Required: Please consider the three independent scenarios provided below. You are required to: 1. Provide the...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

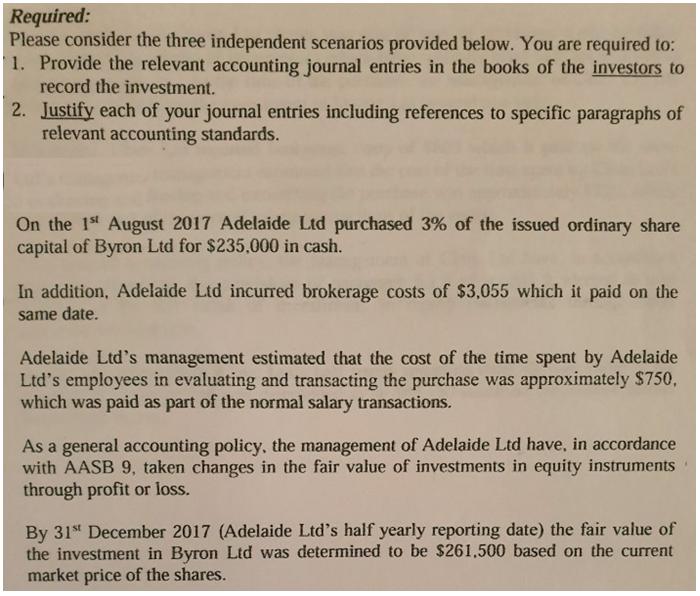

Required: Please consider the three independent scenarios provided below. You are required to: 1. Provide the relevant accounting journal entries in the books of the investors to record the investment. 2. Justify each of your journal entries including references to specific paragraphs of relevant accounting standards. On the 1s August 2017 Adelaide Ltd purchased 3% of the issued ordinary share capital of Byron Ltd for $235,000 in cash. In addition, Adelaide Ltd incurred brokerage costs of $3,055 which it paid on the same date. Adelaide Ltd's management estimated that the cost of the time spent by Adelaide Ltd's employees in evaluating and transacting the purchase was approximately $750, which was paid as part of the normal salary transactions. As a general accounting policy, the management of Adelaide Ltd have, in accordance with AASB 9, taken changes in the fair value of investments in equity instruments through profit or loss. By 31" December 2017 (Adelaide Ltd's half yearly reporting date) the fair value of the investment in Byron Ltd was determined to be $261,500 based on the current market price of the shares. Required: Please consider the three independent scenarios provided below. You are required to: 1. Provide the relevant accounting journal entries in the books of the investors to record the investment. 2. Justify each of your journal entries including references to specific paragraphs of relevant accounting standards. On the 1s August 2017 Adelaide Ltd purchased 3% of the issued ordinary share capital of Byron Ltd for $235,000 in cash. In addition, Adelaide Ltd incurred brokerage costs of $3,055 which it paid on the same date. Adelaide Ltd's management estimated that the cost of the time spent by Adelaide Ltd's employees in evaluating and transacting the purchase was approximately $750, which was paid as part of the normal salary transactions. As a general accounting policy, the management of Adelaide Ltd have, in accordance with AASB 9, taken changes in the fair value of investments in equity instruments through profit or loss. By 31" December 2017 (Adelaide Ltd's half yearly reporting date) the fair value of the investment in Byron Ltd was determined to be $261,500 based on the current market price of the shares.

Expert Answer:

Answer rating: 100% (QA)

aJournal entries for the said transactions 11817 Investment in equity sharesByron Ac Dr 235000 To Cash Ac 235000 Purchase Of shares 21817 Investment i... View the full answer

Related Book For

Financial Accounting

ISBN: 978-1259914898

5th edition

Authors: David Spiceland, Wayne M. Thomas, Don Herrmann

Posted Date:

Students also viewed these accounting questions

-

Consider the three independent situations below (amounts are $ in millions): Required: 1. Calculate cash received from customers. 2. Prepare the summary journal entry for each situation. Sales...

-

Prepare entries in the books of Thinker, Inc., to reflect the following. (Assume cash transactions.) 1. Purchased a milling machine to be used by the firm in its production process. Invoice price . ....

-

On 31 December 2017 Real Estate Company issued K300, 000 of 10% bonds. The bonds are due on January 1, 2023, with interest payable each July 1 and January 1. The bonds are issued to yield 8%...

-

2. There are different kinds of statistical analyses, and you will need to use one that is best suited to the data available and the information you need to collect in the given scenario (Good Days)....

-

Sketch the graph of f(x) = (x - 2)2 - 4 using translations. Discuss.

-

Saira Morrow is the sole owner of Buena Vista Park, a public camping ground near the Crater Lake National Recreation Area. Saira has compiled the following financial information as of December 31,...

-

Renkas Heaters selected data for October 2017 are presented here (in millions): Calculate the following costs: 1. Direct materials inventory 10/31/2017 2. Fixed manufacturing overhead costs for...

-

McBurgers fast-food restaurant has a drive-through window with a single server who takes orders from an intercom and also is the cashier. The window operator is assisted by other employees who...

-

4. (50 points) The goal of this simulation study is to study the relative performance of uniform search, golden section search, and parabolic interpolation (algorithms 1-3 from class notes). Fix m...

-

The proposed rates were not in the range the CEO expected given the pricing analysis. The CEO has asked the pricing actuary to verify the total projected loss cost excluding potential large storm...

-

Assume the company prices its product at $100. What is the CM per unit? Assume the company prices its product at $100. How many units does it need to sell per month to break even? Assume the company...

-

Say that you want to establish a scholarship fund that will make fixed payments forever. To fund the scholarship, you plan to make 1 3 annual contributions of $ 9 . 3 k to an investment account with...

-

What in your view are the three most important aspects of Capital Budgeting? Explain why you have chosen these three over other potentially important facets of budgeting. Respond to this to make your...

-

You have the following account balances as on 3 1 / 1 Accounts Payable = 2 0 , 0 0 0 NotesPayable ( due June 2 0 2 3 ) = 1 5 , 0 0 0 Bonds Payable = 5 0 , 0 0 0 ( 5 equal installments are due to pay...

-

You have been asked to estimate the program cost value per life saved of a program intended to place an armed security guard in every public school in the United States. Limit your analysis to first...

-

SMC 60- 25 80 70 50 40 Revenue and cost (dollars) 30 20 10 22 ATC AVC D MR 0 20 40 60 80 100 120 140 160 Output The graph above shows the demand and cost conditions facing a monopolist. What price...

-

Janie has $3. She earns $1.20 for each chore she does and can do fractions of chores. She wants to earn enough money to buy a CD for $13.50. Write an inequality to determine the number of chores, c,...

-

What are the six activities involved in the physical supply/distribution system?

-

Refer to the information provided in P113A for Alliance Technologies. Required: Prepare the operating activities section of the statement of cash flows for Alliance Technologies using the direct...

-

Below are transactions for Bronco Corporation during the month of June. Calculate the amount of expense to recognize in June. If the transaction does not require an expense to be recognized, indicate...

-

Record each of the following external transactions using debits and credits. a. Receive cash of $1,200 for providing services to a customer. b. Pay rent of $500 for the current month. c. Purchase a...

-

When adopting resource-leveling heuristics, which of the following are relevant decision rules? a. The activities with the least slack time should have resources allocated to them first b. The...

-

Project resource constraints can involve any of the following examples? a. Poorly trained workers b. Lack of available materials for construction c. Environmental or physical constraints of the...

-

When are the resource requirements estimated? a. After the activities have been defined but before the schedule has been developed b. After the schedule has been developed but before the activities...

Study smarter with the SolutionInn App