Question: Required: Prepare the required adjusting journal entry at December 31 for the following situations: a) Cash of $5,220 was collected on November Ist for services

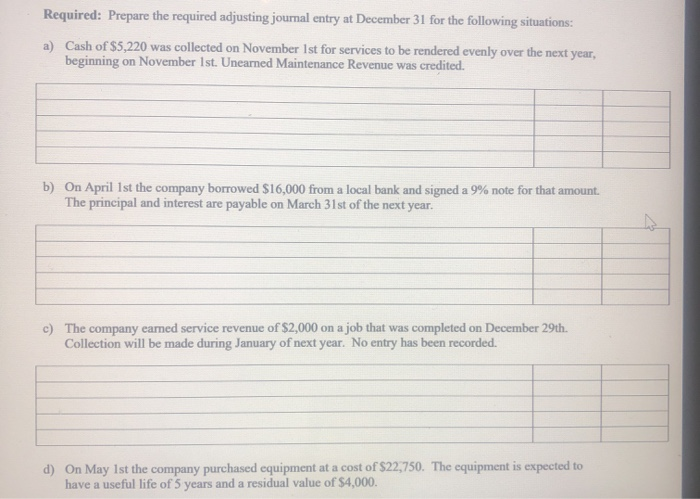

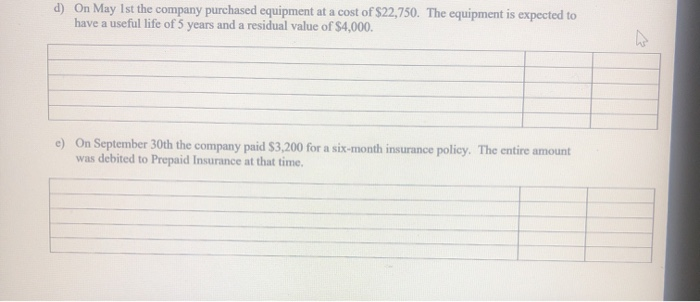

Required: Prepare the required adjusting journal entry at December 31 for the following situations: a) Cash of $5,220 was collected on November Ist for services to be rendered evenly over the next year, beginning on November 1st. Unearned Maintenance Revenue was credited. b) On April 1st the company borrowed $16,000 from a local bank and signed a 9% note for that amount. The principal and interest are payable on March 31st of the next year. c) The company earned service revenue of $2,000 on a job that was completed on December 29th. Collection will be made during January of next year. No entry has been recorded. d) On May Ist the company purchased equipment at a cost of $22,750. The equipment is expected to have a useful life of 5 years and a residual value of $4,000. d) On May Ist the company purchased equipment at a cost of $22,750. The equipment is expected to have a useful life of 5 years and a residual value of $4,000. he c) On September 30th the company paid $3,200 for a six-month insurance policy. The entire amount was debited to Prepaid Insurance at that time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts