Question: Required: Provide at least three possible explanations for Momentum's alpha found for the Fama- French 3-factor model. The following information is obtained from historical data

Required:

Provide at least three possible explanations for Momentum's alpha found for the Fama- French 3-factor model.

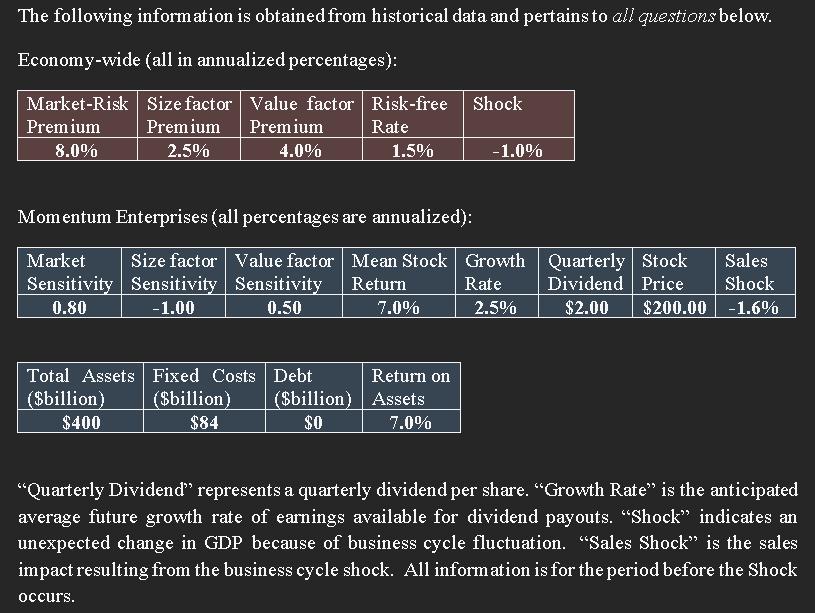

The following information is obtained from historical data and pertains to all questions below. Economy-wide (all in annualized percentages): Market-Risk Premium 8.0% Size factor Value factor Risk-free Shock Premium Premium Rate 2.5% 4.0% Total Assets ($billion) $400 Momentum Enterprises (all percentages are annualized): Market Size factor Value factor Mean Stock Growth Quarterly Stock Sales Sensitivity Sensitivity Sensitivity Shock $2.00 $200.00 -1.6% Return Rate Dividend Price 0.80 -1.00 0.50 Fixed Costs Debt ($billion) $84 1.5% ($billion) $0 7.0% -1.0% Return on Assets 7.0% 2.5% "Quarterly Dividend" represents a quarterly dividend per share. "Growth Rate" is the anticipated average future growth rate of earnings available for dividend payouts. "Shock" indicates an unexpected change in GDP because of business cycle fluctuation. "Sales Shock" is the sales impact resulting from the business cycle shock. All information is for the period before the Shock occurs.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

1 Momentum Enterprises has a higher Value factor sensitivity ... View full answer

Get step-by-step solutions from verified subject matter experts