Question: Required: Problem 1 1 - 2 5 1 a . , 1 b . , and 1 c . : From the standpoint of the

Required: Problem

a b and c:

From the standpoint of the selling division, Alpha Division:

Transfer price per Variable cost unit

Transfer Price or

But, from the standpoint of the buying division, Beta Division:

Transfer Price of Cost of buying from outside supplier $

a b and c:

From the standpoint of the selling division, Alpha Division:

Transfer price Variable cost Ver unit

Transfer Price or

From the standpoint of the buying division, Beta Division:

Transfer Price of Cost of buying from outside supplier

In this instance, the range of acceptable transfer prices is:

$or Transfer Price or $ Problem continued

d The loss in potential profits to the company as a whole will be:

Beta Division's outside purchase price

Alpha Division's variable cost on the internal transfer...

Potential added contribution margin lost to the

company as a whole.

Number of units

Potential added contribution margin and company

profits forgone

Another way to derive the same answer is to look at the loss in potential profits

for each division and then total the losses for the impact on the company as a

whole. The loss in potential profits in Alpha Division will be:

Suggested selling price per unit

Alpha Division's variable cost on the internal transfer...

Potential added contribution margin per unit

Number of units

Potential added contribution margin and divisional

profits forgone

The loss in potential profits in Beta Division will be:

Outside purchase price per unit

Suggested price per unit inside.

Potential cost avoided per unit.

Number of units

Potential added contribution margin and divisional

profits forgone

The total of these two amounts equals the $

profits for the company as a whole.

loss in potential

a From the standpoint of the selling division, Alpha Division:

Transfer Price or Problem continued

and c

From the standpoint of the buying division, Beta Division:

Transfer Price of Cost of buying from outside supplier $

In this case, the range of acceptable transfer prices is:

&

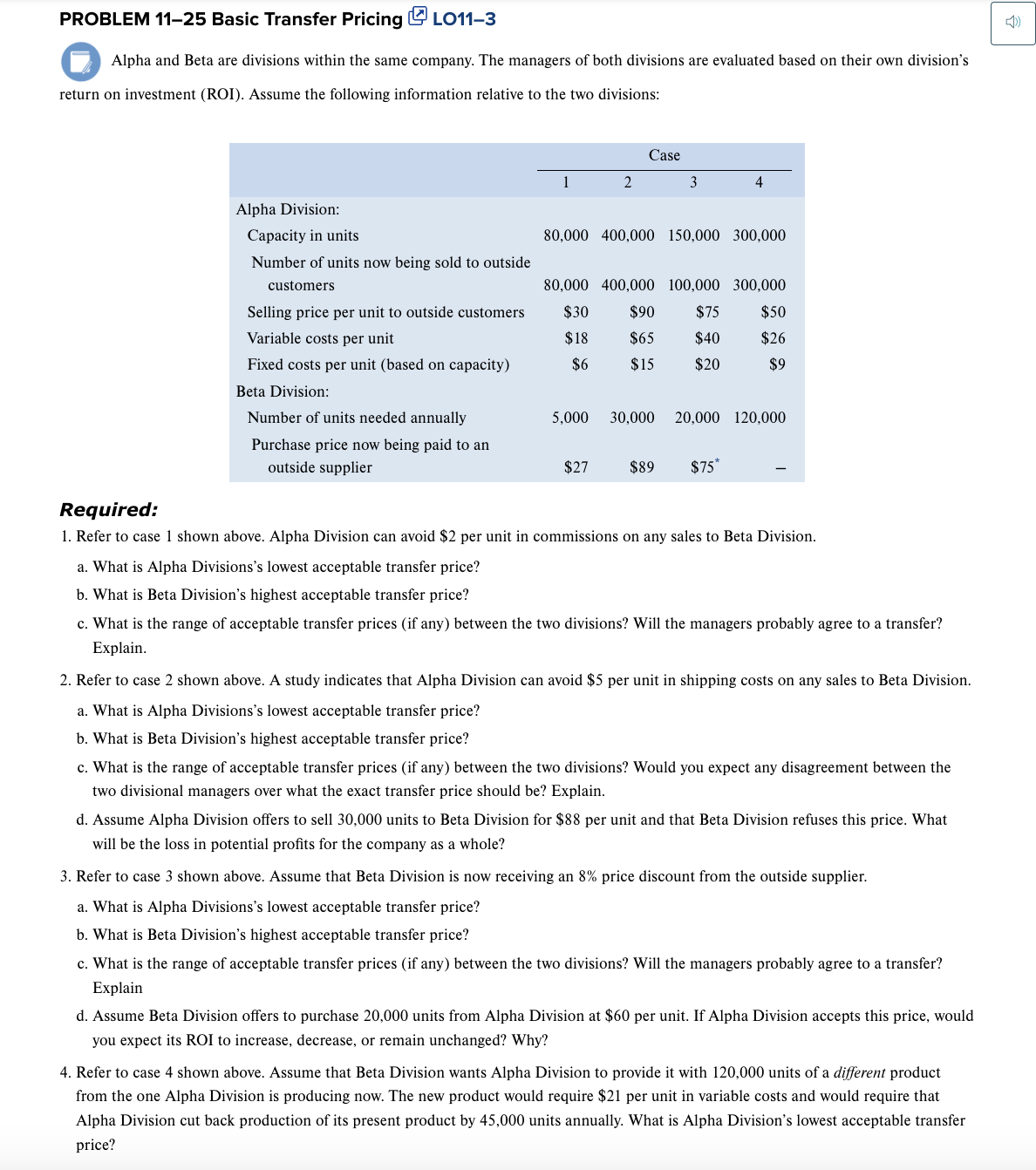

Refer to case shown above. Alpha Division can avoid $ per unit in commissions on any sales to Beta Division.

a What is Alpha Divisions's lowest acceptable transfer price?

b What is Beta Division's highest acceptable transfer price?

c What is the range of acceptable transfer prices if any between the two divisions? Will the managers probably agree to a transfer?

Explain.

Refer to case shown above. A study indicates that Alpha Division can avoid $ per unit in shipping costs on any sales to Beta Division.

a What is Alpha Divisions's lowest acceptable transfer price?

b What is Beta Division's highest acceptable transfer price?

c What is the range of acceptable transfer prices if any between the two divisions? Would you expect any disagreement between the

two divisional managers over what the exact transfer price should be Explain.

d Assume Alpha Division offers to sell units to Beta Division for $ per unit and that Beta Division refuses this price. What

will be the loss in potential profits for the company as a whole?

Refer to case shown above. Assume that Beta Division is now receiving an price discount from the outside supplier.

a What is Alpha Divisions's lowest acceptable transfer price?

b What is Beta Division's highest acceptable transfer price?

c What is the range of acceptable transfer prices if any between the two divisions? Will the managers probably agree to a transfer?

Explain

d Assume Beta Division offers to purchase units from Alpha Division at $ per unit. If Alpha Division accepts this price, would

you expect its ROI to increase, decrease, or remain unchanged? Why?

Refer to case shown above. Assume that Beta Division wants Alpha Division to provide it with units of a different product

from the one Alpha Division is producing now. The new product would require $ per unit in variable costs and would require that

Alpha Division cut back production of its present product by units annually. What is Alpha Division's lowest acceptable transfer

price?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock