Question: Required: Prepare a consolidation worksheet for 2 0 X 9 . Assume the company prepares the optional Accumulated Depreciation Consolidation Entry and that the depreciation

Required:

Prepare a consolidation worksheet for X Assume the company prepares the optional Accumulated Depreciation Consolidation Entry and that the depreciation expense was the same amount in both X and X

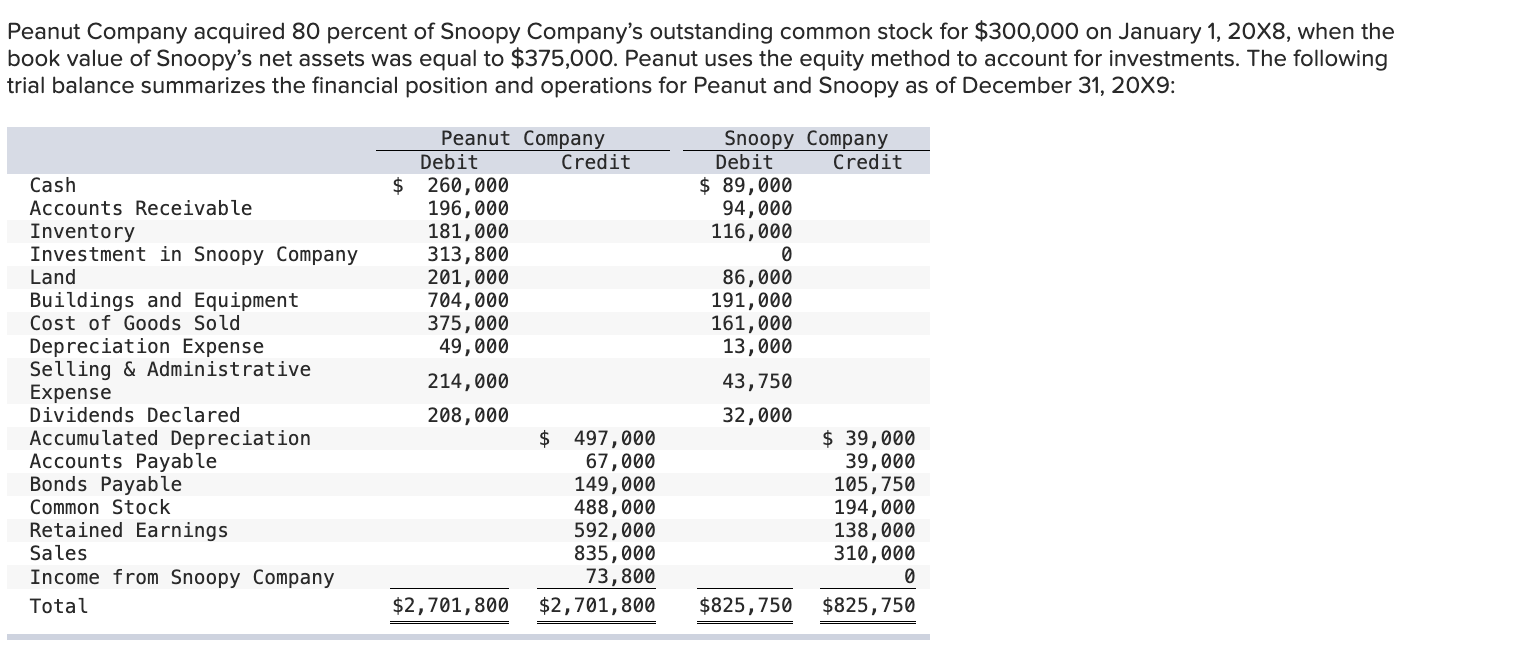

Peanut Company acquired 80 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $375,000. Peanut uses the equity method to account for investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Peanut Company Debit Credit Snoopy Company Debit Credit Cash $ 260,000 $ 89,000 Accounts Receivable 196,000 Inventory 181,000 94,000 116,000 Investment in Snoopy Company Land 313,800 0 201,000 86,000 Buildings and Equipment 704,000 191,000 Cost of Goods Sold 375,000 161,000 Depreciation Expense 49,000 13,000 Selling & Administrative Expense 214,000 43,750 Dividends Declared 208,000 32,000 Accumulated Depreciation Accounts Payable $ 497,000 67,000 $ 39,000 39,000 Bonds Payable 149,000 105,750 Common Stock 488,000 194,000 Sales Retained Earnings Income from Snoopy Company 592,000 138,000 835,000 310,000 73,800 0 Total $2,701,800 $2,701,800 $825,750 $825,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts