Question: Required Question # 1 (40 marks, How has Pepsi Corporation performed over the 10-year time period from 1981 to 1990? In your critical discussion focus

Required

Question # 1

(40 marks,

How has Pepsi Corporation performed over the 10-year time period from 1981 to 1990?

In your critical discussion focus on qualitative and quantitative indicators. Include the spread between return on equity (ROE) and cost of equity (Ke) in your quantitative discussion.

Question # 2

(30 marks)

Calculate the costs of capital for the individual business segments (soft drinks, restaurants, snack foods)? Be sure to show your assumptions.

Question # 3

(30 marks,

Do business segments cost of capital add up to 11% for the overall corporate cost of capital? Critically discuss Why or why not?

PepsiCo, Inc.: Cost of Capital

This case is distributed without profit to students who have an interest in receiving the included information for research and educational purposes. This constitutes a fair use of any such material as provided for in the Lebanese Law.

"At PepsiCo Inc., cola was king, but it is quietly being dethroned."

It was this lead sentence of a front-page article in the Wall Street Journal that had caught Michael McCartt's eye on June 13, 1991, exactly one week ago. The timing of the article could not have been more appropriate, because McCartt had just received a call from PepsiCo on the morning of June 13 to schedule an interview for a position on the company's treasury staff. As McCartt read the article, he decided that, because of PepsiCo's diversification, he would focus during the interview on the concept of PepsiCo's cost of capital, so he could display the analytical abilities and knowledge of financial concepts he had just honed in business school. He had spent the past week reading PepsiCo's annual reports and gathering information on its competitors in preparation for the interview tomorrow afternoon in New York.

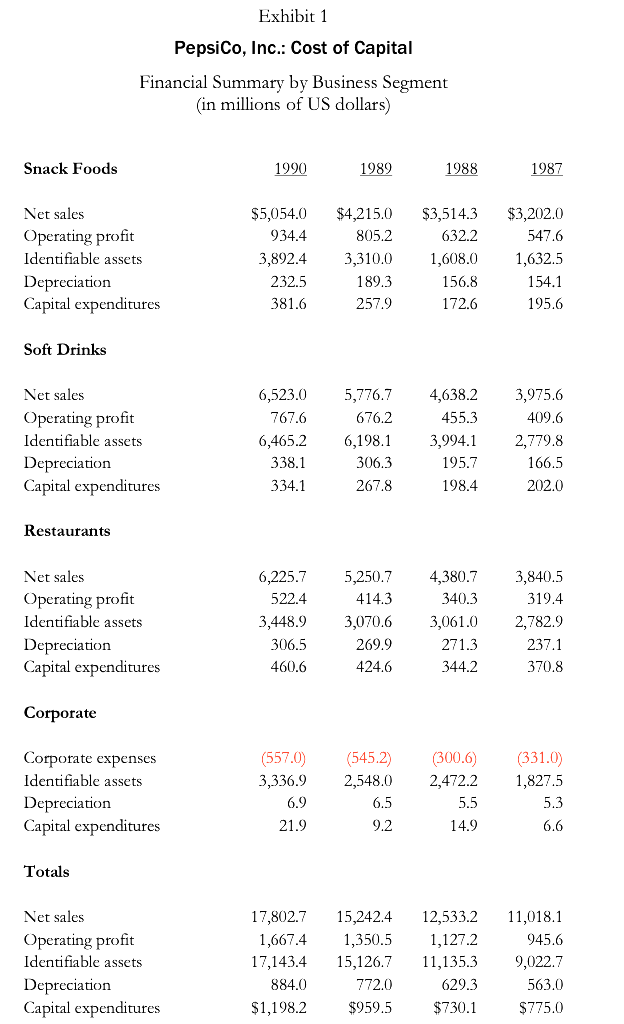

McCartt's research had revealed some interesting facts about PepsiCo. For example, he had been surprised to learn that PepsiCo had invested more than 40% of its capital spending over the last two years in fast-food restaurants, opening them at the rate of three per day, and that during the 1991 fiscal year, the restaurant group was expected to surpass beverages as the company's biggest revenue producer among its three business segments (see Exhibit 1 for a financial summary by business segment). Snack foods, PepsiCo's third line of business, was the biggest profit generator of the three business segments. These findings had raised a central question that McCartt wanted to be prepared to answer for the interview: How should PepsiCo's investment dollars be allocated among the three divisions (i.e., what criteria should be used in a diversified company like PepsiCo to evaluate potential investments)?

PepsiCo History

In its 1990 annual report, PepsiCo described itself as "first and foremost a growth company. Our primary corporate objective is to maximize the value of our shareholders' investments through a strategy of rapid sales growth, close control of costs, and astute investment of our financial resources."

The company was originally incorporated in 1919 under the name of Loft, Inc. The name was changed to the Pepsi-Cola Co. in 1941 after Loft merged with its Pepsi-Cola subsidiary, which it had acquired some three years earlier. The current name, PepsiCo, was adopted in 1965 after Pepsi-Cola merged with Frito-Lay. Under the name of PepsiCo, the company made several significant acquisitions. In November 1977, the Pizza Hut chain was acquired as a PepsiCo subsidiary, as was Taco Bell some seven months later. In July 1986, PepsiCo purchased Seven Up International for $246 million in cash, and three months and $841 million later, Kentucky Fried Chicken (KFC) joined the corporate fold. In 1988 and 1989, the cash outlays continued as two bottling operations, Grand Metropolitan and General Cinema, were bought for $705 million and $1.77 billion, respectively. PepsiCo expanded internationally in 1989 with the purchase of Smiths Crisps Ltd. and Walkers Crisps Holding Ltd., the leading snack- food companies in the United Kingdom, and in 1990 with the acquisition of Mexico's number-one cookie manufacturer, Gamesa.

The resulting conglomerate was a leader in all three of its business segments. As noted by Wayne Calloway, chairman and CEO of PepsiCo, the soft-drink division generated more revenue than General Mills, Inc.; the restaurant group was bigger than Campbell Soup Co.; and the snack-food business approximated Kellogg Co. "PepsiCo doesn't have one flagship, it has three flagships," stated Calloway, "and people would kill to have one of our flagships." Indeed, PepsiCo could boast of having eight different brands?Doritos, Ruffles, KFC Original Recipe, Pizza Hut Pan Pizza, Pepsi, Diet Pepsi, Mountain Dew, and Seven Up?that achieved over $1 billion in retail sales each year. Of its other brands, 25 achieved at least $100 million in annual retail sales.

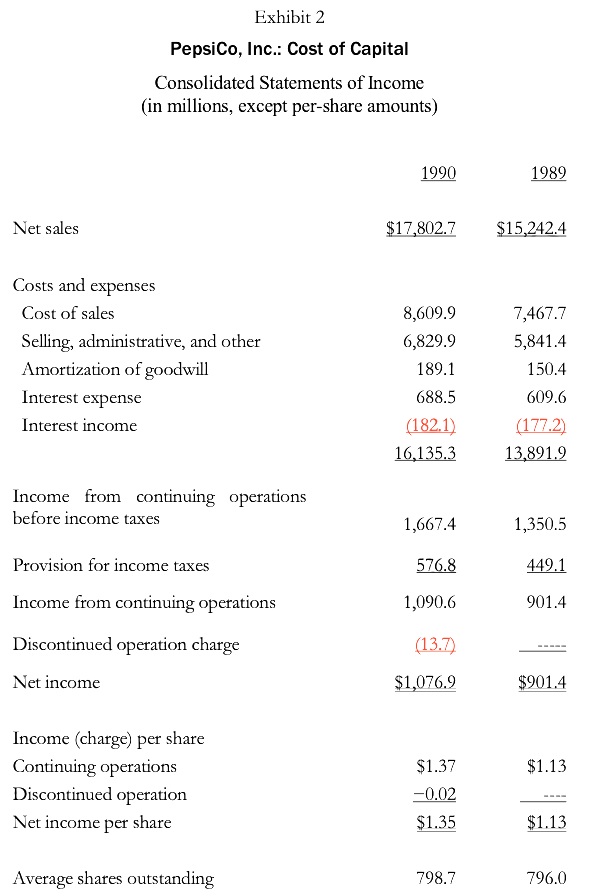

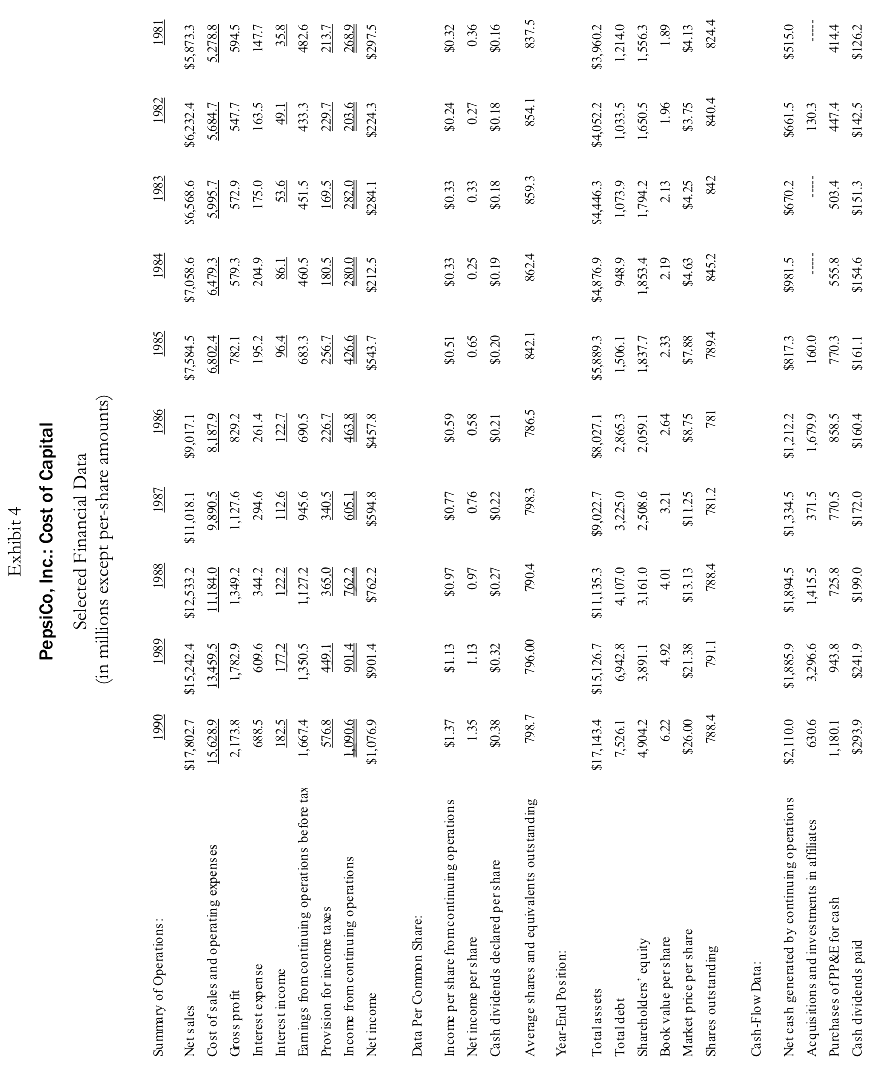

The financial success of PepsiCo is detailed in Exhibits 2, 3, and 4. Between 1985 and 1990, company sales increased at a compound rate of 19%, and income from continuing operations at a compound rate of 21%. In the beverage segment, PepsiCo had Pepsi Cola, the largest-selling food product of any type in US supermarkets and a $13 billion brand worldwide. In the global market, Pepsi Cola was joined on the list of the top 10 selling brands by Diet Pepsi, Caffeine Free Diet Pepsi, and Mountain Dew. With its latest bottling acquisitions, PepsiCo was running the nation's largest network of soft-drink bottling plants. As for the snack-food division, Frito-Lay had the largest share of the US chip market and was more than four times the size of its nearest competitor. With the purchase of Smiths Crisps and Walkers Crisps, PepsiCo Foods International became the leading chip company in Europe. It was in the restaurant segment, however, that the size and scope of PepsiCo's accomplishments may have been the most impressive.

PepsiCo was running the largest restaurant system in the world, with close to 18,500 units, and the three categories of food served by PepsiCo restaurants (pizza, chicken, and Mexican food) were among the fastest- growing segments of the quick-service market. PepsiCo's worldwide sales were greater than $17 billion, and the number of its US restaurants was growing at more than twice the industry average. Pizza Hut not only had a 24% share of the US market as of 1990, but it was also represented in 54 countries internationally and was the leading pizza chain in 46 of those markets. Taco Bell was the leading Mexican-food chain domestically and was just beginning to expand internationally. KFC opened its 3,000th restaurant outside the United States in 1989, making it the largest restaurant chain overseas and the number-one quick-service chicken restaurant in the world.

Financial Strategy

Some industry analysts believed that Pepsi had obtained Frito-Lay in 1965 partly because chips go well with cola, and had obtained the restaurant franchises as a means of getting new fountain outlets. Over the years, however, the company's focus had clearly shifted. The Wall Street Journal article asserted that CEO Calloway was not on any sort of "global beverage quest,"3 but was more interested in building a consumer-products company with the best possible return on equity. PepsiCo's emphasis on performance was clearly stated in the 1990 annual report: "PepsiCo's principal objective is to increase the value of its shareholders' investments through integrated operating, investing and financing strategies that maximize cash returns on investments and optimize the cost of capital."

Although PepsiCo's stock price had increased substantially over the past several years, the aggressive investment strategy had also resulted in an increased amount of debt on the books. Regarding the debt financing, PepsiCo management said:

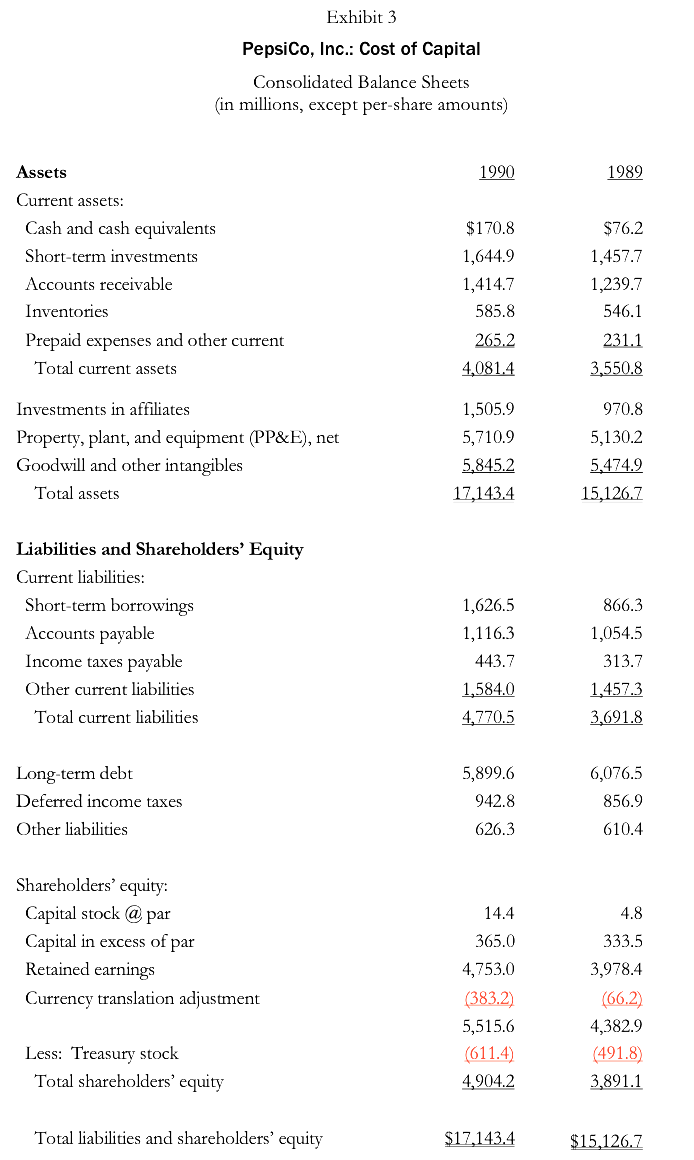

We support these investments with financial policies that strive to fund our businesses at the lowest possible cost, while giving us the flexibility to pursue growth. Every company faces the question of how much debt is appropriate. PepsiCo's philosophy hasn't changed much over the years, despite leveraged buyouts and the ups and downs of the bond market. We carefully set a corporate leverage target, or a ratio of our net debt4 plus market value of equity. Over time, we strive to achieve a ratio of 20% to 25%. We use market value as a yardstick, rather than the traditional book value, because the market standard reflects the tremendous value of our intangible assets?especially our brands' reputations?while also taking into account our strong potential for growth. Our leveraged target is set with an eye toward maintaining flexibility, which means we can exceed our target occasionally to take advantage of attractive investment opportunities.

The Cost of Capital

According to PepsiCo management, "The cost of capital is a weighting of the cost of debt and equity, with the latter representing a measure of expected returns to investors in PepsiCo's stock. PepsiCo estimates its current cost of capital to be approximately 11%." It was this statement that McCartt had decided to use as the centerpiece of his interview strategy. He had learned in business school that the true cost of capital depended on how the capital was put to use. For instance, the Wall Street Journal article stated that PepsiCo's restaurants were a lot "trickier" to manage than soft drinks. They commanded lower margins and were more fragmented, more capital intensive, and more vulnerable to shifts in consumer spending. McCartt concluded that investments in the restaurant division should be evaluated by using not the corporate weighted-average cost of capital (WACC), but a higher cost of capital.

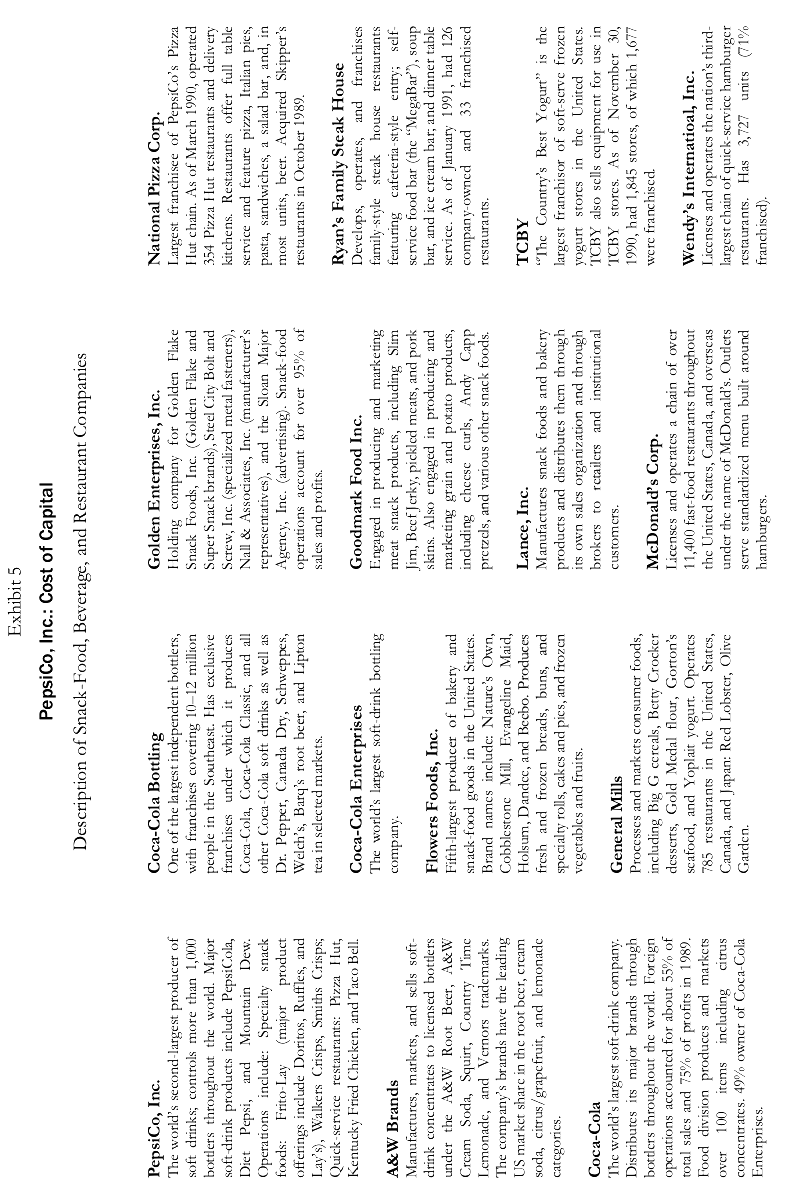

He recalled reading an article by Russell Fuller and Halbert Kerr5 that outlined how to estimate the cost of capital of a division in a multidivision firm. Essentially, each division was matched with a publicly traded company having a single line of business that was as similar as possible to the division's. The cost of capital of such a so-called "pure-play" company served as the best guess of the division's cost of capital. McCartt knew finding perfect pure-plays would be impossible, but he had succeeded in putting together a list of companies with publicly traded stocks that competed in the same business segments as PepsiCo (Exhibit 5).

McCartt assumed that PepsiCo was calculating its cost of equity by using the capital-asset pricing model, the formula for which is given in Equation 1:

Ke =Rf+?(Rm -Rf) (1).

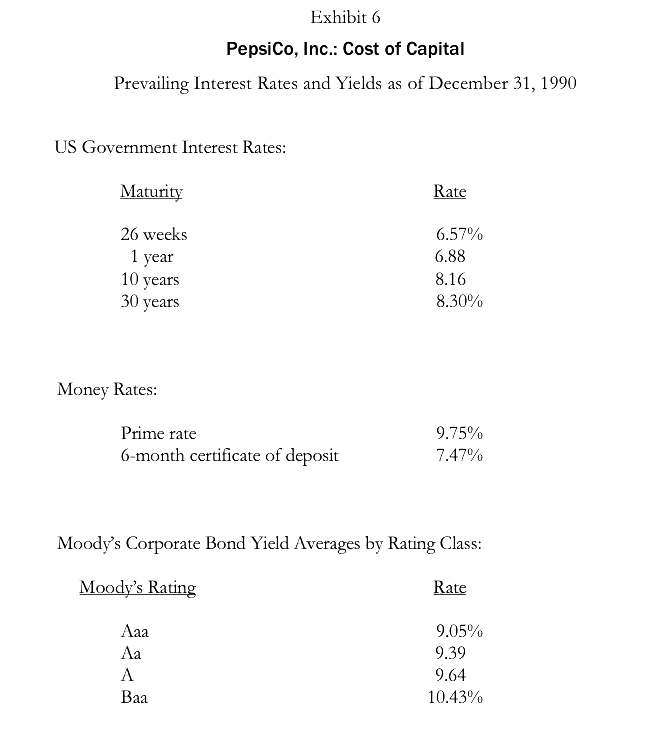

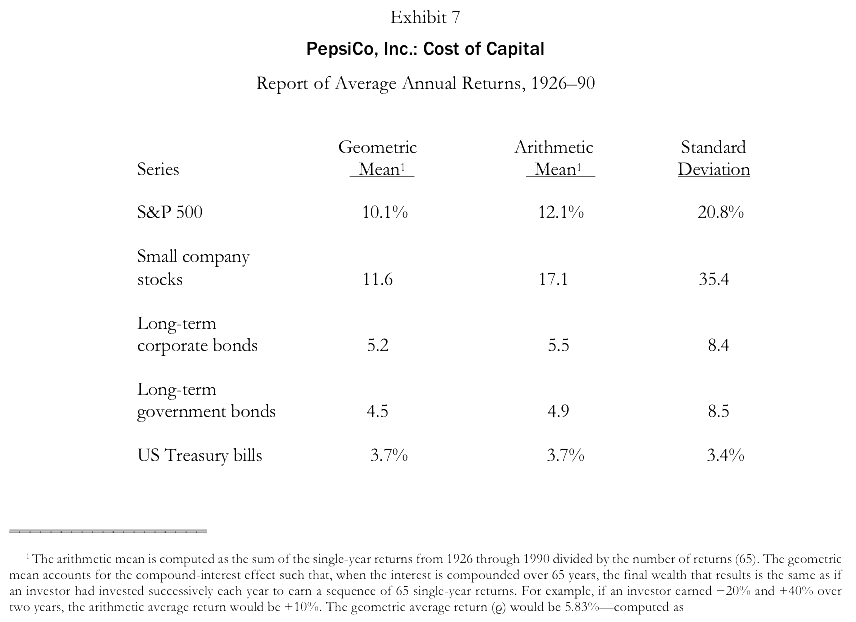

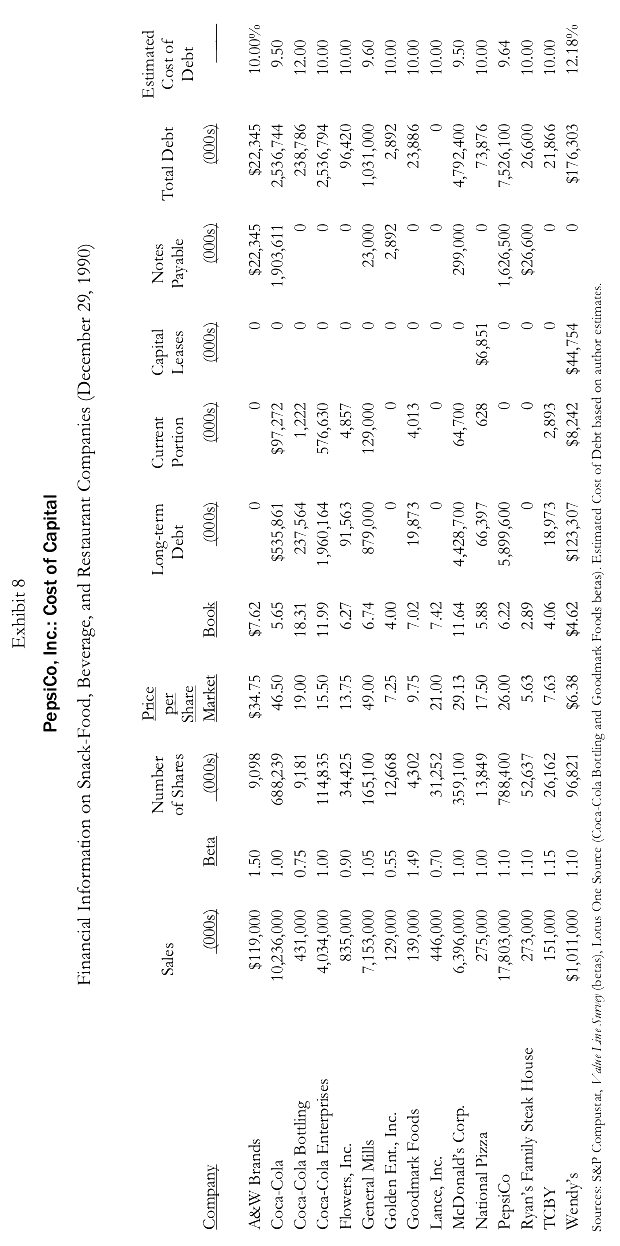

To choose the appropriate risk-free rate, Rf, he looked up the Treasury bond yields in the Wall Street Journal for December 31, 1990, the date of the latest financial information he had for PepsiCo (Exhibit 6). The market risk premium, Rm - Rf, was more difficult to determine, but once he gathered he believed he could decide the appropriate risk premium. The betas, ?, of the pure-play comparable companies are reported in Exhibit 8. Although the pure-plays exhibited a wide range of financial leverage, Fuller and Kerr had reported that unadjusted pure-play betas were better approximations of the division betas than were adjusted betas. McCartt therefore decided not to worry about adjusting betas for financial leverage.

Once he had determined the costs of equity for PepsiCo's three divisions, McCartt intended to calculate their respective hurdle rates using the WACC formula in Equation 2,

WACC=Kd (1??)D/(D+E)+KeE/(D+E) (2),

where Kd is the firm's cost of debt, ? is the corporate tax rate, D is the amount of debt, and E is the amount of equity. His research had revealed that PepsiCo's effective marginal tax rate was 38%, which reflected the combined effects of federal, state, and local taxes, and that its cost of publicly traded debt on December 31, 1990, was 9.6%. After computing each business segment's WACC, McCartt wanted to weight the three costs of capital to see if they summed to 11%, the number given in the annual report. If the individual costs of capital did not prove to be consistent with the corporate cost of capital, McCartt would have difficulty presenting his findings convincingly to his interviewers.

McCartt could not remember reading any other company's annual report that touched on as many financial concepts as PepsiCo's did: shareholder value creation, the cost of capital, market valuation of equity, target- debt ratios, and more. The more he read, the more he could understand why PepsiCo had recently been named one of Fortune magazine's most admired corporations in America, and the more determined he was to make the best of his job interview.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts