Question: Required: Prepare a T 1 Return for Ms . Smith using the ProFIle Software. Submit the ProFIle file ( either 1 9 T / 2

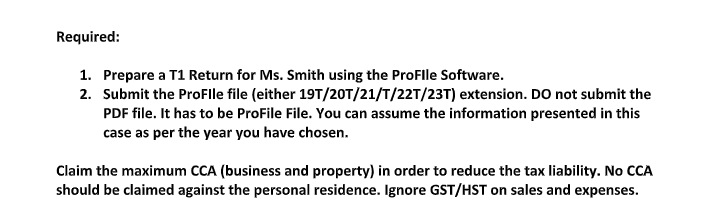

Required:

Prepare a T Return for Ms Smith using the ProFIle Software.

Submit the ProFIle file either TTTTT extension. DO not submit the PDF file. It has to be ProFile File. You can assume the information presented in this case as per the year you have chosen.

Claim the maximum CCA business and property in order to reduce the tax liability. No CCA should be claimed against the personal residence. Ignore GSTHST on sales and expenses.

During the taxation year, Ms Smith purchased $ worth of items for resale in her business.

Her brother is always helping out with the business; however, he has never received any kind of renumeration for the assistance he has provided.

Ms Smith has a business bank account and the monthly banking fees associated with this account are $ a month.

In March, one of Ms Smiths best customers went bankrupt and was unable to pay for the purchased she made. The customer owed a total of $ to Ms Smith.

Ms Smith pays $ a month for a storage locker that she has had for over years. Everything in the storage locker was bequeathed to her from her great uncle. She has no use for the items, but she cant seem to let them go

A couple of years ago, Ms Smith received an inheritance and she decided to use that money to purchase two condominium units in the same development. Both units are finalized on January and they were both rented out for the entirety of the taxation year.

Condo Class had a purchase price of $ and is rented out for $ a month. The monthly condo fees are $ and Ms Smith paid in total $ in mortgage interest. The property taxes were $ and the insurance for the unit was $ The tenant that rented out this property all year told Ms Smith that she hated the colour of the carpet in the bedrooms. In order to keep the tenant happy, Ms Smith paid to get the carpet replaced for $

Condo Class had a purchase price of $ and is rented out for $ a month. The monthly condo fees are $ and Ms Smith paid in total $ in mortgage interest. The property taxes are $ and the insurance for the unit was $ This is the bigger of the two units and Ms Smith decided that she would buy a freezer Class for $ for the tenants as the freezer that came with the fridge was too small for a family of four.

In the current year, Ms Smith received a hot stock tip from a friend regarding a brandnew industry and she decided to buy shares at $ each. The investment did not turn out so well and on December th Ms Smith decided to sell all the shares at $ She was devasted when she had to sell them, but she was scared that the share price would have dropped even lower.

In the current year, Ms Smith received another hot stock tip from an article she read online. On March st she bought shares at $ each. Due to the financial instability she decided to also sell all of these shares on December for $ each. Ms Smith has sworn off selfdirected investments due to the stress they both caused her over the past months. Required:

Prepare a T Return for Ms Smith using the Proflle Software.

Submit the Proflle file either mathrm~Tmathrm~Tmathbf T T T extension. DO not submit the PDF file. It has to be ProFile File. You can assume the information presented in this case as per the year you have chosen.

Claim the maximum CCA business and property in order to reduce the tax liability. No CCA should be claimed against the personal residence. Ignore GSTHST on sales and expenses.

Assignment

Address: Same as Ms Smith

Business Income

In addition to working a standard am pm job, Ms Smith had an innovative idea and a couple of years ago she started her own business. The details you will need to complete her T Return are below:

The unincorporated business earns $ per month.

Ms Smith operates an unincorporated business out of her personal residence and the entire basement which is of the total house is dedicated to the business. The

Business Income

In addition to working a standard am pm job, Ms Smith had an innovative idea and a couple of years ago she started her own business. The details you will need to complete her T Return are below:

The unincorporated business earns $ per month.

Ms Smith operates an unincorporated business out of her personal residence and the entire basement which is of the total house is dedicated to the business. The house has three levels, including the basement. No other part of the house is used to earn income. Ms Smith regularly meets clients there to discuss future sales.

To furnish the home office, Ms Smith spent $ on office furniture Class for CCA on January Ms Smith was getting tired of the dated bathroom on the top floor of the house and decided to renovate it for a cost of $

The monthly heating and utility bills for the whole hou

During the taxation year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock