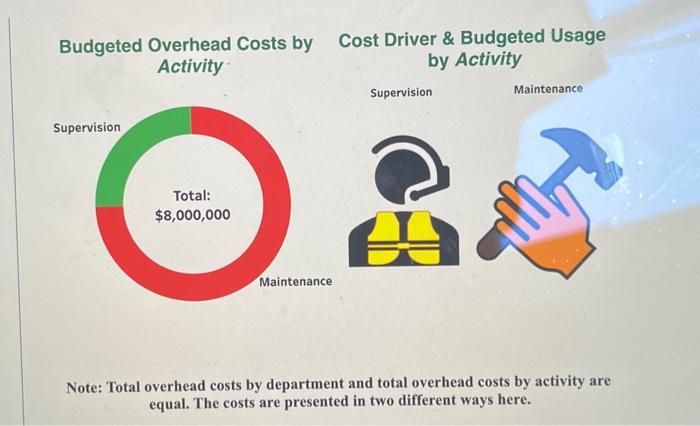

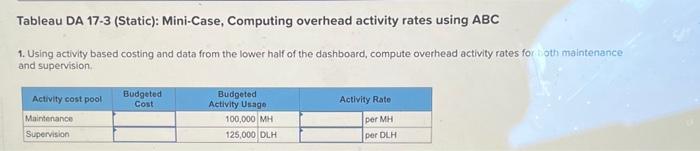

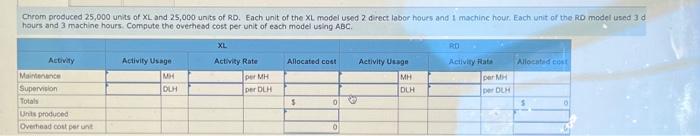

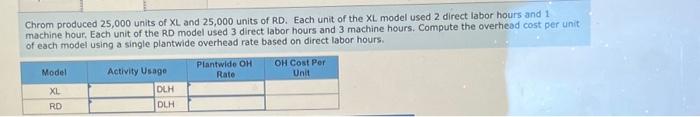

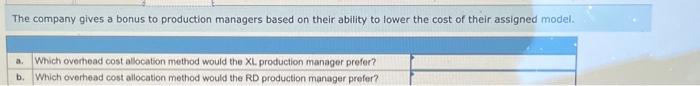

Required intormation Tableau DA 17-3 (Static): Mini-Case, Computing and assigning overhead costs using activity-based costing LOP3 Chrom Company manufactures two models, the XL and RD. It also has two departments, Assembly and Finishing. The company wants to assign budgeted overhead costs to its two different models to better understand the profitability of each model, The Tableau Dashboard provides data for our analysis. Budgeted Overhead Costs by Cost Driver \& Budgeted Usage Antivity . by Activity Note: Total overhead costs by department and total overhead costs by activity are equal. The costs are presented in two different ways here. Tableau DA 17-3 (Static): Mini-Case, Computing overhead activity rates using ABC 1. Using activity based costing and data from the lower half of the dashboard, compute overhead activity rates for woth maintenance and supervision. Chrom produced 25,000 units of XL and 25,000 units of RD. Each unit of the XL model used 2 drect labor hours and 1 machinc hour. Each unit of the RD model ased 3d hours and 3 machine hours. Compute the ovethesd cost per unit of esch model using ABC. Chrom produced 25,000 units of XL and 25,000 units of RD. Each unit of the XL model used 2 direct labor hours and 1 machine hour, Each unit of the RD model used 3 direct labor hours and 3 machine hours. Compute the overhead cost per unit of each model using a single plantwide overhead rate based on direct labor hours. The company gives a bonus to production managers based on their ability to lower the cost of their assigned model. a. Which overhead cost allocation method would the XL. production manager prefer? b. Which overhead cost allocation method would the RD production manager prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts