Question: Required: Prepare the company's cash flow statement for the current year under the INDIRECT METHOD. Assets Current Assets Cash Trading Debt Investments Accounts Receivable -

Required:

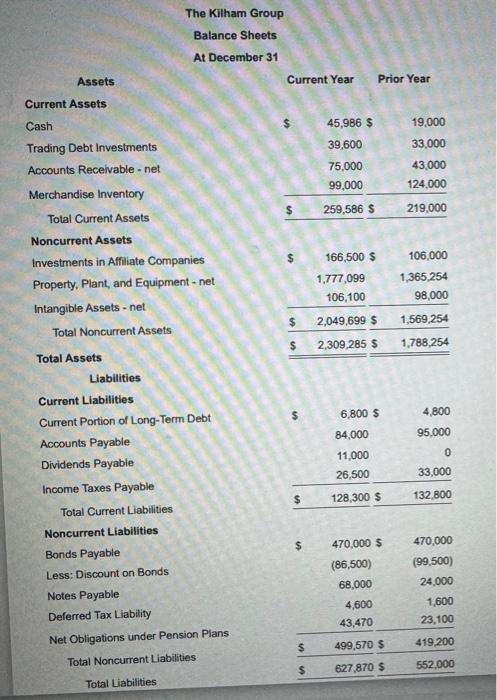

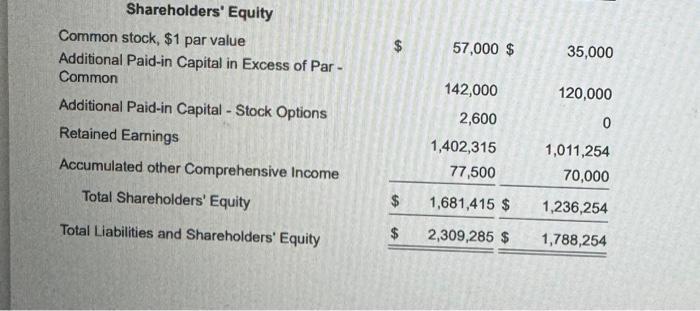

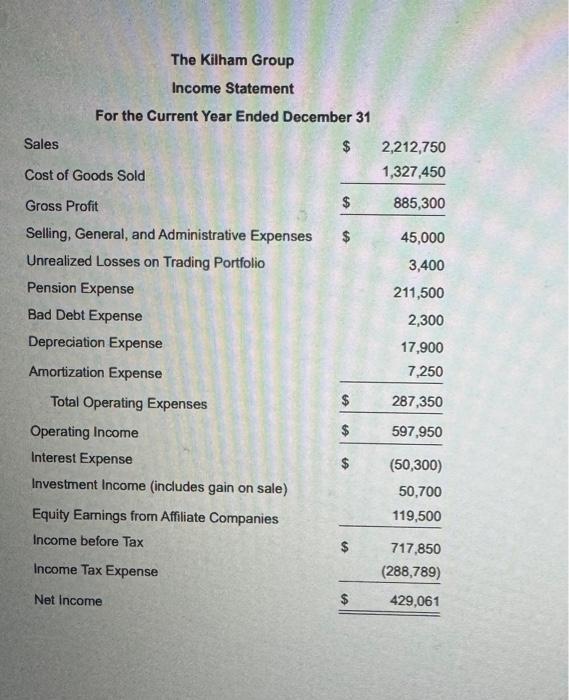

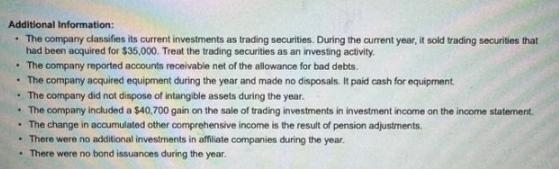

Prepare the company's cash flow statement for the current year under the INDIRECT METHOD.Assets Current Assets Cash Trading Debt Investments Accounts Receivable - net Merchandise Inventory Total Current Assets Noncurrent Assets Investments in Affiliate Companies Property, Plant, and Equipment - net Intangible Assets - net Total Noncurrent Assets Total Assets Liabilities Current Liabilities Current Portion of Long-Term Debt Accounts Payable Dividends Payable Income Taxes Payable The Kilham Group Balance Sheets At December 31 Total Current Liabilities Noncurrent Liabilities Bonds Payable Less: Discount on Bonds Notes Payable Deferred Tax Liability Net Obligations under Pension Plans Total Noncurrent Liabilities Total Liabilities Current Year $ $ $ $ $ $ $ 45,986 $ 39,600 75,000 99,000 259,586 $ 166,500 $ 1,777,099 106,100 2,049,699 $ 2,309,285 $ Prior Year 6,800 $ 84,000 11,000 26,500 128,300 $ 470,000 $ (86,500) 68,000 4,600 43,470 499,570 $ 627,870 $ 19,000 33,000 43,000 124,000 219,000 106,000 1,365,254 98,000 1,569,254 1,788,254 4,800 95,000 0 33,000 132,800 470,000 (99,500) 24,000 1,600 23,100 419,200 552,000

Step by Step Solution

There are 3 Steps involved in it

SOLUTION To prepare the cash flow statement for Kilham Group for the current year using the indirect ... View full answer

Get step-by-step solutions from verified subject matter experts