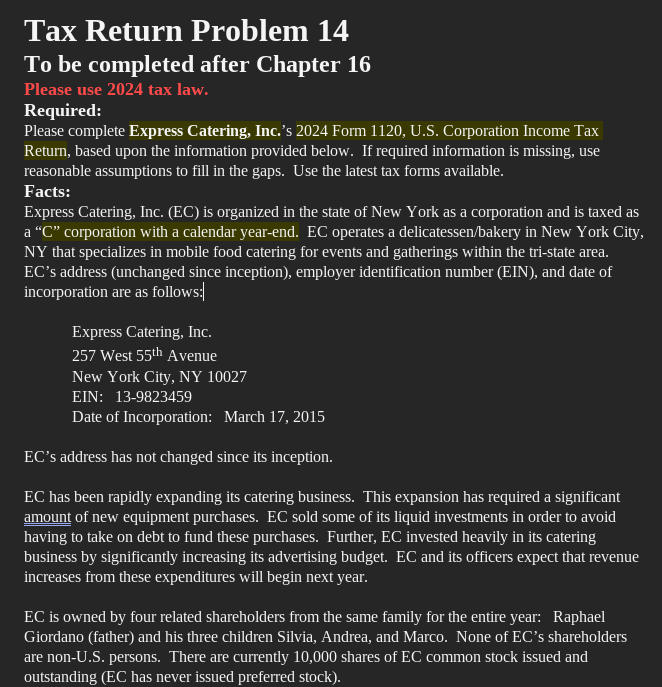

Question: Required: Please complete Express Catering, Inc. ' s 2 0 2 4 Form 1 1 2 0 , U . S . Corporation Income Tax

Required:

Please complete Express Catering, Inc.s Form US Corporation Income Tax Return, based upon the information provided below. If required information is missing, use reasonable assumptions to fill in the gaps. Use the latest tax forms available.

Facts:

Express Catering, Inc. EC is organized in the state of New York as a corporation and is taxed as a C corporation with a calendar yearend. EC operates a delicatessenbakery in New York City, NY that specializes in mobile food catering for events and gatherings within the tristate area. EC's address unchanged since inception employer identification number EIN and date of incorporation are as follows:

Express Catering, Inc.

West text th Avenue

New York City, NY

EIN:

Date of Incorporation: March

EC's address has not changed since its inception.

EC has been rapidly expanding its catering business. This expansion has required a significant amount of new equipment purchases. EC sold some of its liquid investments in order to avoid having to take on debt to fund these purchases. Further, EC invested heavily in its catering business by significantly increasing its advertising budget. EC and its officers expect that revenue increases from these expenditures will begin next year.

EC is owned by four related shareholders from the same family for the entire year: Raphael Giordano father and his three children Silvia, Andrea, and Marco. None of EC's shareholders are nonUS persons. There are currently shares of EC common stock issued and outstanding EC has never issued preferred stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock