Question: Required: Prepare a statement of cash flows using the direct method . Changes in accounts receivable and accounts payable relate to sale and cost of

Required:

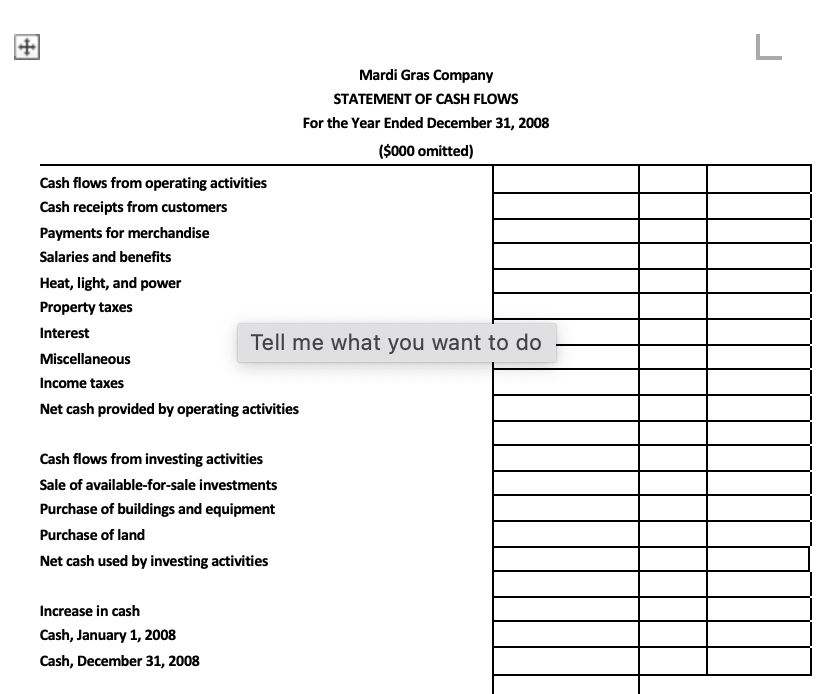

Prepare a statement of cash flows using the direct method. Changes in accounts receivable and accounts payable relate to sale and cost of goods sold. Do not prepare a reconciliation schedule.

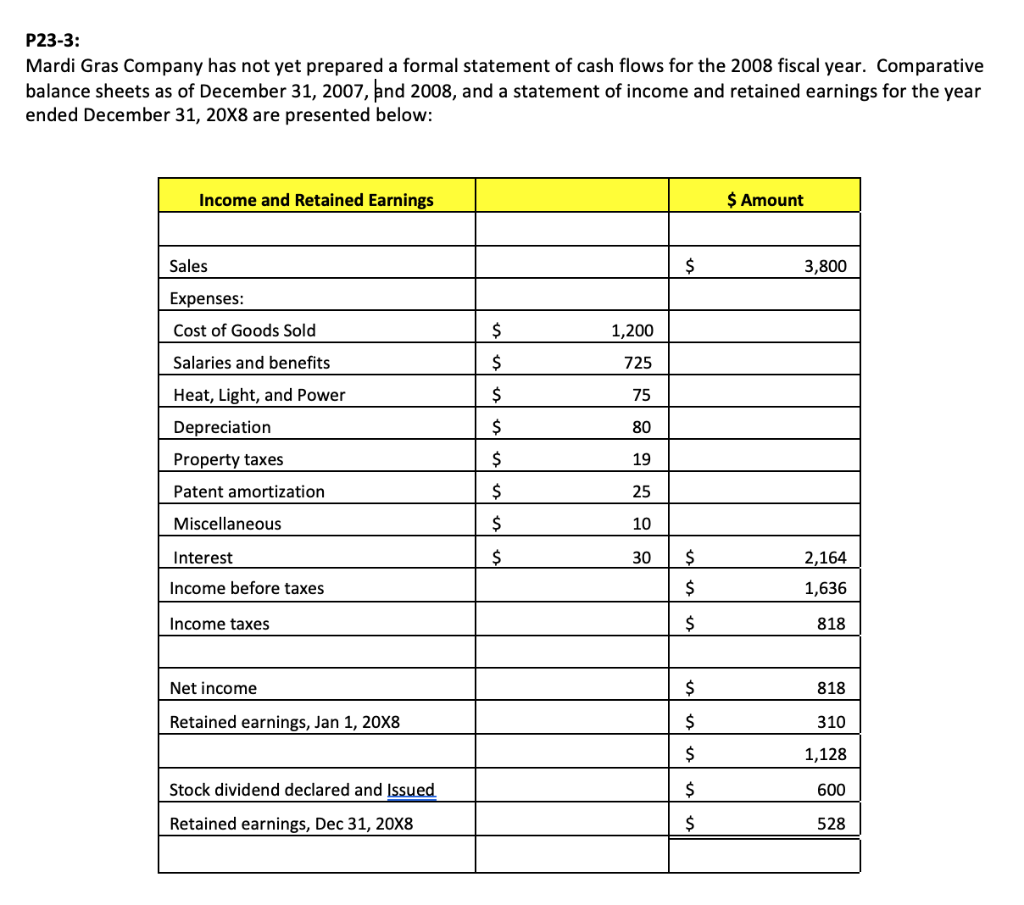

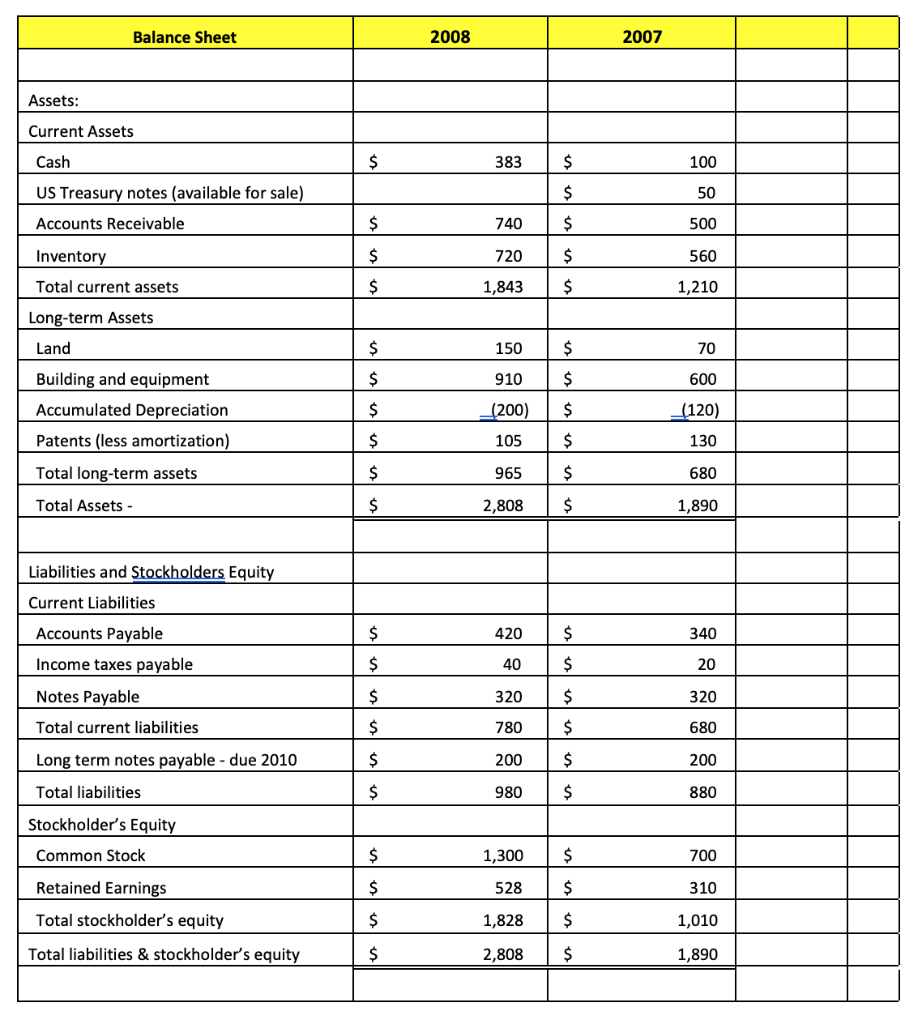

P23-3: Mardi Gras Company has not yet prepared a formal statement of cash flows for the 2008 fiscal year. Comparative balance sheets as of December 31, 2007, d 2008, and a statement of income and retained earnings for the year ended December 31, 20X8 are presented below: Income and Retained Earnings $ Amount Sales $ 3,800 Expenses: Cost of Goods Sold $ 1,200 Salaries and benefits $ 725 Heat, Light, and Power $ 75 $ 80 $ 19 $ 25 Depreciation Property taxes Patent amortization Miscellaneous Interest Income before taxes $ 10 $ 30 $ 2,164 1,636 $ Income taxes $ 818 Net income $ 818 Retained earnings, Jan 1, 20X8 $ 310 $ 1,128 Stock dividend declared and Issued $ 600 Retained earnings, Dec 31, 20X8 $ 528 Balance Sheet 2008 2007 Assets: Current Assets Cash $ 383 $ 100 US Treasury notes (available for sale) $ 50 Accounts Receivable $ 740 $ 500 $ 720 $ 560 Inventory Total current assets Long-term Assets $ 1,843 $ 1,210 Land $ 150 $ 70 $ 910 $ 600 Building and equipment Accumulated Depreciation Patents (less amortization) $ $ _(200) 105 (120) 130 $ $ Total long-term assets $ 965 $ 680 Total Assets - $ 2,808 $ 1,890 Liabilities and Stockholders Equity Current Liabilities Accounts Payable $ 420 $ 340 Income taxes payable $ 40 $ 20 Notes Payable $ 320 $ 320 Total current liabilities $ 780 $ 680 Long term notes payable - due 2010 $ 200 $ 200 Total liabilities $ 980 $ 880 Stockholder's Equity Common Stock $ 1,300 $ 700 $ 528 $ 310 Retained Earnings Total stockholder's equity $ 1,828 $ 1,010 Total liabilities & stockholder's equity $ 2,808 $ 1,890 L Mardi Gras Company STATEMENT OF CASH FLOWS For the Year Ended December 31, 2008 ($000 omitted) Cash flows from operating activities Cash receipts from customers Payments for merchandise Salaries and benefits Heat, light, and power Property taxes Interest Tell me what you want to do Miscellaneous Income taxes Net cash provided by operating activities Cash flows from investing activities Sale of available-for-sale investments Purchase of buildings and equipment Purchase of land Net cash used by investing activities Increase in cash Cash, January 1, 2008 Cash, December 31, 2008 Computation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts