Question: Required Problem 1- Partially Owned Subsidiary - Acquisition at Other Than Book Value (Cost Method) On January 2, 2008, P Company acquires 16,000 shares of

Required

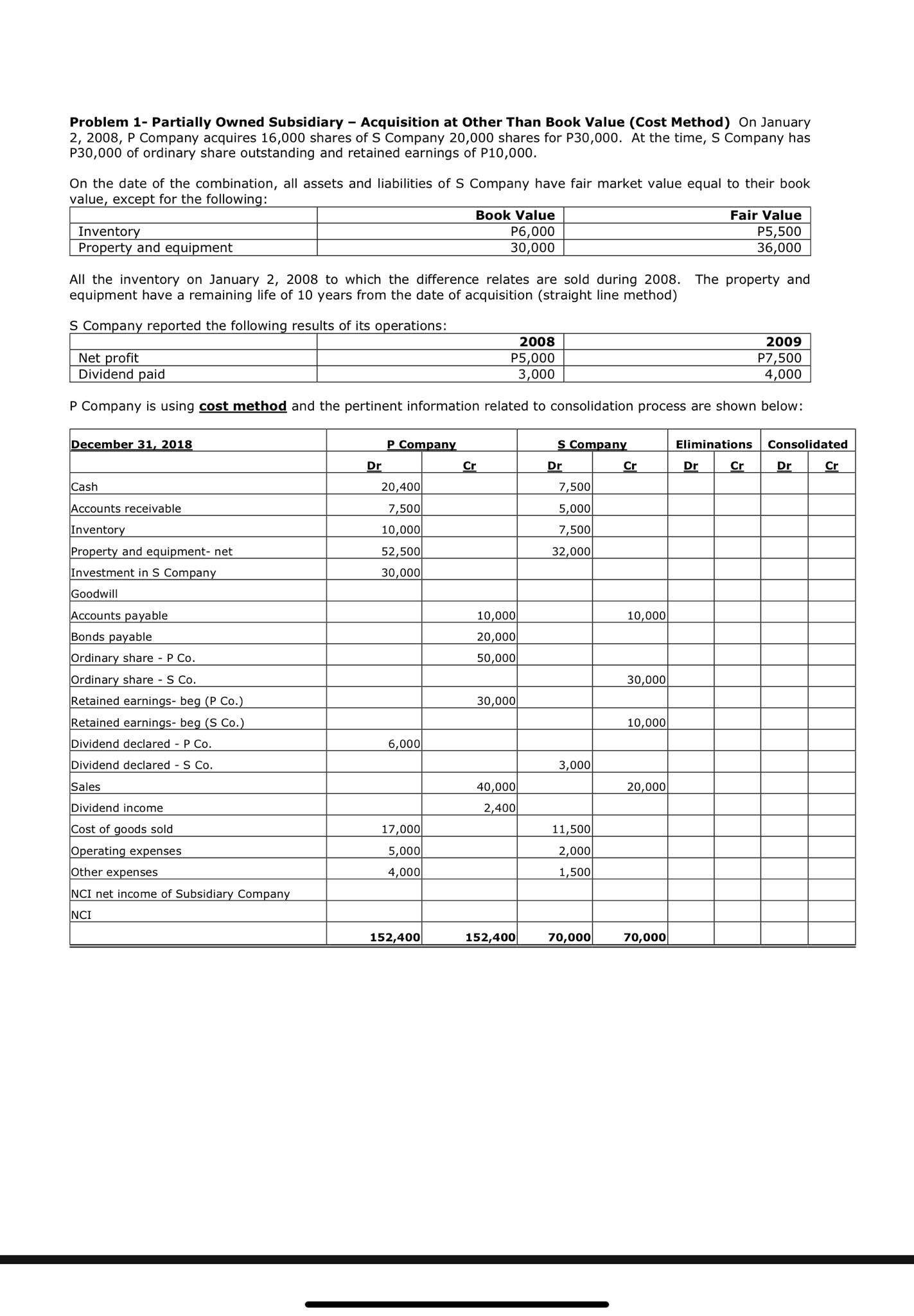

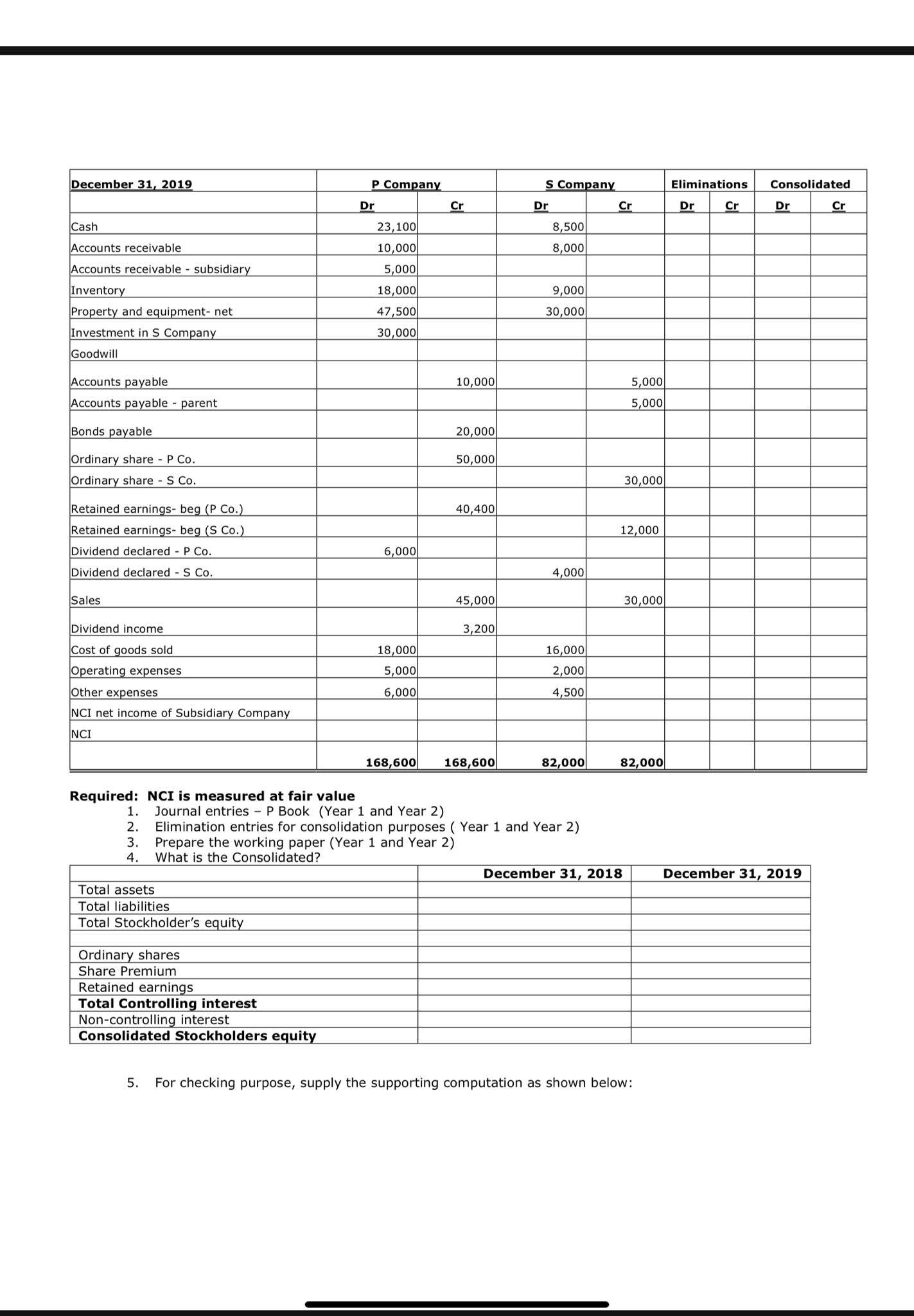

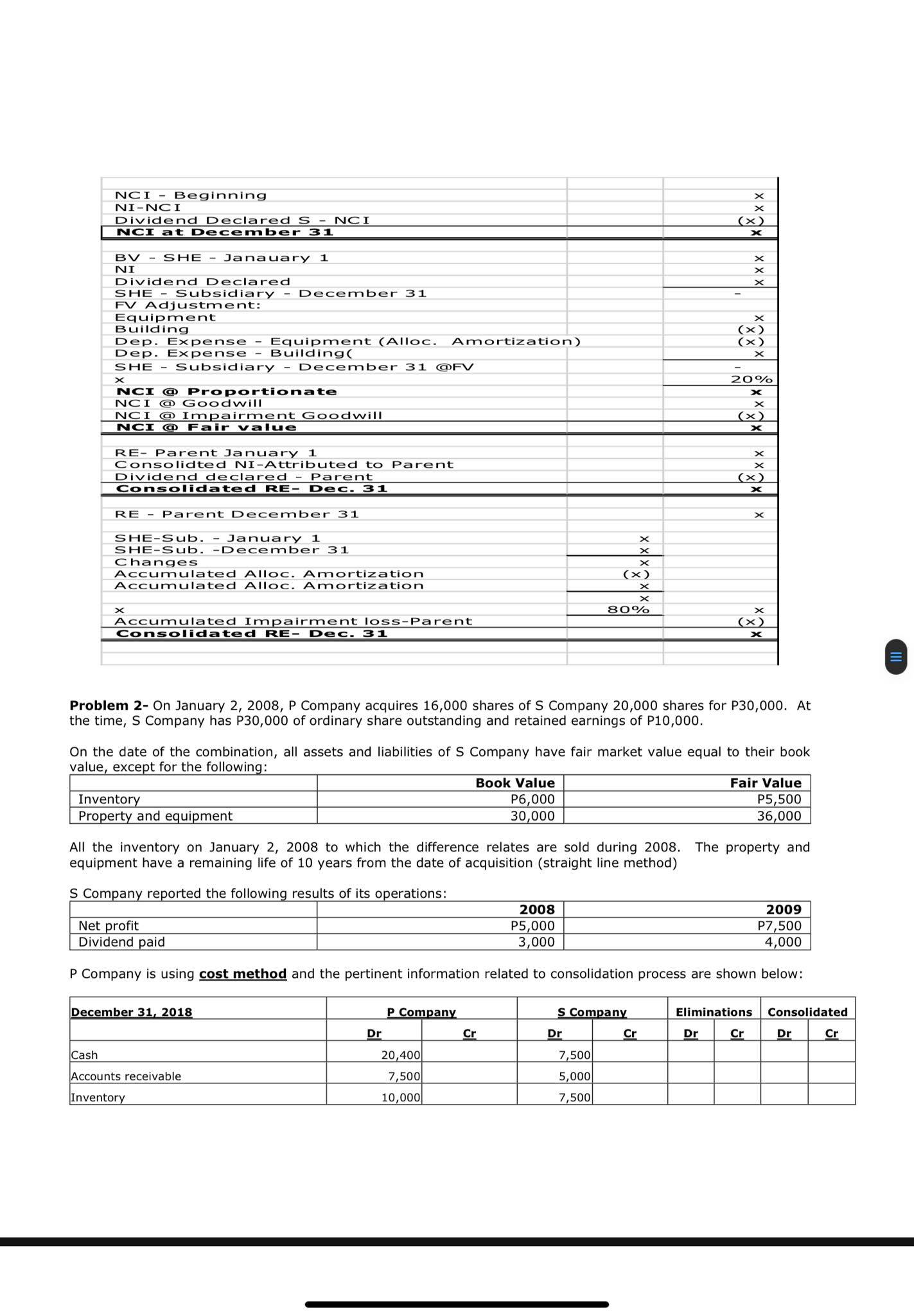

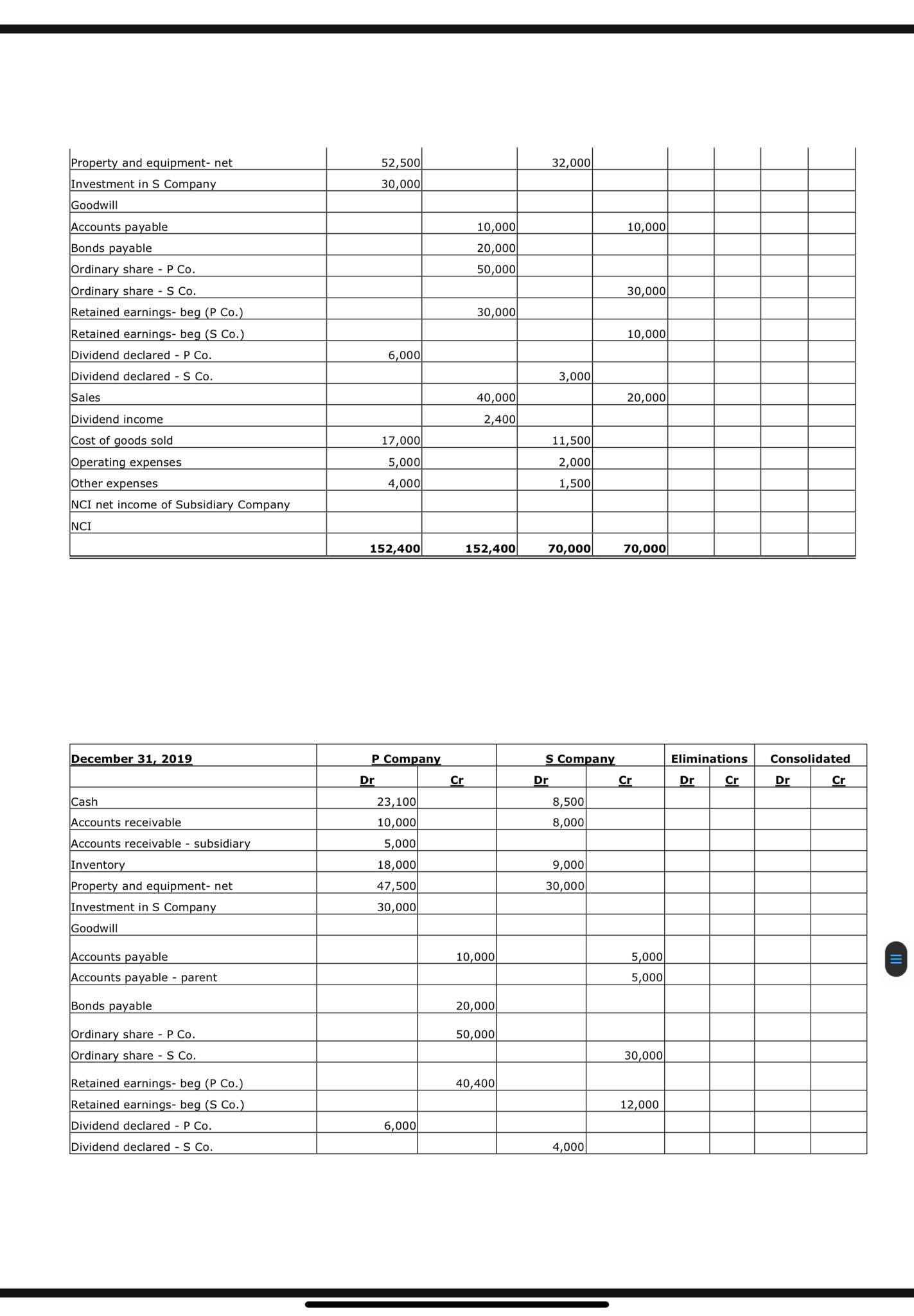

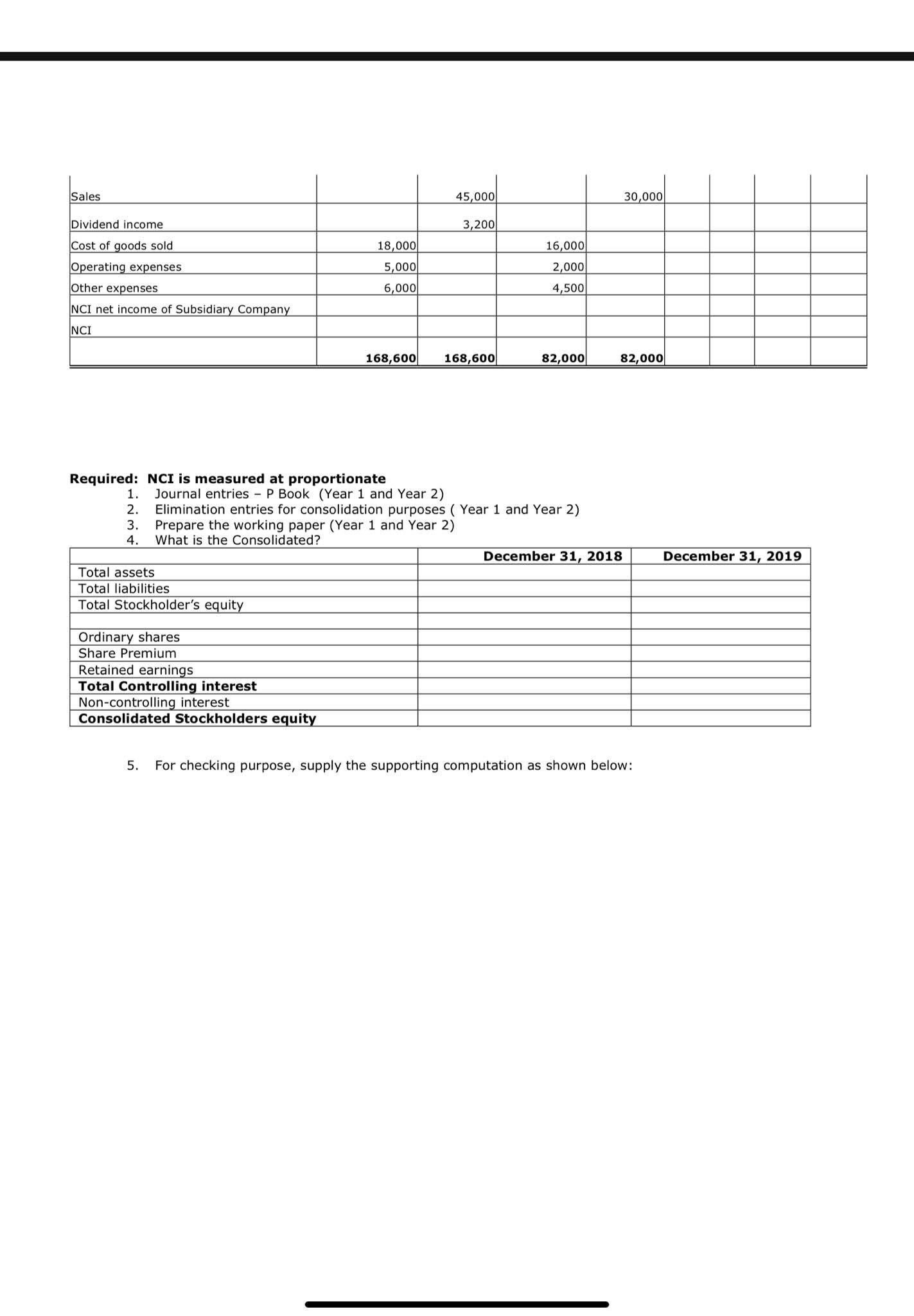

Problem 1- Partially Owned Subsidiary - Acquisition at Other Than Book Value (Cost Method) On January 2, 2008, P Company acquires 16,000 shares of S Company 20,000 shares for P30,000. At the time, S Company has P30,000 of ordinary share outstanding and retained earnings of P10,000. On the date of the combination, all assets and liabilities of S Company have fair market value equal to their book value, except for the following: Book Value Fair Value Inventory P6,000 P5,500 Property and equipment 30,000 36,000 All the inventory on January 2, 2008 to which the difference relates are sold during 2008. The property and equipment have a remaining life of 10 years from the date of acquisition (straight line method) S Company reported the following results of its operations: 2008 2009 Net profit P5,000 7,500 Dividend paid 3,000 4,000 P Company is using cost method and the pertinent information related to consolidation process are shown below: December 31, 2018 P Company S Company Eliminations Consolidated Dr Cr Dr Cr Dr Cr Dr Cr Cash 20,400 7,500 Accounts receivable 7,500 5,00 Inventory 10,000 7,500 Property and equipment- net 52,500 32,000 Investment in S Company 30,000 Goodwill Accounts payable 10,000 10,000 Bonds payable 20,000 Ordinary share - P Co. 50,000 Ordinary share - S Co. 30,000 Retained earnings- beg (P Co.) 30,000 Retained earnings- beg (S Co.) 10,000 Dividend declared - P Co. 6,000 Dividend declared - S Co. 3,000 Sales 40,000 20,000 Dividend income 2,400 Cost of goods sold 17,000 11,500 Operating expenses 5,000 2,000 Other expenses 4,000 1,500 NCI net income of Subsidiary Company NCI 152,400 152,400 70,000 70,000December 31, 2019 P Company S Company Eliminations Consolidated Dr C Dr Cr Dr Cr Dr Cr Cash 23,100 8,50 Accounts receivable 10,000 8,000 Accounts receivable - subsidiary 5,000 Inventory 18,000 9,000 Property and equipment- net 47,500 30,000 Investment in S Company 30,000 Goodwill Accounts payable 10,000 5,00 Accounts payable - parent 5,00 Bonds payable 20,000 Ordinary share - P Co. 50,000 Ordinary share - S Co 30,000 Retained earnings- beg (P Co.) 40,400 Retained earnings- beg (S Co.) 12,000 Dividend declared - P Co. 6,000 Dividend declared - S Co. 4,000 Sales 45,000 30,000 Dividend income 3,200 Cost of goods sold 18,000 16,000 Operating expenses 5,000 2,000 Other expenses 6,000 4,500 NCI net income of Subsidiary Company NCI 168,600 168,600 82,000 82,00 Required: NCI is measured at fair value 1. Journal entries - P Book (Year 1 and Year 2) Elimination entries for consolidation purposes ( Year 1 and Year 2) 3. Prepare the working paper (Year 1 and Year 2) 4 What is the Consolidated? December 31, 2018 December 31, 2019 Total assets Total liabilities Total Stockholder's equity Ordinary shares Share Premium Retained earnings Total Controlling interest Non-controlling interest Consolidated Stockholders equity 5. For checking purpose, supply the supporting computation as shown below:NCI - Beginning NI-NCI Dividend Declared S - NCI NCI at December 31 X X X x _ x X BV - SHE - Janauary 1 NI Dividend Declared SHE - Subsidiary December 31 FV Adjustment: Equipment Building Dep . E Expense - Equipment (Alloc. Amortization) Dep. Expense - Building( SHE - Subsidiary - December 31 @FV x NCI @ Proportionate NCI @ Goodwill NCI @ Impairment Goodwill NCI @ Fair value X X X X x x x Q RE- Parent January 1 Consolidted NI-Attributed to Parent Dividend declared - Parent Consolidated RE- Dec. 3 RE - Parent December 31 SHE-Sub. - January 1 SHE-Sub. -December 31 Changes Accumulated Alloc. Amortization Accumulated Alloc. Amortization X 80% Accumulated Impairment loss-Parent Consolidated RE- Dec. 31 Problem 2- On January 2, 2008, P Company acquires 16,000 shares of S Company 20,000 shares for P30,000. At the time, S Company has P30,000 of ordinary share outstanding and retained earnings of P10,000. On the date of the combination, all assets and liabilities of S Company have fair market value equal to their book value, except for the following Book Value Fair Value Inventory P6,000 P5,500 Property and equipment 30,000 36,000 All the inventory on January 2, 2008 to which the difference relates are sold during 2008. The property and equipment have a remaining life of 10 years from the date of acquisition (straight line method) S Company reported the following results of its operations: 2008 2009 Net profit 5,000 7,500 Dividend paid 3,000 4,000 P Company is using cost method and the pertinent information related to consolidation process are shown below: December 31, 2018 P Company S Company Eliminations Consolidated Dr Cr Dr Cr Dr Cr Dr Cr Cash 20,400 7,500 Accounts receivable 7,500 5,000 Inventory 10,000 7,500Property and equipment- net 52,500 32,000 Investment in S Company 30,000 Goodwill Accounts payable 10,000 10,000 Bonds payable 20,000 Ordinary share - P Co 50,000 Ordinary share - S Co. 30,000 Retained earnings- beg (P Co.) 30,000 Retained earnings- beg (S Co.) 10,000 Dividend declared - P Co. 6,000 Dividend declared - S Co. 3,000 Sales 40,000 0,000 Dividend income 2,400 Cost of goods sold 17,000 11,500 Operating expenses 5,000 2,000 Other expenses 4,000 1,500 NCI net income of Subsidiary Company NCI 152,400 152,400 70,000 70,000 December 31, 2019 P Company S Company Eliminations Consolidated Dr Cr Dr Cr Dr cr Dr Cr Cash 23,100 3,500 Accounts receivable 10,000 8,00 Accounts receivable - subsidiary 5,000 Inventory 18,000 9,000 Property and equipment- net 47,500 30,000 Investment in S Company 30,000 Goodwill Accounts payable 10,000 5,000 Accounts payable - parent 5,000 Bonds payable 20,000 Ordinary share - P Co 50,000 Ordinary share - S Co. 30,000 Retained earnings- beg (P Co.) 40,400 Retained earnings- beg (S Co.) 12,000 Dividend declared - P Co. 6,000 Dividend declared - S Co. 4,000Sales 45,000 30,000 Dividend income 3,200 Cost of goods sold 18,000 16,000 Operating expenses 5,000 2,000 Other expenses 6,000 4,500 NCI net income of Subsidiary Company NCI 168,600 168,600 82,000 82,000 Required: NCI is measured at proportionate 1. Journal entries - P Book (Year 1 and Year 2) 2. Elimination entries for consolidation purposes ( Year 1 and Year 2) 3 . Prepare the working paper (Year 1 and Year 2) 4 What is the Consolidated? December 31, 2018 December 31, 2019 Total assets Total liabilities Total Stockholder's equity Ordinary shares Share Premium Retained earnings Total Controlling interest Non-controlling interest Consolidated Stockholders equity 5. For checking purpose, supply the supporting computation as shown below