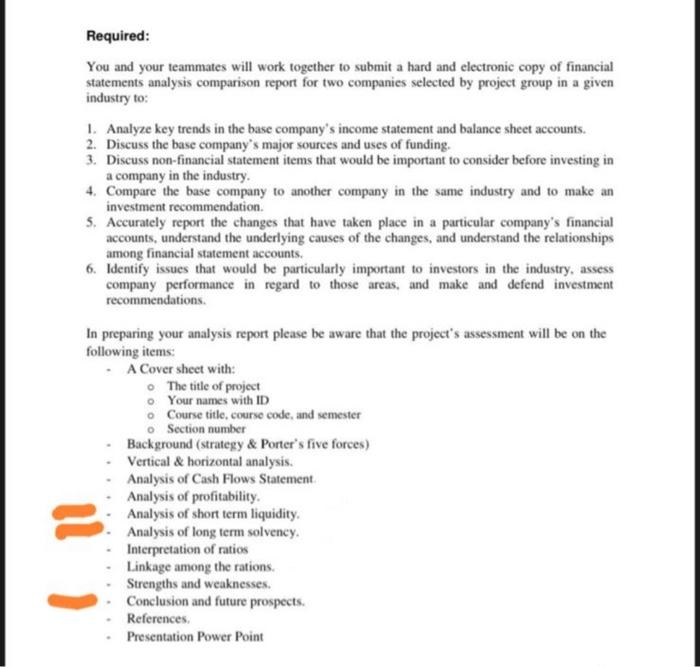

Question: Required is statements analysis comparison report for two companies , the companies are Wizz air , Finnair . Only the one with an orange arrow

Required: You and your teammates will work together to submit a hard and electronic copy of financial statements analysis comparison report for two companies selected by project group in a given industry to: 1. Analyze key trends in the base company's income statement and balance sheet accounts. 2. Discuss the base company's major sources and uses of funding. 3. Discuss non-financial statement items that would be important to consider before investing in a company in the industry. 4. Compare the base company to another company in the same industry and to make an investment recommendation. 5. Accurately report the changes that have taken place in a particular company's financial accounts, understand the underlying causes of the changes, and understand the relationships among financial statement accounts. 6. Identify issues that would be particularly important to investors in the industry, assess company performance in regard to those areas, and make and defend investment recommendations. In preparing your analysis report please be aware that the project's assessment will be on the following items: - A Cover sheet with: - The title of project - Your names with ID - Course title, course code, and semester - Section number - Background (strategy \& Porter's five forces) - Vertical \& horizontal analysis. - Analysis of Cash Flows Statement. - Analysis of profitability. - Analysis of short term liquidity. - Analysis of long term solvency. - Interpretation of natios - Linkage among the rations. - Strengths and weaknesses. - Conclusion and future prospects. - References. - Presentation Power Point Required: You and your teammates will work together to submit a hard and electronic copy of financial statements analysis comparison report for two companies selected by project group in a given industry to: 1. Analyze key trends in the base company's income statement and balance sheet accounts. 2. Discuss the base company's major sources and uses of funding. 3. Discuss non-financial statement items that would be important to consider before investing in a company in the industry. 4. Compare the base company to another company in the same industry and to make an investment recommendation. 5. Accurately report the changes that have taken place in a particular company's financial accounts, understand the underlying causes of the changes, and understand the relationships among financial statement accounts. 6. Identify issues that would be particularly important to investors in the industry, assess company performance in regard to those areas, and make and defend investment recommendations. In preparing your analysis report please be aware that the project's assessment will be on the following items: - A Cover sheet with: - The title of project - Your names with ID - Course title, course code, and semester - Section number - Background (strategy \& Porter's five forces) - Vertical \& horizontal analysis. - Analysis of Cash Flows Statement. - Analysis of profitability. - Analysis of short term liquidity. - Analysis of long term solvency. - Interpretation of natios - Linkage among the rations. - Strengths and weaknesses. - Conclusion and future prospects. - References. - Presentation Power Point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts